Cummins (CMI): Valuation Check After $500 Million U.S. Army Deal and Recent Analyst Upgrades

Cummins (CMI) just locked in a $500 million contract with the U.S. Army for mobile power generators, a deal that reinforces its core power systems franchise and gives investors a fresh earnings catalyst.

See our latest analysis for Cummins.

The Army deal lands after a run of upbeat developments, including recent analyst upgrades, and helps extend what has already been a powerful move, with Cummins delivering a roughly mid-20s three-month share price return and a strong triple-digit three-year total shareholder return that signals momentum is still very much intact.

If this contract has you thinking about the broader defense supply chain, it might be worth exploring other aerospace and defense stocks that could benefit from similar long-term spending trends.

With shares near record highs after hefty gains and analysts nudging targets upward, is Cummins still trading at a discount to its true earnings power, or has the market already priced in the next leg of growth?

Most Popular Narrative: 2.2% Undervalued

With Cummins last closing at $510.05 against a narrative fair value near $522, the market is seen trailing its long term earnings potential.

The fair value estimate has risen slightly to approximately $522 from about $510, reflecting modestly higher long term earnings expectations.

The future P/E has moved up slightly to roughly 20.0x from about 19.7x, pointing to a small expansion in the valuation multiple applied to forward earnings.

Want to see what is driving that higher earnings power story? The narrative leans on rising margins, steadier growth, and a richer future multiple. Curious which assumptions really move the needle and how far profits might stretch under this view? Dive in to see the full blueprint behind that upgraded fair value.

Result: Fair Value of $521.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained North American truck weakness and slower progress in zero emission technologies could easily derail those higher margin and earnings assumptions.

Find out about the key risks to this Cummins narrative.

Another Angle on Value

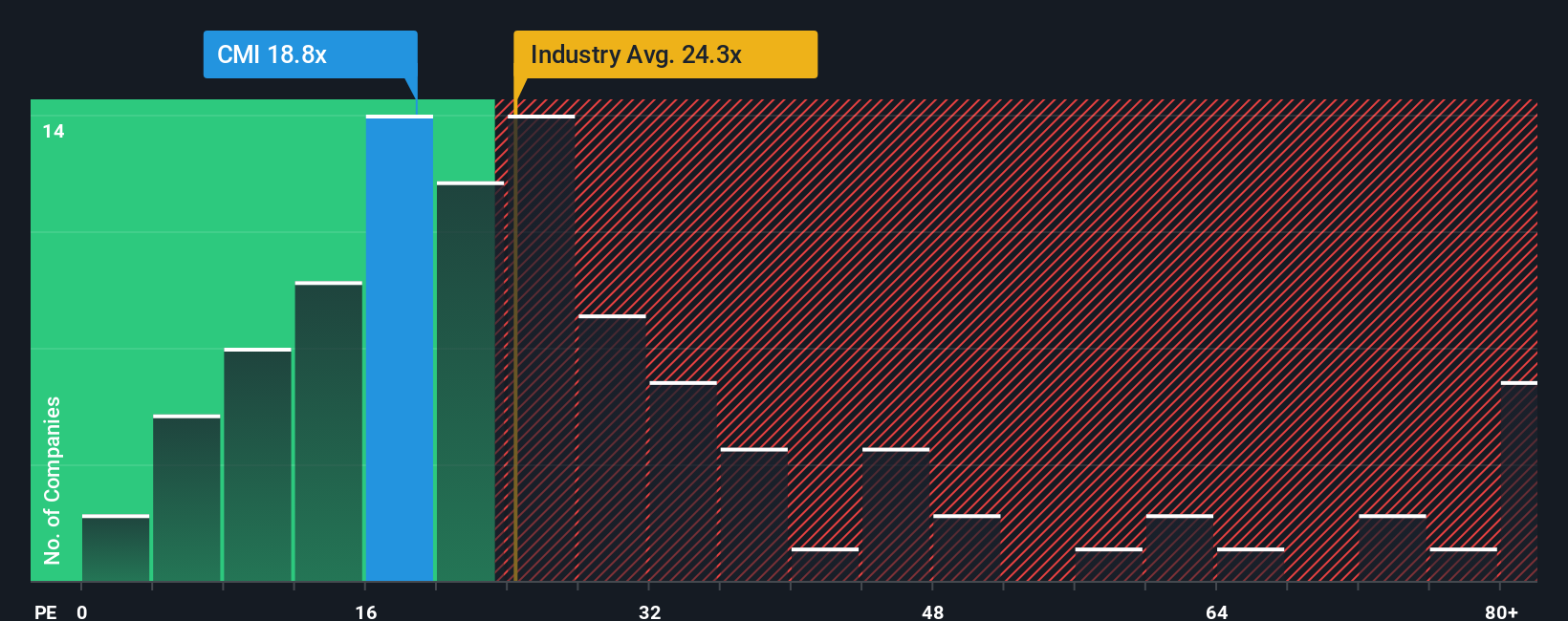

On earnings, Cummins is no obvious bargain, with a 26.4x P/E that sits above both the US Machinery industry at 26x and peer average of 23.9x. Yet our fair ratio points to 35.1x, which hints the market could still re rate the stock. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cummins Narrative

If you see the story differently, or simply want to stress test the assumptions with your own inputs, you can build a complete narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Cummins.

Ready for your next investing move?

Before you move on, lock in your edge by using the Simply Wall St Screener to spot focused opportunities other investors might overlook.

- Capture value-focused opportunities by scanning these 907 undervalued stocks based on cash flows that trade below their estimated cash flow potential and could rerate as sentiment shifts.

- Tap into early stage innovation by reviewing these 3606 penny stocks with strong financials that pair small market caps with improving fundamentals and room for explosive growth.

- Boost your income strategy by selecting these 13 dividend stocks with yields > 3% that combine attractive yields with balance sheets built to sustain payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal