Visa (V): Assessing Valuation After Recent Share Price Gains

Visa (V) shares are quietly grinding higher, adding about 0.6% today and roughly 5% over the past week, as investors lean into its steady double digit earnings growth and resilient payment volumes.

See our latest analysis for Visa.

That steady climb sits on top of a solid backdrop, with the share price now at $347.83 and Visa posting a double digit year to date share price return. Longer term total shareholder returns signal durable compounding, suggesting momentum is still building rather than fading.

If Visa’s steady grind higher has you thinking about what else could deliver durable growth, this is a good moment to explore fast growing stocks with high insider ownership.

But with revenue and profits still growing near double digits, and the share price inching toward analyst targets, is Visa quietly undervalued, or is the market already baking in years of future expansion and leaving little upside?

Most Popular Narrative Narrative: 12.1% Undervalued

With Visa closing at $347.83 against a narrative fair value near $396, the latest consensus view sees meaningful upside still on the table.

Rapidly accelerating adoption of value added services (VAS), with VAS revenue up 26% year over year and expanding into areas such as AI, risk solutions, and open banking, is increasing Visa's mix of higher margin business lines, which should lift net margins and improve overall earnings quality.

Curious how steady transaction growth morphs into a much richer earnings profile? The narrative leans on expanding margins, powerful cash returns, and a premium future multiple. Want to see exactly how those moving parts add up to that fair value call?

Result: Fair Value of $395.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, real time payment alternatives and regulatory pressure on interchange fees could erode Visa’s pricing power, challenging the margin expansion baked into this narrative.

Find out about the key risks to this Visa narrative.

Another Angle on Valuation

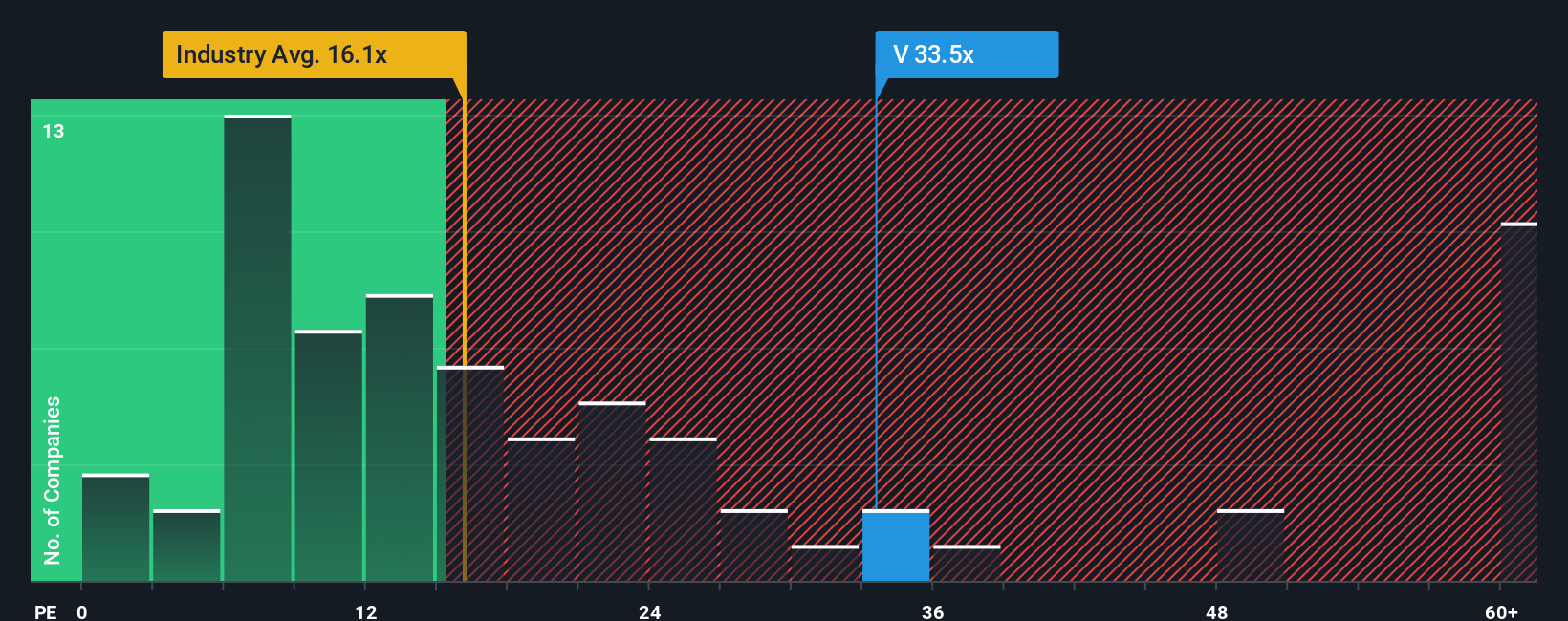

Look past the narrative fair value and Visa suddenly looks pricey. At 33.5 times earnings, it trades at almost double both peers at 17.6 times and the industry at 13.6 times, and well above a 20 times fair ratio, which could cap upside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Visa Narrative

If you see Visa’s story differently or simply want to stress test the numbers yourself, you can craft a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Visa.

Ready for more investing ideas?

If you stop at Visa, you could miss some of the market’s most exciting opportunities. Use the Simply Wall Street Screener to keep your edge sharp.

- Capture early stage potential by targeting under the radar opportunities using these 3606 penny stocks with strong financials before broader market enthusiasm catches on.

- Position yourself for structural growth by focusing on transformative automation and intelligent platforms through these 26 AI penny stocks.

- Lock in value focused opportunities by screening for companies trading below intrinsic worth with these 907 undervalued stocks based on cash flows before sentiment corrects the mispricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal