Cogent Communications Holdings, Inc. (NASDAQ:CCOI) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Those holding Cogent Communications Holdings, Inc. (NASDAQ:CCOI) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 70% share price decline over the last year.

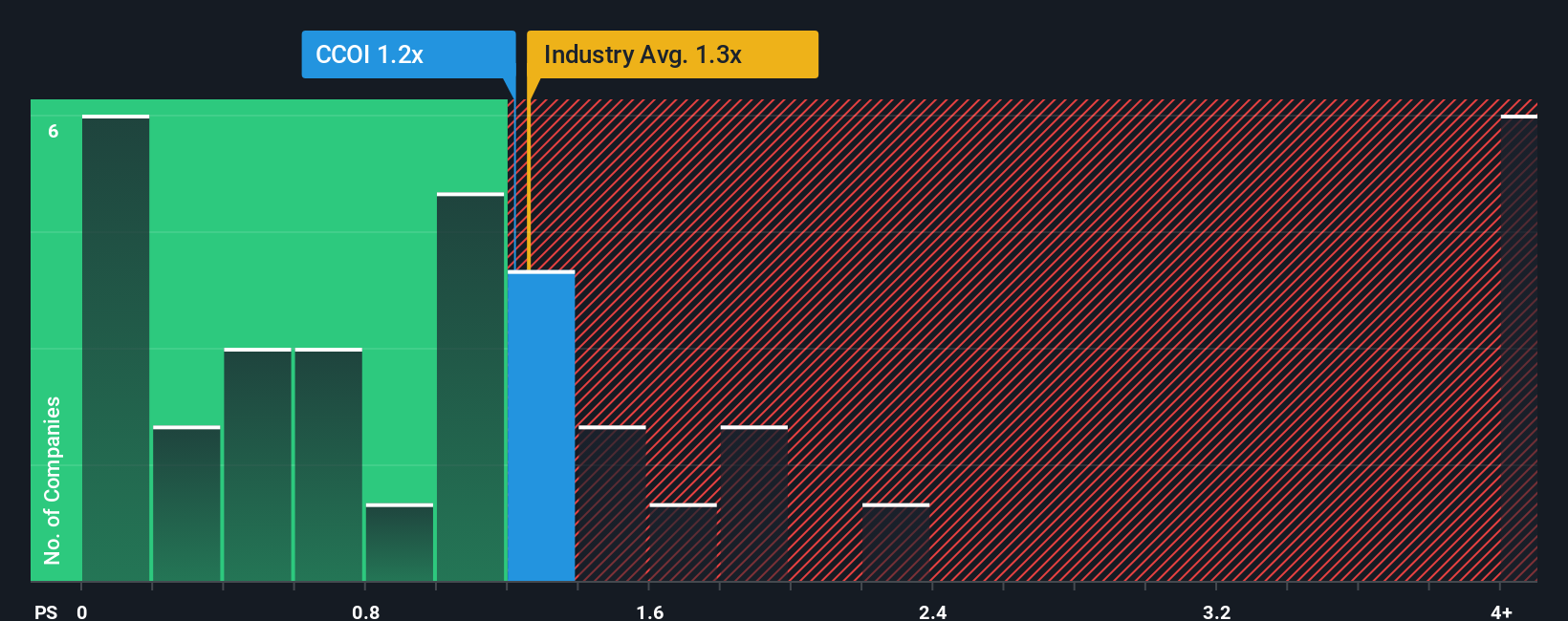

Although its price has surged higher, you could still be forgiven for feeling indifferent about Cogent Communications Holdings' P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Telecom industry in the United States is also close to 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Cogent Communications Holdings

What Does Cogent Communications Holdings' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Cogent Communications Holdings' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cogent Communications Holdings.Do Revenue Forecasts Match The P/S Ratio?

Cogent Communications Holdings' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.0%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 57% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.5% per annum as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 116% per annum, which is noticeably more attractive.

With this in mind, we find it intriguing that Cogent Communications Holdings' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Cogent Communications Holdings' P/S?

Cogent Communications Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Cogent Communications Holdings' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Having said that, be aware Cogent Communications Holdings is showing 5 warning signs in our investment analysis, and 3 of those can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal