Is Coinbase Still Attractive After a 630.8% Three Year Surge?

- Wondering whether Coinbase Global at around $267 a share is still a smart way to play crypto, or if the big move is already behind it, you are not alone.

- The stock has cooled off recently, slipping about 0.8% over the last week, 12.0% over the last month and sitting roughly 4.0% up year to date after a wild 630.8% gain over three years.

- That volatility has been underpinned by shifting sentiment around crypto regulation in the US and the growing adoption of Bitcoin ETFs. Both of these factors keep Coinbase squarely in the spotlight. At the same time, ongoing debates about the long term role of centralized exchanges versus DeFi have added a fresh layer of risk and opportunity to the story.

- Right now, Coinbase scores just 2 out of 6 on our valuation checks, which suggests pockets of value but also some clear red flags. Next, we will unpack what different valuation methods say about the stock and, by the end, look at a more complete way to judge whether the current price really makes sense.

Coinbase Global scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Coinbase Global Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the minimum return that investors demand on its equity, then capitalizes those extra profits into an intrinsic value per share.

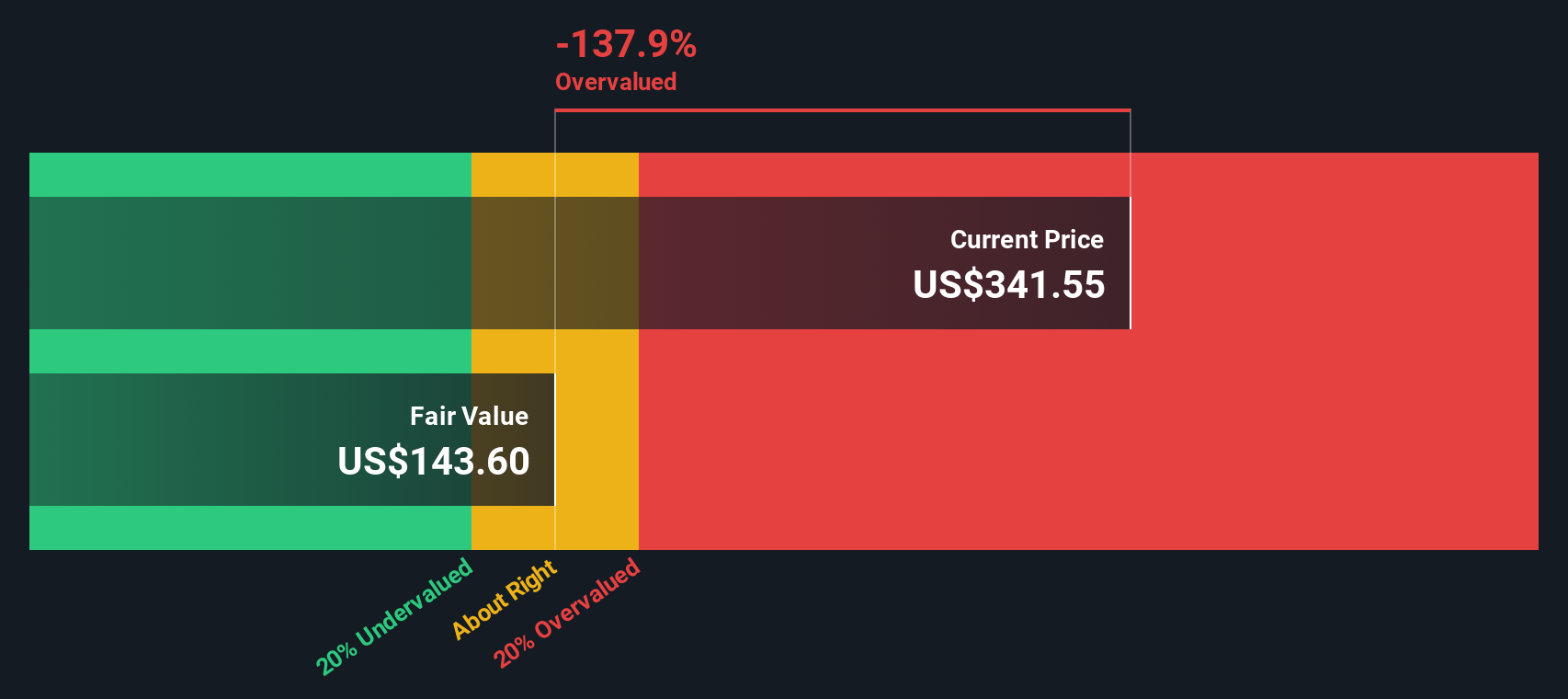

For Coinbase Global, the model starts with a Book Value of $59.62 per share and a Stable Book Value of $55.13 per share, based on forward estimates from analysts. Using a Stable EPS of $8.33 per share, derived from weighted future Return on Equity forecasts from 7 analysts, the company is expected to earn an Average Return on Equity of 15.11% over the long run.

Investors are assumed to require a Cost of Equity of $4.62 per share, so Coinbase is projected to generate an Excess Return of $3.71 per share above that hurdle. When these excess returns are projected and discounted, the model arrives at an intrinsic value of about $127.54 per share in $.

Against the current market price around $267, this implies the stock is roughly 109.7% overvalued on this framework, suggesting expectations in the share price are well ahead of the modeled economics.

Result: OVERVALUED

Our Excess Returns analysis suggests Coinbase Global may be overvalued by 109.7%. Discover 907 undervalued stocks or create your own screener to find better value opportunities.

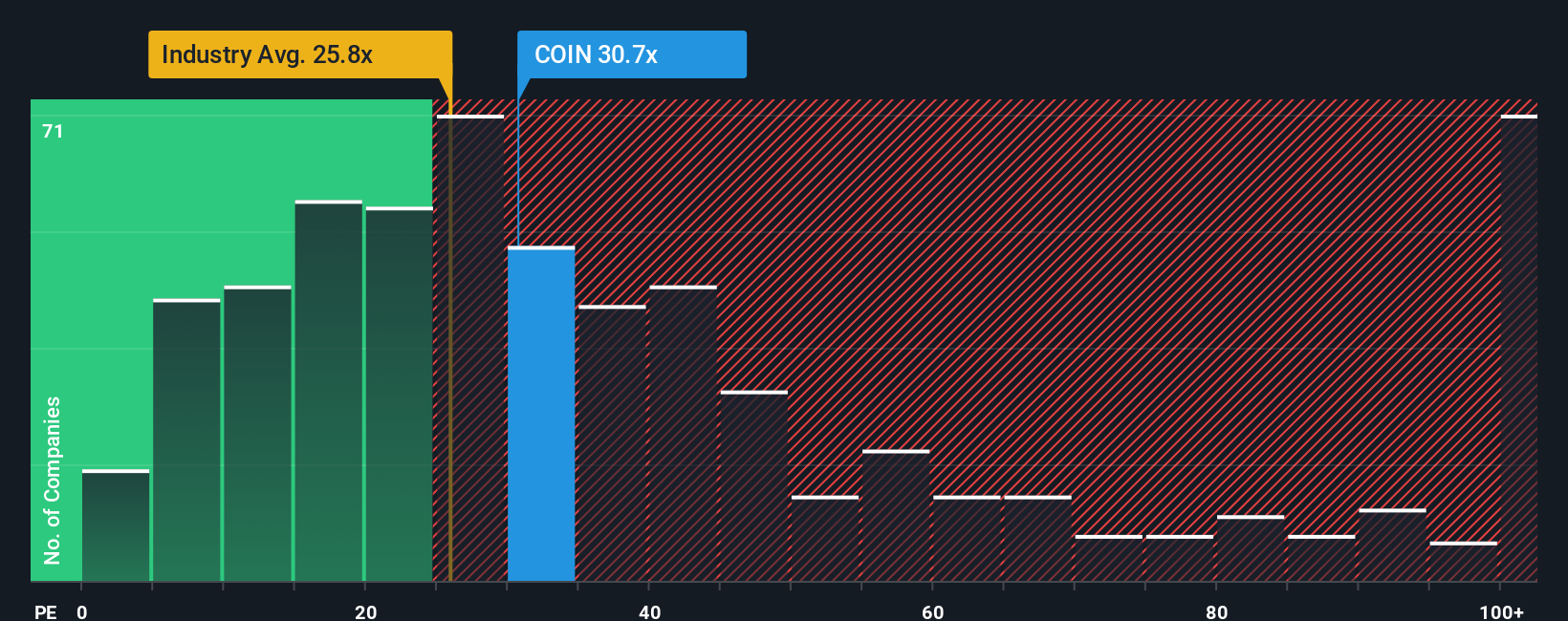

Approach 2: Coinbase Global Price vs Earnings

For a profitable business like Coinbase, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. It naturally embeds expectations about future growth and the risk of those earnings, with higher growth and lower perceived risk typically justifying a higher PE, and vice versa.

Coinbase currently trades on a PE of about 22.4x. That sits below the peer average of roughly 31.9x and also a little below the broader Capital Markets industry average of around 25.4x. On the surface, that might suggest the stock is being valued a bit more conservatively than many comparable names.

Simply Wall St’s Fair Ratio for Coinbase is 22.3x, which is its proprietary estimate of what a reasonable PE should be after accounting for factors like Coinbase’s earnings growth profile, profit margins, risk characteristics, industry and market cap. This is more tailored than a simple comparison with peers or the sector, which can miss company specific nuances. With the Fair Ratio almost identical to the current PE, the market’s pricing looks roughly aligned with Coinbase’s fundamentals on this metric.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1448 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coinbase Global Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company, tied directly to your assumptions for its future revenue, earnings, margins and, ultimately, fair value. A Narrative connects three things in one place: the business story, a quantified forecast, and a resulting fair value that you can compare with today’s share price to decide whether Coinbase looks like a buy, hold or sell. On Simply Wall St, Narratives live inside the Community page and are easy to use, with millions of investors already building, sharing and following them, and they automatically update when new data, news or earnings arrive so your view stays current without constant manual tweaking. For Coinbase, one investor might build a bullish Narrative with strong growth from tokenization, Base and USDC that supports a fair value near the high end of recent targets, while another might focus on fee pressure, ETF competition and regulatory costs that justify a much lower fair value, and both perspectives can coexist transparently on the platform.

Do you think there's more to the story for Coinbase Global? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal