Lululemon (LULU) Margin Compression Challenges Bullish Growth Narrative After Q3 2026 Results

lululemon athletica (LULU) has just posted another solid quarter, with Q3 2026 revenue of about $2.6 billion and net income of roughly $307 million, translating to EPS of $2.59, while over the last 12 months earnings grew just 0.01% and net margin eased from 17.1% to 15.7%. The company has seen revenue move from $2.40 billion in Q3 2025 to $2.57 billion in Q3 2026, with EPS shifting from $2.87 to $2.59 over the same stretch. This sets up a story where healthy top line levels are now rubbing up against margin compression and softer earnings momentum.

See our full analysis for lululemon athletica.With the latest numbers on the table, the next step is to see how this mix of resilient sales and tighter margins lines up against the key narratives investors have been debating around lululemon athletica.

See what the community is saying about lululemon athletica

Flat 0.01% Earnings Growth Versus 21.7% History

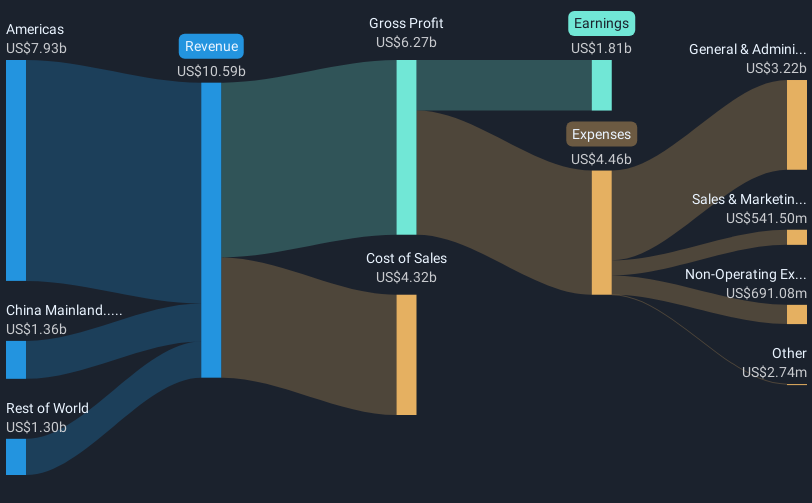

- Over the last 12 months, earnings barely moved, up just 0.01%, compared with a 21.7% per year growth rate over the past five years, and trailing net income sits at about $1.7 billion on roughly $11.1 billion of revenue.

- Consensus narrative leans on a reset of product strategy and faster design and supply chain processes to reaccelerate growth. This sits in contrast to the very modest 0.01% earnings growth and slower forecast revenue growth of about 4.6% per year versus the 10.6% US market benchmark.

- Supporters point to international strength, with recent quarters showing China up 25% and Rest of World up 19%, as a path to get back closer to that 21.7% historical earnings growth pace.

- At the same time, the consensus view acknowledges that US softness and a maturing brand mean the current low growth profile could persist if the product reset and innovation push do not translate into higher conversion.

Margins Slip From 17.1% To 15.7%

- Trailing net profit margin has declined from 17.1% to 15.7% over the last year, even though trailing 12 month revenue climbed from about $10.6 billion to $11.1 billion and net income edged from roughly $1.8 billion to $1.7 billion.

- Bears argue that rising tariffs and weaker US demand could keep pressuring profitability, and the margin drop to 15.7% lines up with that concern, especially with forecasts calling for profit margins to move from 16.4% to 14.5% over the next three years.

- Critics highlight estimates that new tariffs and the removal of the de minimis provision could cut gross and operating margins by roughly 300 to 390 basis points around 2025, which would weigh further on earnings unless mitigation efforts work.

- Bears also focus on a 1 to 2% expected decline in the US business and fatigue in casual and lifestyle categories, which, if not fixed by new products, could mean more markdowns and additional pressure on that already lower 15.7% net margin.

Low 13.8x P/E And 19% DCF Discount

- The stock trades at a P/E of 13.8 times trailing earnings, well below the 50.9 times peer average and the 22.4 times US Luxury industry, and sits about 19.3% below an estimated DCF fair value of roughly $253.9 versus the current share price of $204.97.

- Bulls contend that high earnings quality and ongoing investments in digital, AI, and omnichannel capabilities can support long term demand and eventually stabilize margins. They see this as mispriced given the 13.8 times P/E and discount to the $253.9 DCF fair value.

- Supporters point to analysts expecting earnings to rise from about $1.8 billion to roughly $1.9 billion by 2028, alongside revenue growing about 5.4% annually, as justification for a future P/E of 14.9 times that would still sit below the current 19.8 times industry multiple.

- What stands out is that these growth and margin assumptions are being applied to a business already generating around $11.1 billion in annual revenue and $1.7 billion in net income, yet the market price of $204.97 lags both the $205.91 consensus target and the higher DCF fair value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for lululemon athletica on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently and want your view heard quickly? Take just a few minutes to shape your own storyline around lululemon athletica, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding lululemon athletica.

See What Else Is Out There

lululemon athletica now faces slower earnings growth and shrinking margins, raising questions about how durable its performance can be through the next cycle.

If that wobble in consistency leaves you uneasy, use our stable growth stocks screener (2103 results) to immediately focus on companies already proving they can deliver steadier revenue and earnings regardless of short term turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal