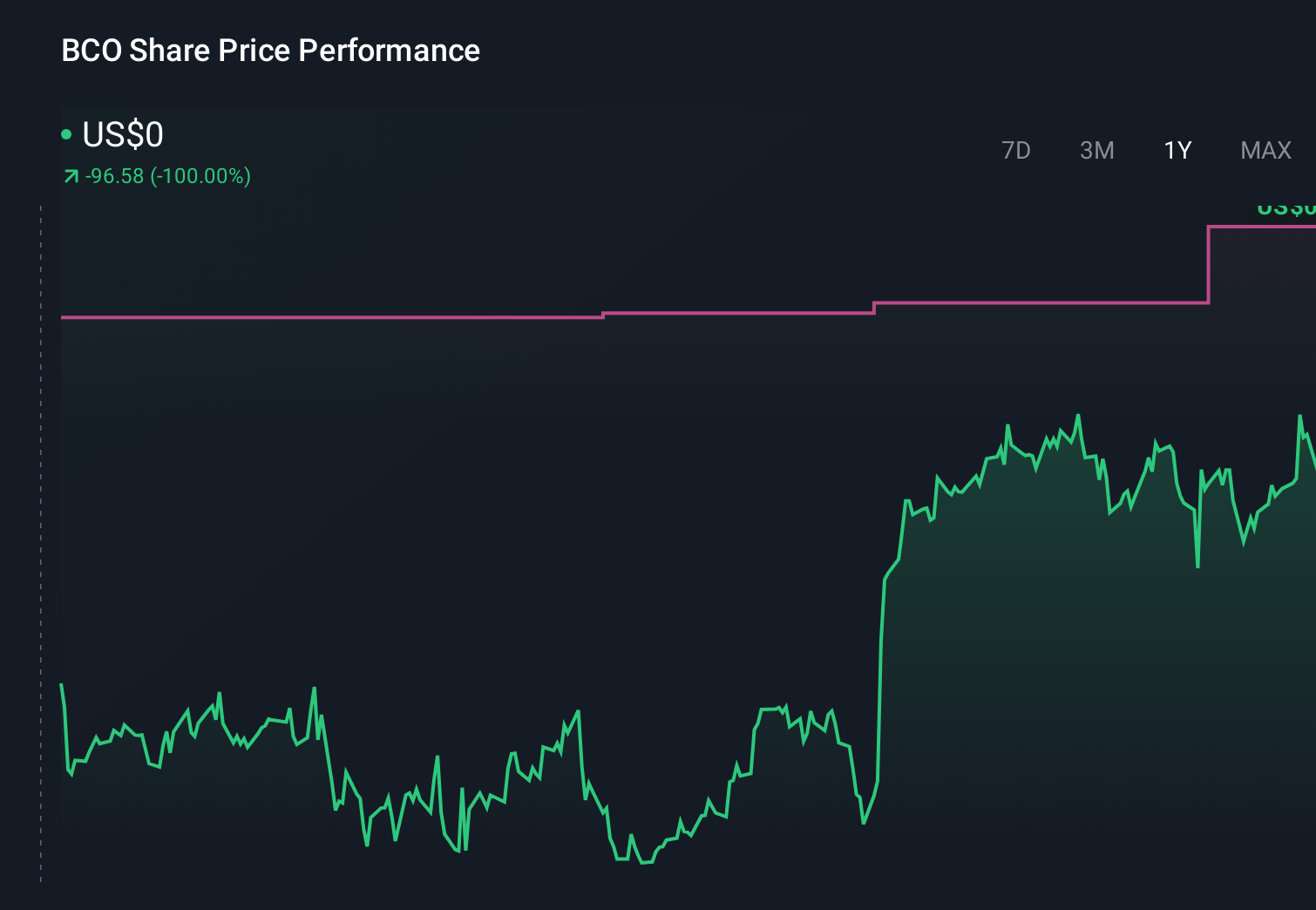

What Brink's (BCO)'s New US$750 Million Buyback Plan Means For Shareholders

- The Brink's Company recently announced that its board approved a new share repurchase program authorizing up to US$750 million in buybacks, with the plan set to run through December 31, 2027.

- This authorization amounts to more than 15% of Brink's current market value, signaling management’s confidence in its cash generation and AMS/DRS-led growth strategy.

- Next, we’ll examine how Brink’s sizable new buyback authorization could reshape the existing investment narrative around capital allocation.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Brink's Investment Narrative Recap

To own Brink's today, you need to believe its pivot toward AMS and DRS can offset structural pressure on cash usage while supporting healthy free cash flow. The new US$750,000,000 buyback reinforces that free cash flow story but does not materially change the near term catalyst, which remains execution in higher margin services, or the key risk that accelerated digital payments adoption could weigh on long term demand.

The most connected recent announcement is Brink's ongoing execution of its prior US$500,000,000 repurchase plan, under which it had already bought back roughly US$357,050,000 of stock by early November 2025. The new, larger authorization extends this capital return approach through 2027, which could amplify the impact of any future swings in AMS and DRS growth on per share metrics if cash usage trends or competitive pressures shift unexpectedly.

But investors should also be aware that if cashless adoption accelerates faster than Brink's AMS and DRS can offset, then...

Read the full narrative on Brink's (it's free!)

Brink's narrative projects $6.0 billion revenue and $755.1 million earnings by 2028. This requires 5.5% yearly revenue growth and about a $593 million earnings increase from $161.7 million today.

Uncover how Brink's forecasts yield a $133.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members currently estimate Brink's fair value anywhere between about US$58 and US$219 per share, underscoring how far apart views can be. Set those opinions against the company’s heavy use of buybacks, and you start to see how assumptions about future AMS and DRS growth could drive very different expectations for Brink's longer term performance.

Explore 5 other fair value estimates on Brink's - why the stock might be worth less than half the current price!

Build Your Own Brink's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brink's research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brink's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brink's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal