Assessing Hawaiian Electric (HE) Valuation After S&P SmallCap 600 Index Inclusion Boosts Investor Interest

Hawaiian Electric Industries (HE) just caught investors attention after being tapped for inclusion in the S&P SmallCap 600 Index, a capital markets upgrade that is already shifting trading volumes and ownership dynamics.

See our latest analysis for Hawaiian Electric Industries.

That index news comes on top of a solid year to date, with a 23.28% year to date share price return and a 15.69% one year total shareholder return suggesting sentiment is improving, even though the three year total shareholder return of negative 69.92% shows longer term holders are still deep in the hole.

If this kind of rebound story has your attention, it might also be worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar names building momentum.

With the stock now trading slightly above the average analyst price target and sentiment turning, is Hawaiian Electric still a contrarian value play for patient investors, or is the market already pricing in a full recovery and future growth?

Most Popular Narrative: 8.4% Overvalued

With Hawaiian Electric Industries last closing at $11.65 against a most-followed fair value of $10.75, the narrative leans toward a cautiously optimistic, but not bargain level, recovery story.

The consensus price target for Hawaiian Electric Industries has been lowered as a result of a sharply higher future P/E and a notable decline in net profit margin, reducing fair value from $11.44 to $10.75.

Want to see what kind of earnings rebound justifies paying a richer multiple on thinner margins? The narrative leans on a carefully staged recovery path. Curious how revenue, profitability and valuation are all expected to line up by the late 2020s?

Result: Fair Value of $10.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, wildfire liabilities and rising mitigation and insurance costs could still squeeze margins and derail the staged earnings recovery currently reflected in forecasts.

Find out about the key risks to this Hawaiian Electric Industries narrative.

Another View: Multiples Point to Value

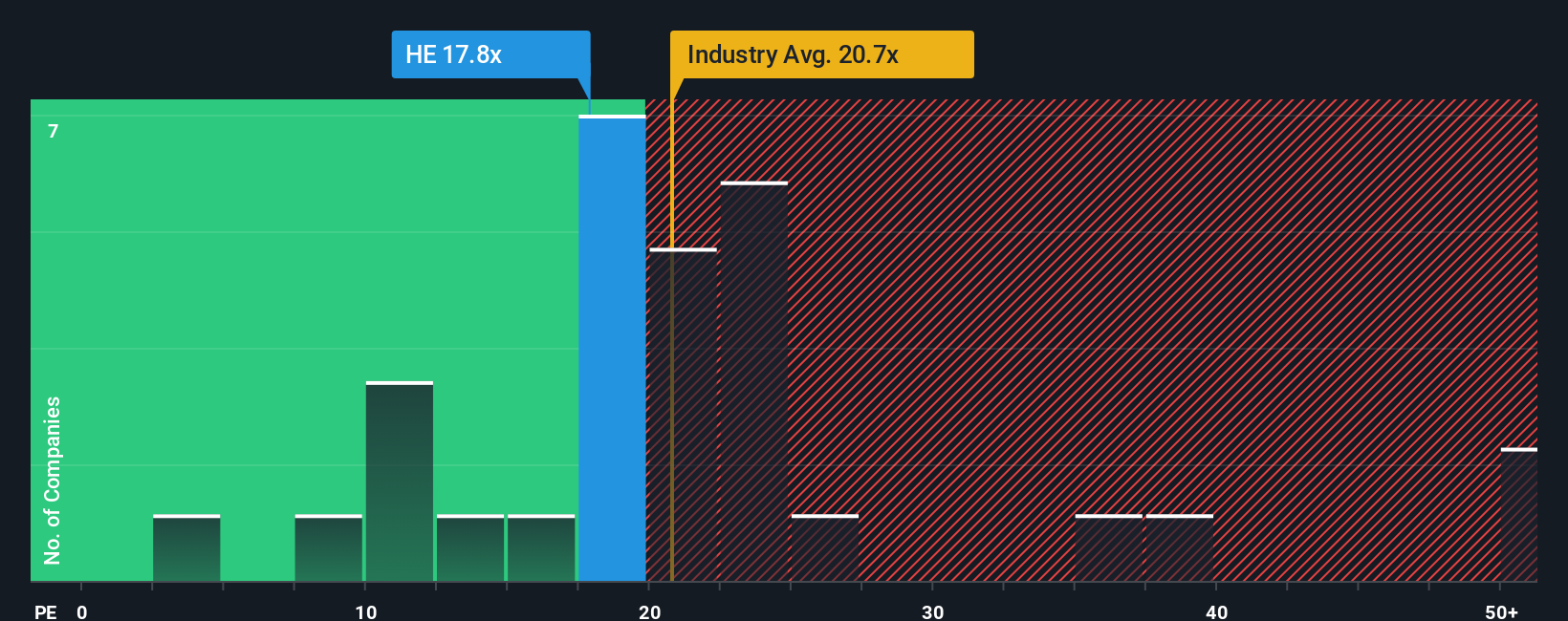

While the narrative fair value says Hawaiian Electric is 8.4% overvalued, the price to earnings picture looks very different. At 17.8x earnings versus peers at 23.5x and a fair ratio of 21.9x, the stock screens as cheaper, not richer. This raises the question: is the market underestimating the recovery?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hawaiian Electric Industries Narrative

If you would rather dig into the numbers yourself and challenge the storyline, you can build a personalized view in minutes: Do it your way.

A great starting point for your Hawaiian Electric Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the market moves on without you, use the Simply Wall St Screener to uncover fresh opportunities that match your strategy and sharpen your next move.

- Capture potential mispricings by targeting quality businesses that still trade at a discount through these 903 undervalued stocks based on cash flows based on cash flows.

- Position yourself for the next wave of innovation by scanning these 25 AI penny stocks that are building real businesses around artificial intelligence.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal