Investors Appear Satisfied With Americas Gold and Silver Corporation's (TSE:USA) Prospects As Shares Rocket 29%

Americas Gold and Silver Corporation (TSE:USA) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days were the cherry on top of the stock's 459% gain in the last year, which is nothing short of spectacular.

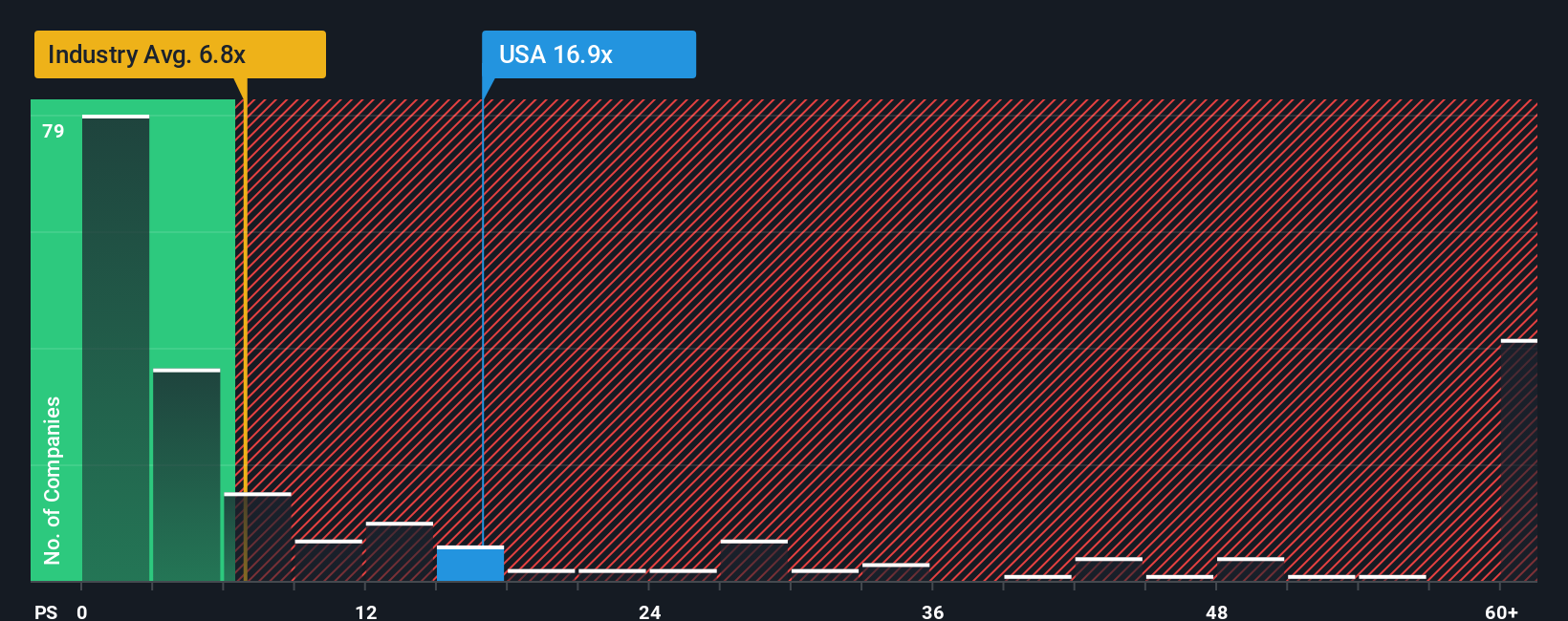

Following the firm bounce in price, Americas Gold and Silver's price-to-sales (or "P/S") ratio of 16.9x might make it look like a strong sell right now compared to other companies in the Metals and Mining industry in Canada, where around half of the companies have P/S ratios below 6.8x and even P/S below 2x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Americas Gold and Silver

What Does Americas Gold and Silver's Recent Performance Look Like?

Americas Gold and Silver hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Americas Gold and Silver will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

Americas Gold and Silver's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 56% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 23% each year, which is noticeably less attractive.

With this in mind, it's not hard to understand why Americas Gold and Silver's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Americas Gold and Silver's P/S

The strong share price surge has lead to Americas Gold and Silver's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Americas Gold and Silver's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Americas Gold and Silver (1 is a bit concerning!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal