After Leaping 32% Skolon AB (publ) (STO:SKOLON) Shares Are Not Flying Under The Radar

Skolon AB (publ) (STO:SKOLON) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

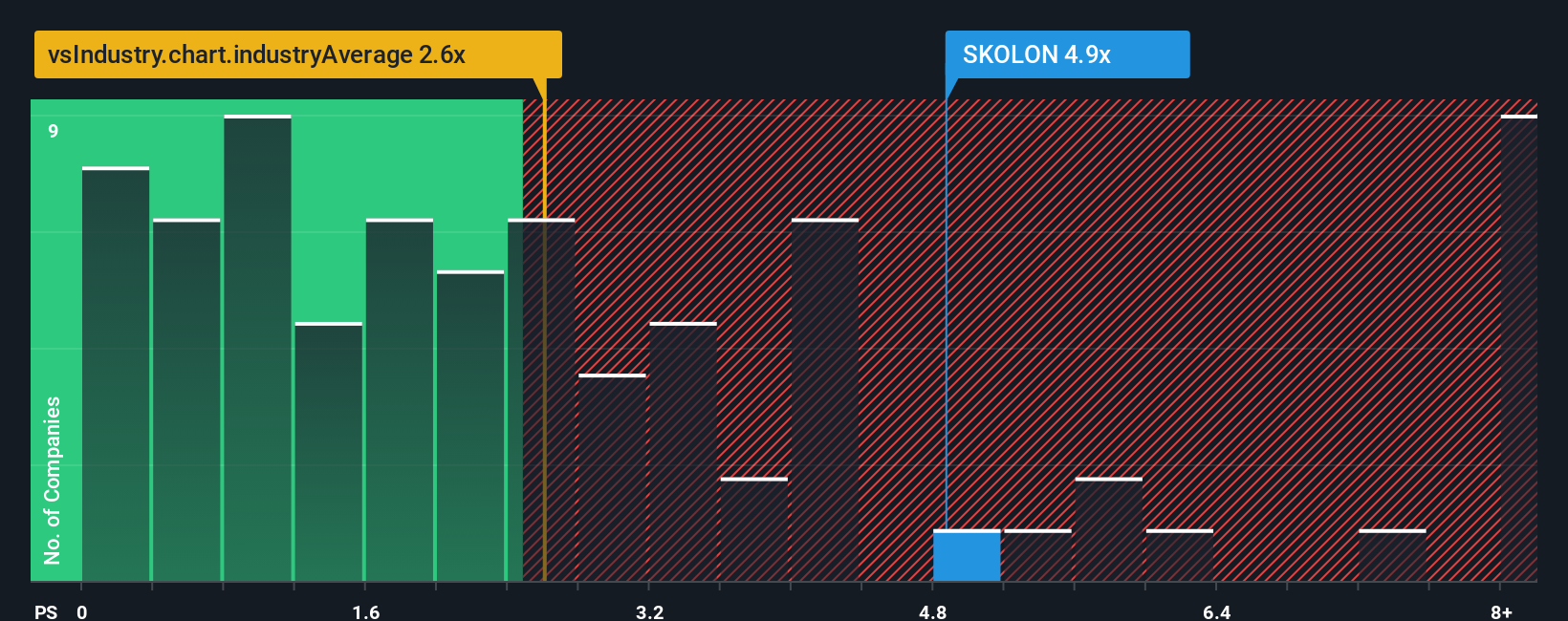

Following the firm bounce in price, you could be forgiven for thinking Skolon is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.9x, considering almost half the companies in Sweden's Software industry have P/S ratios below 2.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Skolon

What Does Skolon's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Skolon has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Skolon.How Is Skolon's Revenue Growth Trending?

In order to justify its P/S ratio, Skolon would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. Pleasingly, revenue has also lifted 203% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 33% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 1.1% growth forecast for the broader industry.

With this information, we can see why Skolon is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Skolon's P/S?

Skolon's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Skolon's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Skolon that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal