Keppel (SGX:BN4): Assessing Valuation After Strategic Portfolio Restructuring and Strengthening Cash Flows

Keppel’s restructuring moves put cash flow and investor sentiment in focus

Keppel (SGX:BN4) has been actively reshaping its portfolio through targeted asset disposals and acquisitions, a restructuring push that is tightening up cash flow and helping underpin the market’s growing confidence in its next phase of growth.

See our latest analysis for Keppel.

That restructuring story is showing up in the price too, with Keppel’s share price at SGD 10.22 after a strong 90 day share price return of 18.15 percent and an impressive five year total shareholder return of 276.94 percent, suggesting momentum is firmly building rather than fading.

If Keppel’s steady realignment has you thinking about what else could rerate, it might be worth exploring fast growing stocks with high insider ownership for other fast moving ideas with skin in the game.

Yet with the shares already up strongly and trading only modestly below analyst targets, the key question now is whether Keppel still trades at a discount to its reshaped prospects, or whether the market has already priced in the next leg of growth.

Most Popular Narrative: 7% Undervalued

With Keppel closing at SGD 10.22 against a narrative fair value of SGD 10.99, the valuation hinges on how convincingly future cash flows improve.

The company's shift to an asset light, recurring income model, alongside ongoing cost optimization and digital transformation (including Project Lean and in house AI), is enhancing operating efficiency and net margins, and supporting a higher, more predictable ROE.

Want to see why modest revenue expectations can still support a richer earnings multiple and higher fair value, all under a 7.46 percent discount rate?

Result: Fair Value of $10.99 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in monetising its 14.4 billion SGD non core portfolio, or weaker than expected performance from new cash flow engines, could quickly challenge this underpriced growth story.

Find out about the key risks to this Keppel narrative.

Another Lens on Valuation

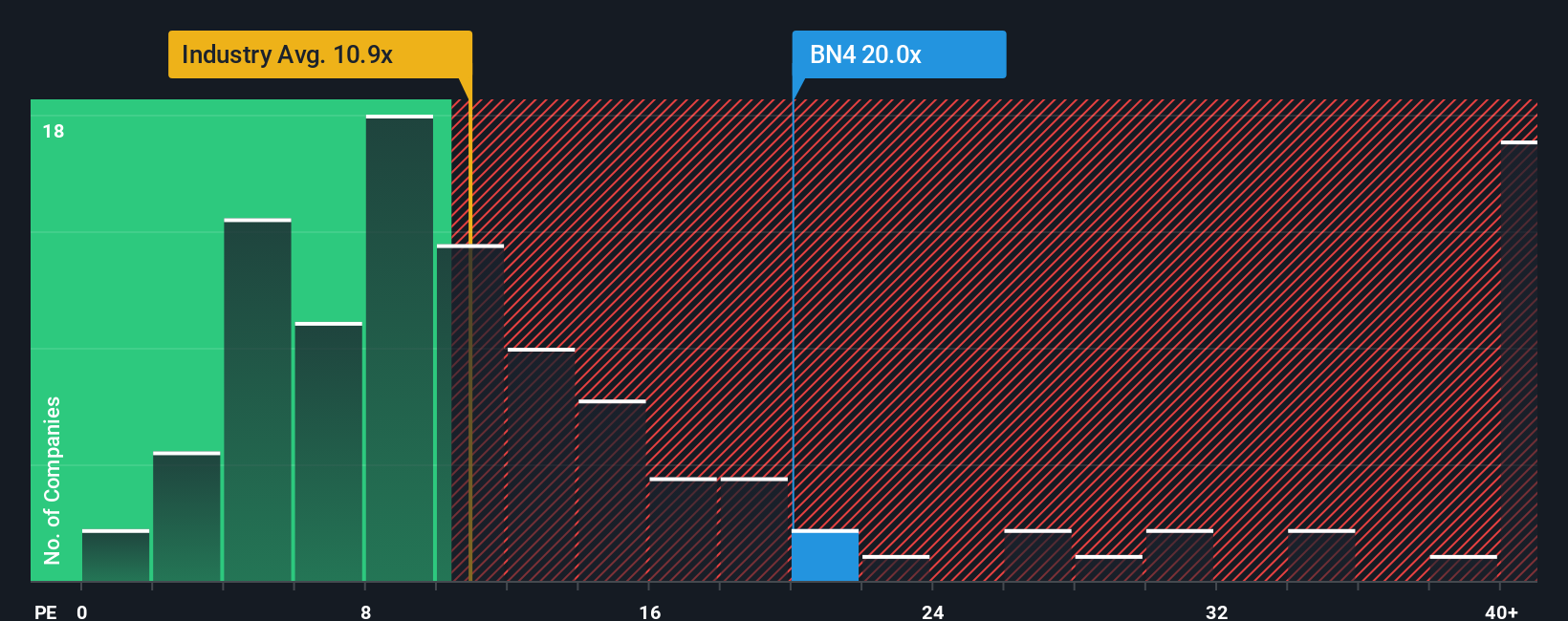

Step away from fair value narratives and the picture looks harsher. On a price to earnings of 20.3 times, Keppel trades well above the Asian industrials average of 10.9 times and its own 17.7 times fair ratio. This leaves less margin for error if execution wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keppel Narrative

If you see things differently or want to dive into the numbers yourself, you can shape a personalised view of Keppel in just a few minutes, Do it your way.

A great starting point for your Keppel research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Keppel might fit your strategy today, but your next great opportunity could be hiding in plain sight, so use the Simply Wall St Screener now.

- Capture emerging themes early by scanning these 26 AI penny stocks where innovation and earnings potential can move faster than the headlines.

- Strengthen your portfolio’s backbone with steady cash generators from these 13 dividend stocks with yields > 3% that can keep paying you through market cycles.

- Position yourself at the edge of digital finance by targeting leaders and enablers within these 80 cryptocurrency and blockchain stocks before the crowd wakes up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal