Will New ecoDemonstrator Tech and Supply-Chain Moves Change Boeing's (BA) Efficiency-Driven Narrative?

- Boeing recently completed flight tests with United Airlines on a 737-8 ecoDemonstrator Explorer to trial an Internet Protocol Suite–based communications system intended to streamline data flows between cockpits, air traffic control and airline operations centers, aiming to improve safety, efficiency and emissions over a decade-long development effort.

- At the same time, Boeing has reinforced its governance and industrial footing by adding former Alaska Air Group CEO Bradley Tilden to its board and closing the Spirit AeroSystems acquisition, tightening control over key supply chains as it benefits from strong order intake and new government contracts for 737 aircraft.

- We’ll now examine how Boeing’s ecoDemonstrator communications advances could influence its investment narrative around technology-driven efficiency and longer-term growth.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Boeing Investment Narrative Recap

To own Boeing, you need to believe it can turn a large backlog and ongoing demand for newer jets into sustainable profits despite current losses and high debt. The ecoDemonstrator communications tests, stronger order intake and the Spirit AeroSystems deal all support the key near term catalyst of stabilizing 737 and 787 production, while the biggest risk remains execution issues that could prolong certification delays, margin pressure and cash burn. The latest news does not materially change that risk balance.

Among recent announcements, the completed acquisition of Spirit AeroSystems looks most relevant here because it gives Boeing tighter control over major 737 structures and spare parts just as it pushes production rate increases. If Boeing can use that control, together with technology programs like ecoDemonstrator, to reduce supply chain bottlenecks and rework, it could support the recovery thesis built on rising volumes and improving free cash flow.

But while these steps point in the right direction, investors should also be aware of the ongoing risk that certification setbacks for key 737 variants could...

Read the full narrative on Boeing (it's free!)

Boeing's narrative projects $114.4 billion revenue and $7.1 billion earnings by 2028. This requires 14.9% yearly revenue growth and an earnings increase of about $18.0 billion from -$10.9 billion today.

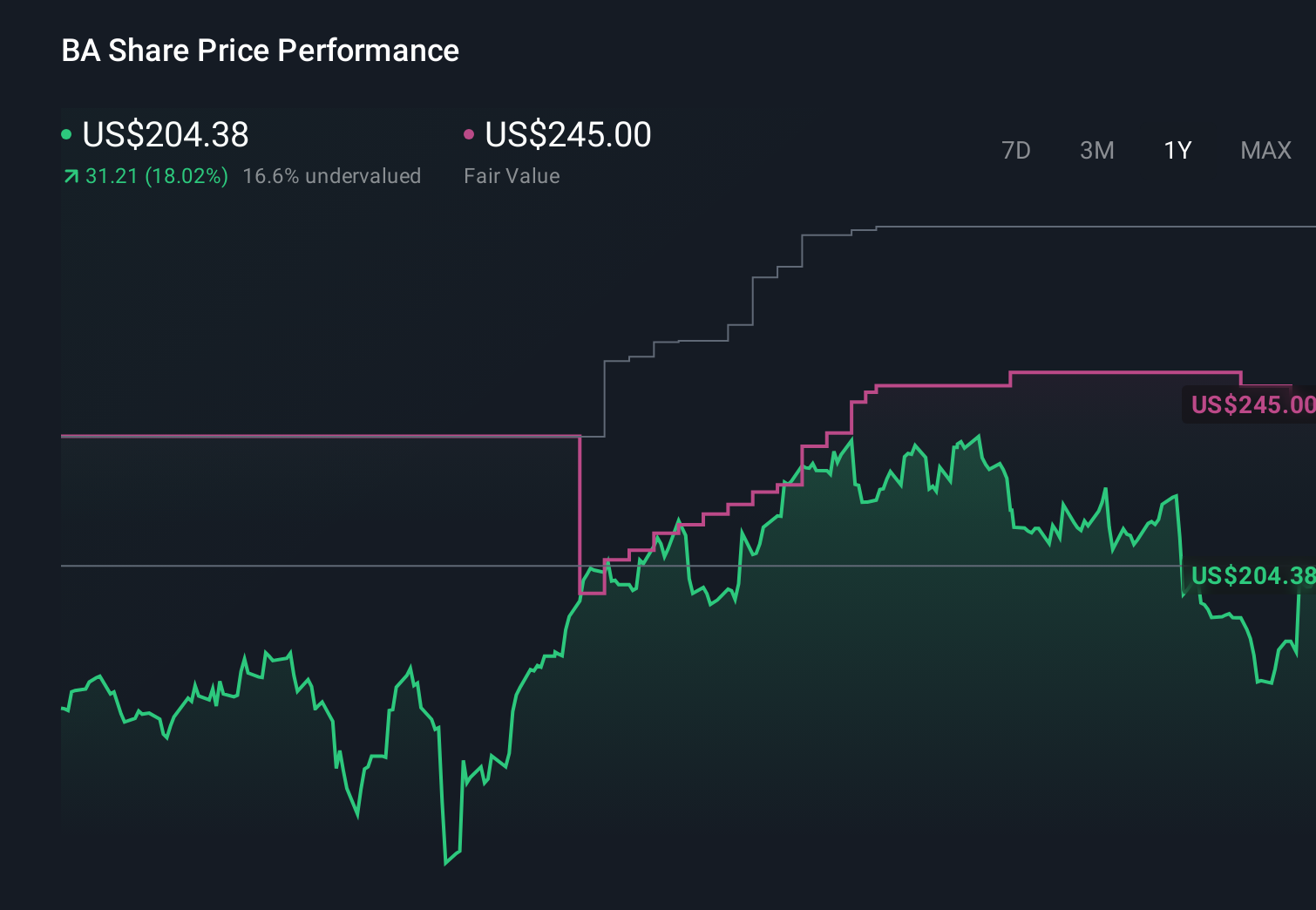

Uncover how Boeing's forecasts yield a $245.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Eighteen members of the Simply Wall St Community currently see Boeing’s fair value between US$206.79 and US$340.06, reflecting very different expectations about what the business is worth. Against that spread of opinions, the central question remains whether Boeing can translate its large order backlog and production ramp into durable profitability before supply chain and certification risks undercut the recovery story.

Explore 18 other fair value estimates on Boeing - why the stock might be worth just $206.79!

Build Your Own Boeing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boeing research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Boeing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boeing's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal