Assessing Arcutis Biotherapeutics After 99% Rally and DCF Signals Further Upside Potential

- If you are wondering whether Arcutis Biotherapeutics is still a smart bet after its big run, or if most of the upside is already priced in, you are not alone. That is exactly what we are going to unpack.

- The stock has pulled back about 7.0% over the last week, but that comes after a sharp 23.8% gain in the past month and a 99.3% rise year to date, with a 128.7% return over the last year that has completely changed how the market looks at this name.

- Those moves have been fueled by a series of clinical and regulatory updates that have shifted sentiment toward Arcutis, including progress on its key dermatology pipeline and growing attention from larger pharma and biotech investors. Together, these developments have pushed the stock onto more radar screens, which can amplify both enthusiasm and volatility as new data points arrive.

- Right now, Arcutis scores a 3 out of 6 on our valuation checks. This suggests it screens as undervalued on half of the metrics we track, but not particularly cheap across the board. Next, we will walk through what those different valuation approaches say and introduce a more integrated way to think about value that pulls everything together at the end of the article.

Approach 1: Arcutis Biotherapeutics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting those back into today’s dollars. For Arcutis Biotherapeutics, this approach uses a 2 stage Free Cash Flow to Equity framework based on analyst forecasts and longer term extrapolations.

Arcutis currently generates negative free cash flow of about $45.4 Million, reflecting ongoing investment in its pipeline. Analyst estimates and Simply Wall St extrapolations point to free cash flow turning strongly positive, rising to roughly $469.1 Million by 2035, with interim projections such as $93 Million in 2026 and $295.5 Million by 2029. All figures are in $ and remain well below the Billion mark.

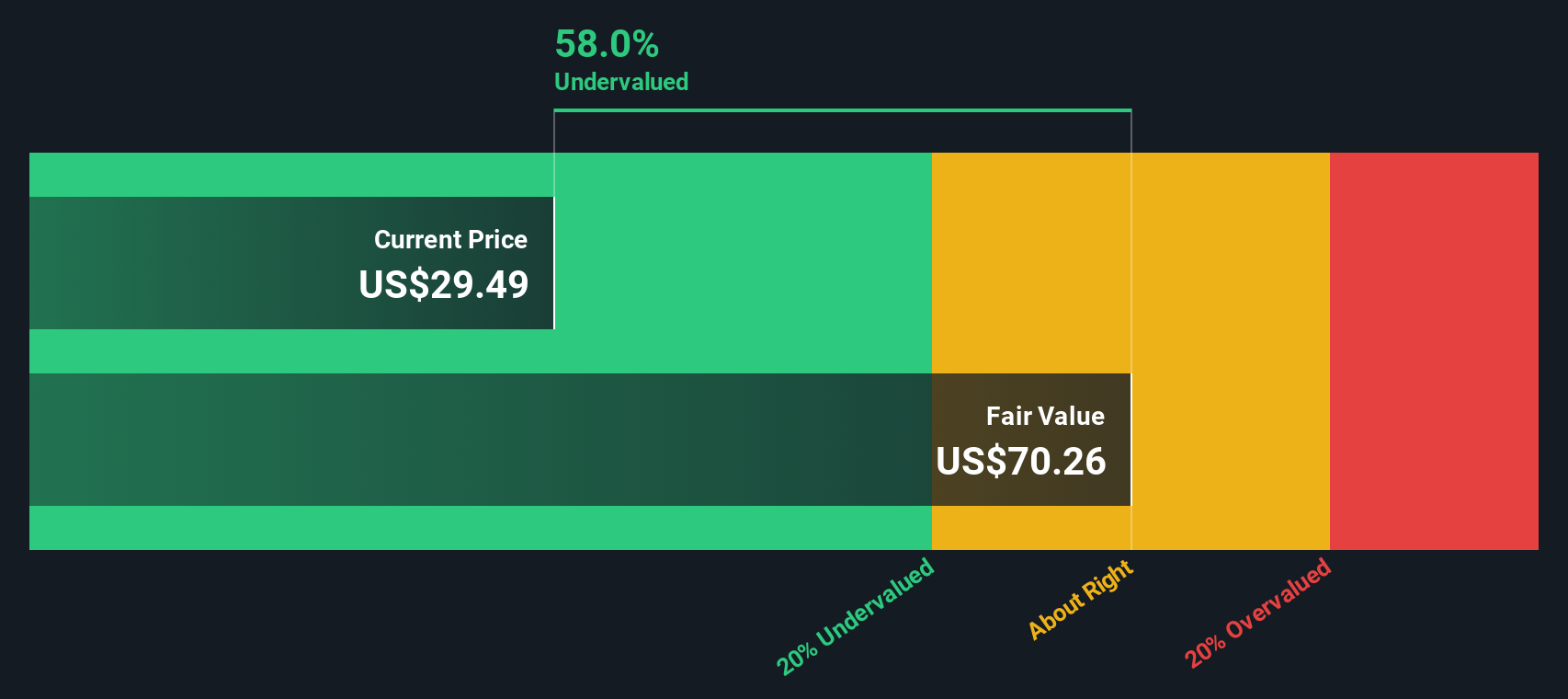

When these projected cash flows are discounted back to today, the DCF model produces an intrinsic value of about $69.28 per share. That implies the stock trades at roughly a 58.1% discount to this estimate. This suggests the market is heavily discounting Arcutis future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Arcutis Biotherapeutics is undervalued by 58.1%. Track this in your watchlist or portfolio, or discover 907 more undervalued stocks based on cash flows.

Approach 2: Arcutis Biotherapeutics Price vs Sales

For a company like Arcutis that is still loss making, the price to sales ratio is often a more useful yardstick than earnings based metrics because revenue is present even when profits are not yet established and better reflects how the market values the current commercial opportunity.

In general, higher growth prospects and lower perceived risk justify a richer multiple, while slower growth or greater uncertainty usually warrant a discount. Against that backdrop, Arcutis currently trades on a price to sales ratio of about 11.18x. That is slightly below the broader Biotechs industry average of 12.08x, but a bit above the peer group average of 9.86x.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable price to sales multiple should be given Arcutis specific growth outlook, profitability profile, industry, market cap and risk factors. For Arcutis, this Fair Ratio comes out at 10.09x, below the current 11.18x, which points to the shares looking somewhat expensive on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arcutis Biotherapeutics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of the Arcutis Biotherapeutics story with a concrete forecast for its future revenue, earnings and margins, and then translate that into a Fair Value you can compare to today’s share price. On Simply Wall St’s Community page, Narratives let millions of investors turn their assumptions into a living valuation that updates automatically as new earnings, clinical data or news arrives, helping them decide whether Arcutis looks like a buy, a hold or a sell at any point in time. For example, one Arcutis Narrative might assume rapid uptake of ZORYVE and a Fair Value around $40 per share, while a more cautious Narrative, focused on concentration and reimbursement risks, might land closer to $21 to $25. This gives you a clear, side by side view of how different stories lead to different price targets.

Do you think there's more to the story for Arcutis Biotherapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal