United Community Banks (UCB): Assessing Valuation After Approving a $100 Million 2026 Share Repurchase Program

United Community Banks (UCB) just doubled down on shareholder returns, with its board signing off on a fresh $100 million stock repurchase program running from January 2026 through the end of that year.

See our latest analysis for United Community Banks.

That new buyback plan lands after a steady climb in sentiment, with a 7.5% 1 month share price return and a 5 year total shareholder return of 33.32%, suggesting momentum is gradually rebuilding from a muted recent patch.

If this kind of capital return story has your attention, it could be a good moment to explore other banks with strong owner alignment through fast growing stocks with high insider ownership.

With shares edging closer to analyst targets but still trading at a sizable modeled discount to intrinsic value, is United Community Banks quietly offering upside, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 7.2% Undervalued

With United Community Banks last closing at $32.39 against a narrative fair value near $34.92, the story frames modest upside built on accelerating fundamentals.

Ongoing diversification of income streams, including fee income from wealth management, mortgage banking, and loan sales, reduces reliance on net interest income and stabilizes earnings, particularly benefitting long-term return on equity and mitigating downside risk from interest rate volatility.

Want to see what happens when faster top line growth, richer margins, and a lower future earnings multiple all collide in one forecast? The narrative breaks it down.

Result: Fair Value of $34.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster shifting competition and any unexpected credit deterioration in commercial real estate could quickly challenge the growth, margin, and valuation assumptions underpinning this story.

Find out about the key risks to this United Community Banks narrative.

Another View: Market Ratio Signals

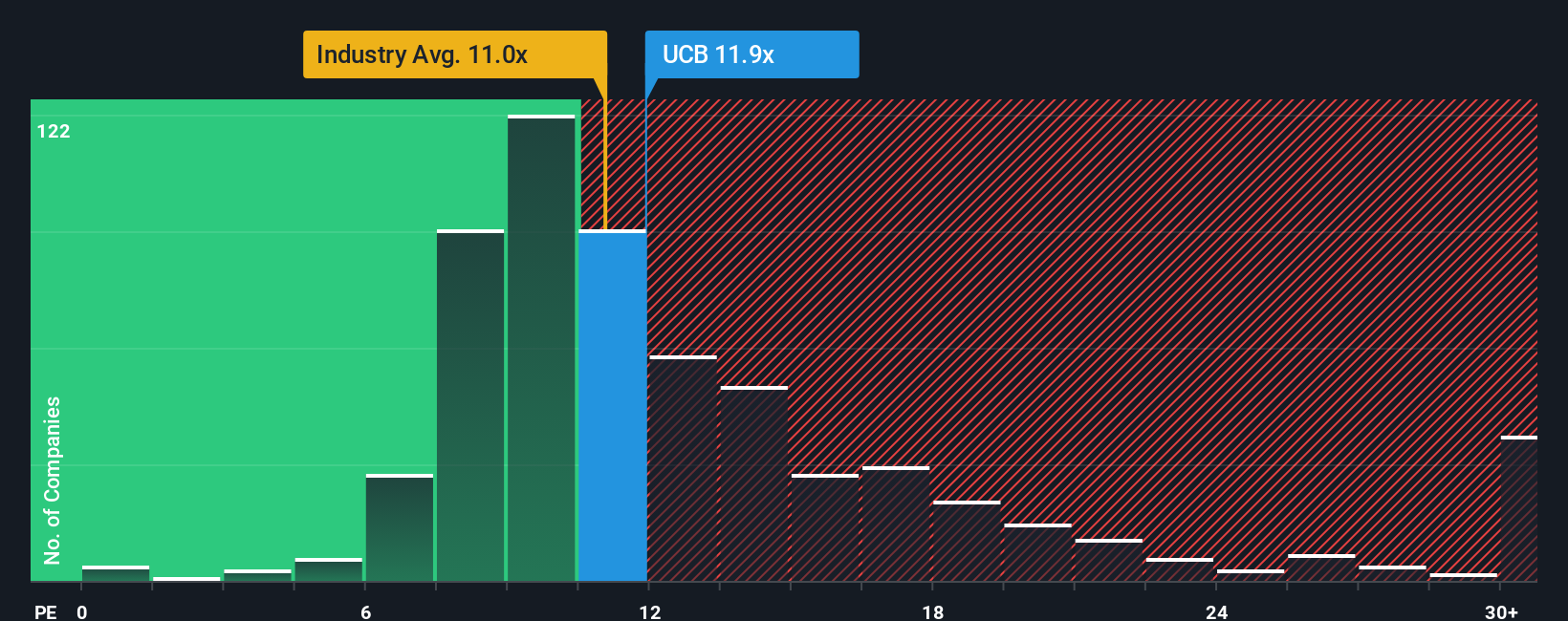

Step away from fair value models for a moment and the picture looks different. UCB trades on a 12.9x earnings multiple against a fair ratio of 12.3x and a 12x US banks average, hinting at only a thin valuation cushion if growth expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own United Community Banks Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding United Community Banks.

Looking for more investment ideas?

Before you move on, consider scanning fresh opportunities on Simply Wall Street that many investors may only notice after significant price moves have already occurred.

- Target companies with more stable cash flows by reviewing these 13 dividend stocks with yields > 3%, which may help support portfolio income while many traders focus on short-lived momentum.

- Explore potential growth opportunities by scanning these 26 AI penny stocks, which are involved in automation, data intelligence, and real-world AI adoption.

- Refine your value-focused approach with these 907 undervalued stocks based on cash flows, highlighting companies that may not yet be fully reflected in current market pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal