How Investors Are Reacting To GQG Partners (ASX:GQG) Net Outflows And Contrarian AI Stance

- In November, GQG Partners reported ongoing net outflows across its equity strategies, yet total funds under management still edged up to US$166.1 billion, supported in part by portfolio moves such as reducing its stake in JSW Energy.

- The firm’s public scepticism about artificial intelligence, including a whitepaper questioning OpenAI’s business model, highlights an investment stance that increasingly contrasts with prevailing market enthusiasm for AI-related themes.

- We’ll now examine how these persistent outflows and GQG’s contrarian AI positioning may influence its previously outlined investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

GQG Partners Investment Narrative Recap

To own GQG Partners, you need to believe that its active, benchmark-aware style and high-fee equity products can keep attracting and retaining client assets despite industry pressure toward cheaper passive options. The latest update, showing a fifth month of equity outflows but a slight lift in total funds under management to US$166.1 billion, largely reinforces that the key near term catalyst remains a stabilisation in net flows, while the most immediate risk is sustained client redemptions that weigh on fee revenue.

The recent reduction of GQG’s stake in JSW Energy, executed through sizeable block trades, sits neatly alongside this picture. It underscores how portfolio repositioning is occurring at the same time as flows remain under pressure, and it gives investors another data point when thinking about how GQG might seek to protect fee levels and fund performance as it leans into, or away from, certain equity exposures.

Yet while flows are the obvious headline risk, investors also need to be aware that...

Read the full narrative on GQG Partners (it's free!)

GQG Partners' narrative projects $913.7 million revenue and $462.4 million earnings by 2028. This requires 4.5% yearly revenue growth and an earnings increase of about $8.3 million from $454.1 million today.

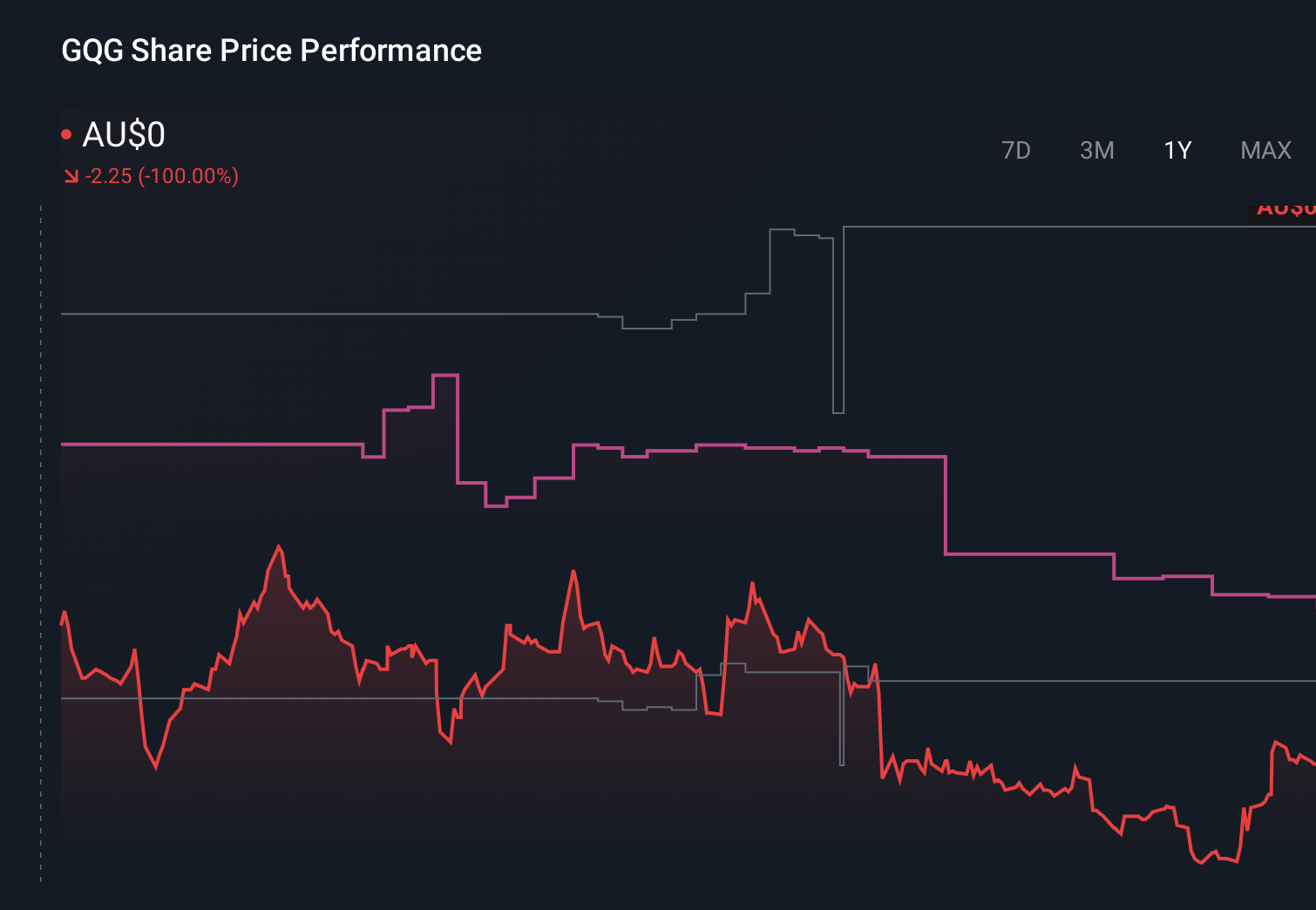

Uncover how GQG Partners' forecasts yield a A$2.31 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Twenty members of the Simply Wall St Community currently place GQG’s fair value anywhere between about A$1.77 and A$4.78, showing how far apart individual views can be. As you weigh those valuations against the recent run of net outflows and what that could mean for fee revenue resilience, it is worth exploring several of these perspectives before forming your own view.

Explore 20 other fair value estimates on GQG Partners - why the stock might be worth just A$1.77!

Build Your Own GQG Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GQG Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free GQG Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GQG Partners' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal