BrightView Holdings (BV): Reassessing Valuation After a Modest One-Month Share Price Rebound

BrightView Holdings (BV) has been quietly grinding higher, with shares up about 6% over the past month even as the stock remains down sharply this year, drawing value oriented investors back in.

See our latest analysis for BrightView Holdings.

The latest move takes the share price to about $12.96, and while the 30 day share price return has turned positive, the year to date share price performance and one year total shareholder return still point to a name working to rebuild confidence after prior weakness.

If this kind of turnaround story is on your radar, it could be worth comparing BrightView with other service focused businesses and exploring fast growing stocks with high insider ownership as a curated set of ideas.

With shares still well below their 52 week highs but trading at a hefty intrinsic discount and a meaningful gap to analyst targets, is BrightView an overlooked value opportunity, or is the market already pricing in a full recovery?

Most Popular Narrative Narrative: 19.3% Undervalued

With BrightView last closing at $12.96 against a narrative fair value near $16.06, the valuation case leans positive and hinges on execution of its growth plan.

The company's focus on expanding development operations into new markets where they already have a maintenance presence, aiming to open 10 branches over the next 24 months and capitalize on its $1.2 billion project backlog, positions BrightView to benefit from continued urban growth and rising demand for green spaces, supporting significant future revenue growth.

Curious how modest revenue growth, a major earnings ramp up, and a lower future profit multiple can still justify a higher value than today? The full narrative unpacks the math driving that gap between price and projected potential.

Result: Fair Value of $16.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained macro headwinds or slower conversion of project work into recurring maintenance revenue could undermine margin expansion and delay the anticipated earnings ramp.

Find out about the key risks to this BrightView Holdings narrative.

Another Way to Look at Value

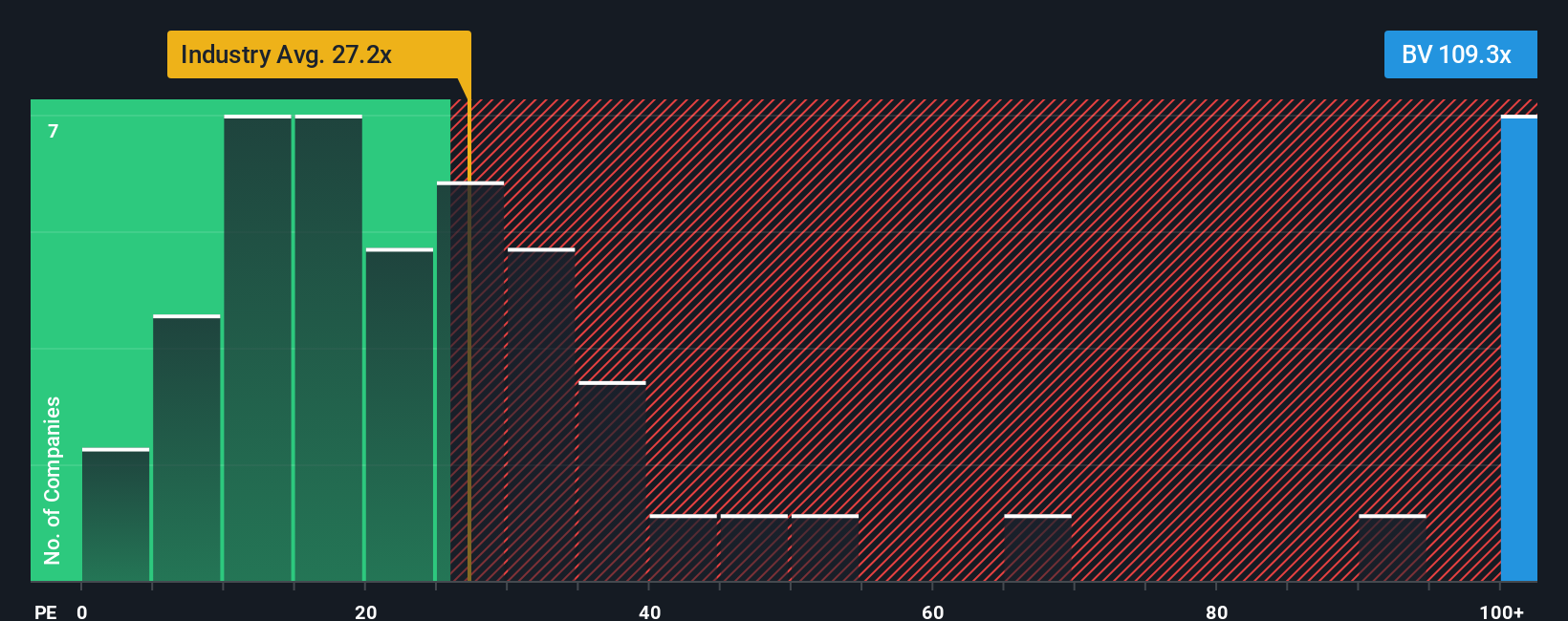

On earnings, BrightView looks anything but cheap. The stock trades around 95.9 times earnings, versus roughly 30.4 times for peers and a fair ratio near 42.6 times. That premium suggests real valuation risk if growth or margins fall short of expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BrightView Holdings Narrative

If this perspective does not fully align with your own, or you prefer to dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A great starting point for your BrightView Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning a fresh set of stock ideas tailored to different strategies, so real opportunities do not pass you by.

- Target potential bargains with strong fundamentals by running through these 905 undervalued stocks based on cash flows and spotting companies the market may be mispricing.

- Position yourself for the next wave of innovation by reviewing these 26 AI penny stocks that could benefit from accelerating investment in artificial intelligence.

- Strengthen your income strategy by assessing these 12 dividend stocks with yields > 3% that aim to deliver cash returns alongside potential capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal