Undiscovered US Gems to Explore This December 2025

As the Dow Jones Industrial Average continues to reach new heights, despite recent pullbacks in the tech sector, investors are keenly observing shifts in market dynamics influenced by AI bubble concerns and economic policy uncertainties. With small-cap stocks often flying under the radar amidst such volatility, identifying promising opportunities requires a focus on companies with strong fundamentals and potential for growth within their niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

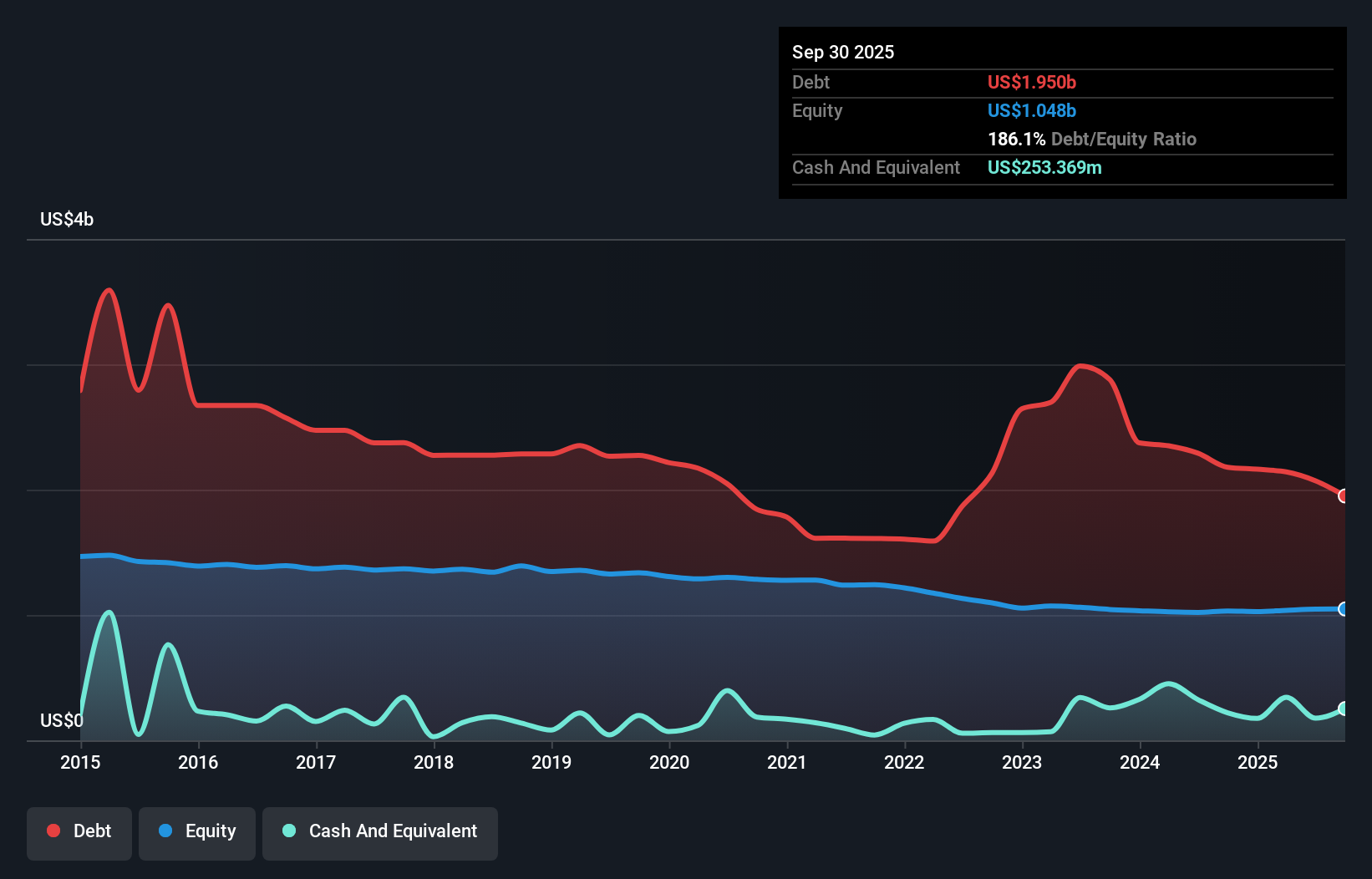

Capitol Federal Financial (CFFN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Capitol Federal Financial, Inc. is the holding company for Capitol Federal Savings Bank, offering a range of retail banking products and services in the United States with a market cap of $898.92 million.

Operations: Capitol Federal Financial generates revenue primarily through its community banking operations, which amount to $200.29 million.

Capitol Federal Financial, with its total assets of $9.8 billion and equity of $1 billion, showcases a solid financial foundation with total deposits at $6.6 billion and loans amounting to $8.1 billion. The company has an appropriate bad loans ratio of 0.6%, reflecting prudent risk management, though the allowance for bad loans sits low at 50%. Recent earnings growth of 78.9% outpaced the industry average, highlighting robust performance alongside a competitive price-to-earnings ratio of 13x compared to the US market's 19x. Notably, it repurchased shares worth $3.85 million in recent months, indicating confidence in its valuation strategy.

- Click here to discover the nuances of Capitol Federal Financial with our detailed analytical health report.

Understand Capitol Federal Financial's track record by examining our Past report.

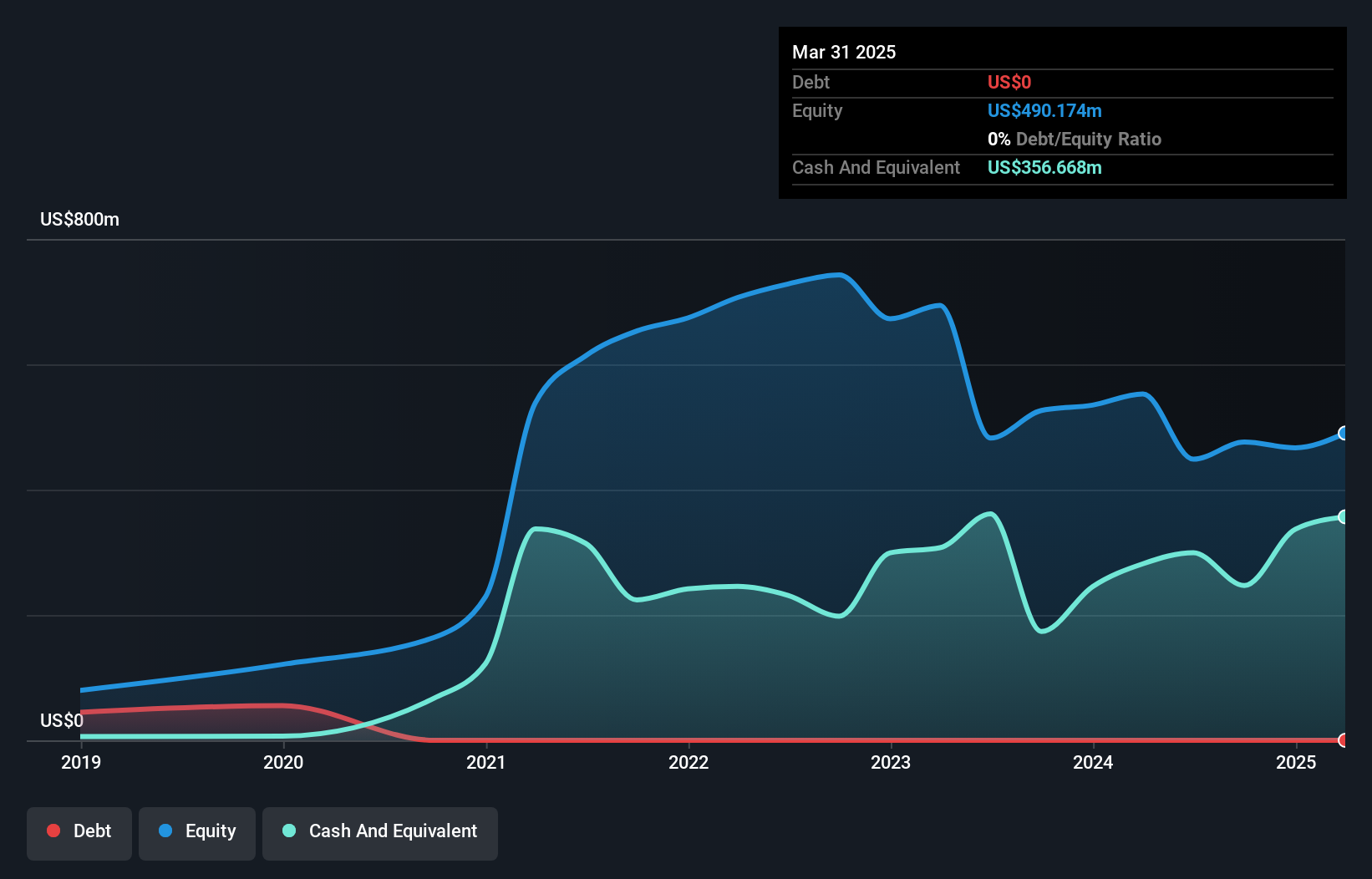

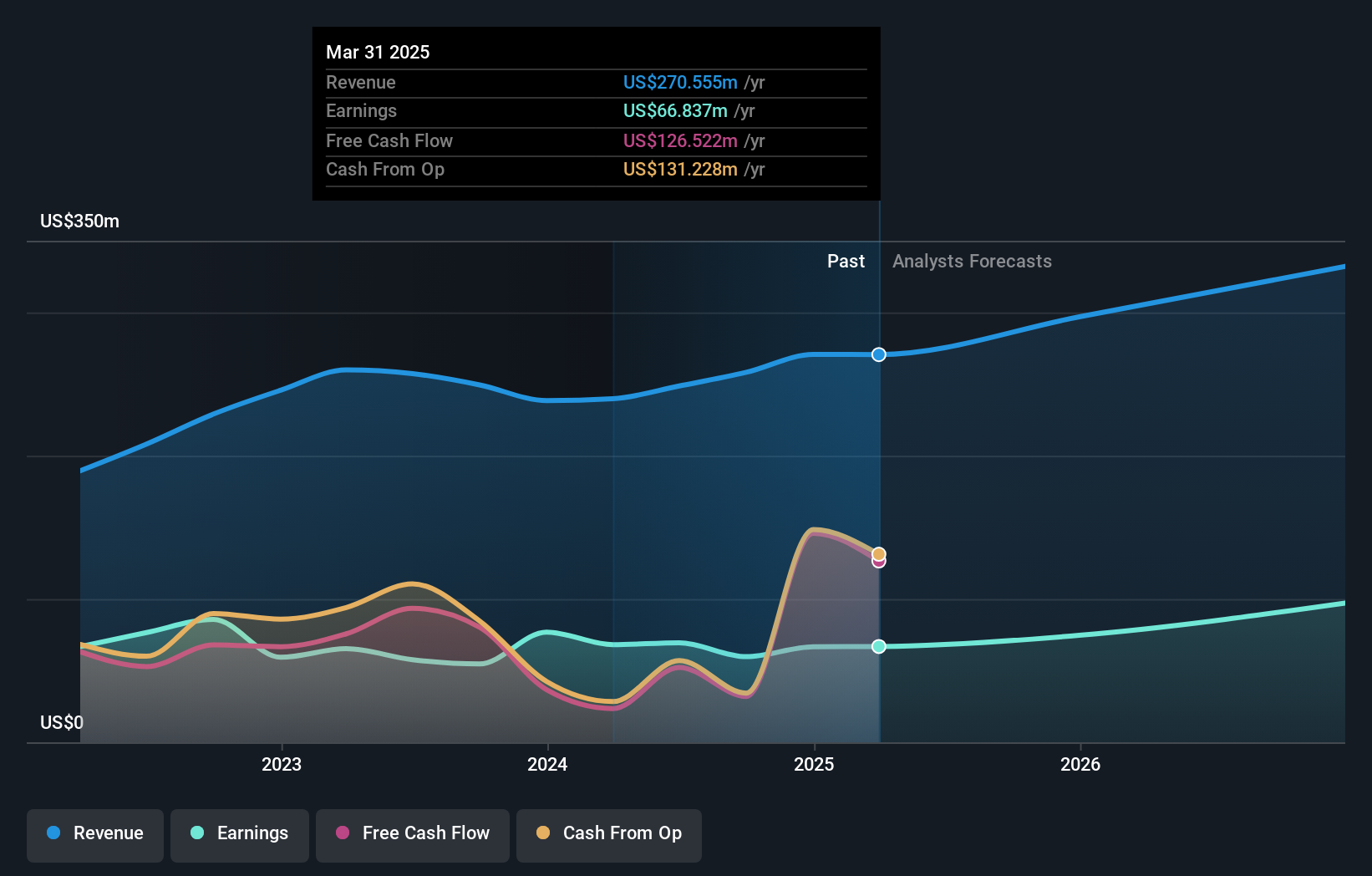

Cricut (CRCT)

Simply Wall St Value Rating: ★★★★★★

Overview: Cricut, Inc. designs, markets, and distributes a creativity platform for crafting handmade goods across various regions including the United States and several international markets, with a market cap of approximately $1.10 billion.

Operations: Cricut, Inc. generates revenue primarily through its platform segment, which contributed $322.83 million, with an additional segment adjustment of $391.66 million.

Cricut, a nimble player in the crafting industry, has been making waves with its recent performance. The company's earnings surged by 30% over the past year, significantly outpacing the Consumer Durables sector's -11.2%. Cricut is trading at a notable 60.7% below its estimated fair value, presenting an intriguing opportunity for investors seeking undervalued stocks. Financially robust with no debt on its books and positive free cash flow, Cricut also reported Q3 revenue of US$170 million and net income of US$20 million—a marked improvement from last year’s figures. Additionally, it completed a share buyback worth US$3 million this quarter.

- Click here and access our complete health analysis report to understand the dynamics of Cricut.

Explore historical data to track Cricut's performance over time in our Past section.

Metropolitan Bank Holding (MCB)

Simply Wall St Value Rating: ★★★★★★

Overview: Metropolitan Bank Holding Corp. is the bank holding company for Metropolitan Commercial Bank, offering a variety of business, commercial, and retail banking products and services with a market cap of $833.31 million.

Operations: Metropolitan Bank Holding Corp. generates revenue primarily from its banking segment, amounting to $261.46 million. The company has a market cap of $833.31 million.

Metropolitan Bank Holding, with assets of US$8.2 billion and equity of US$732 million, presents a solid profile in the banking sector. The company has total deposits of US$7.1 billion and loans amounting to US$6.7 billion, supported by a net interest margin of 3.5%. Its allowance for bad loans stands at 1.2% of total loans, indicating prudent risk management practices. Recent earnings growth over the past five years averaged 7.6% annually, although it lagged behind the industry’s recent performance surge at 18%. A recent share buyback saw the company repurchase 39,166 shares for US$2.71 million this year.

Seize The Opportunity

- Explore the 296 names from our US Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal