Air Liquide (ENXTPA:AI): Evaluating Valuation After New Hydrogen Deal and Low-Carbon Investment in China

L'Air Liquide (ENXTPA:AI) has caught fresh attention after two linked energy transition moves: a deeper hydrogen partnership with Hyundai Motor Group, and a EUR 25 million low carbon upgrade of its Yulin, China air separation unit.

See our latest analysis for L'Air Liquide.

Despite the latest share price at $158.46 and a softer 1 month share price return, the stock still carries solid long term momentum, with a 5 year total shareholder return of 55.67%, suggesting investors continue to back its energy transition strategy.

If this kind of transition story appeals to you, it might be worth exploring other industrial names and what they are doing around hydrogen and electrification. As a next step, compare L'Air Liquide with peers via fast growing stocks with high insider ownership to see which growth stories insiders are backing most strongly.

With shares now lagging recent highs but still boasting strong multi year returns and sizeable upside to analyst targets, the key question is whether L'Air Liquide is quietly undervalued or if markets already price in its future growth.

Most Popular Narrative Narrative: 19.4% Undervalued

With the most followed narrative placing fair value well above the recent €158.46 close, the gap turns on a handful of powerful growth levers.

Major long term contracts and new investments in the global Electronics and semiconductor sector are set to drive double digit growth from carrier gases and advanced materials, directly bolstering revenue and sustaining higher margins as secular demand for high tech manufacturing outpaces other segments.

Curious why a mature industrial name is being priced like a structural growth story, yet still screens as undervalued on future earnings power and margins, not hype?

Result: Fair Value of $196.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained industrial demand softness or delays to large energy transition projects could constrain volumes and margins, which would challenge the current undervaluation narrative.

Find out about the key risks to this L'Air Liquide narrative.

Another Angle on Valuation

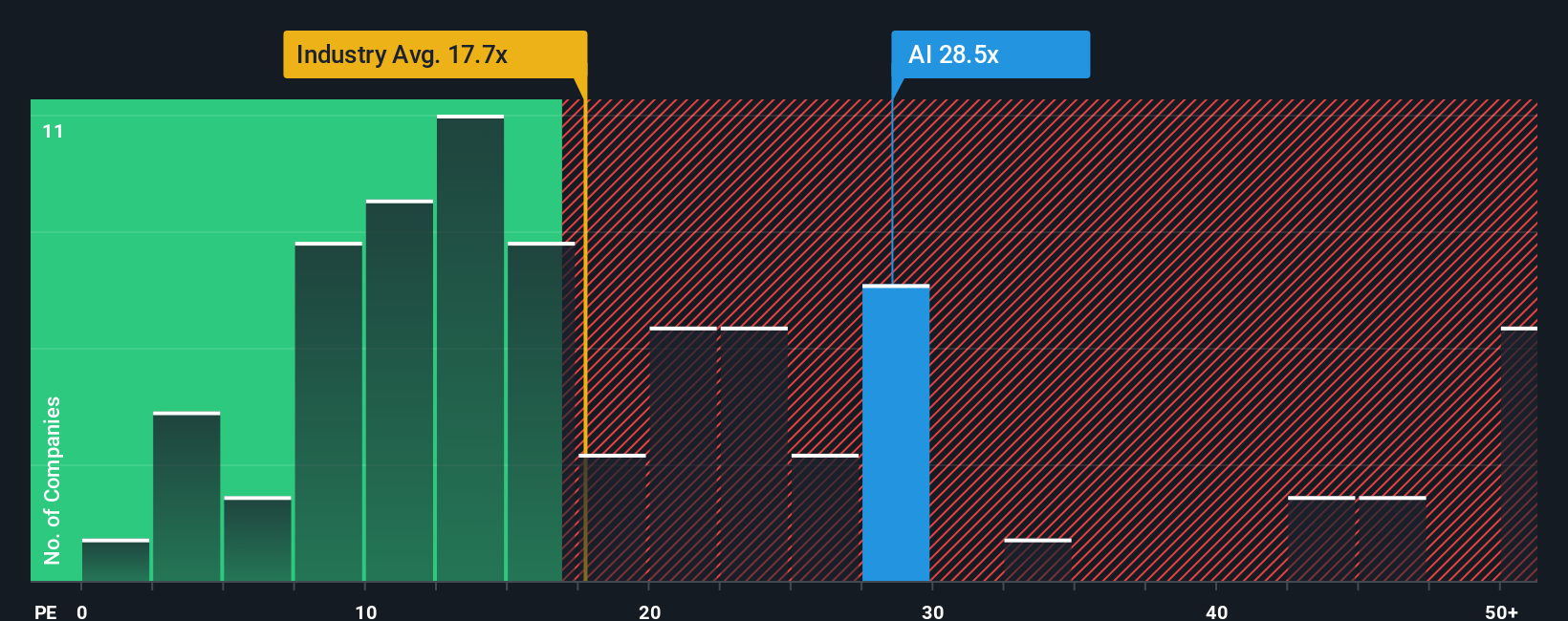

While the consensus narrative sees L'Air Liquide as 19.4% undervalued, a simple earnings based lens paints a tougher picture. At 26.7 times earnings versus 17.3 times for the European chemicals sector and a 25.3 times fair ratio, the shares look richly priced and leave less room for error.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L'Air Liquide Narrative

If this perspective does not fully align with your own thinking, dig into the numbers yourself and craft a personalized view in just a few minutes, then Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding L'Air Liquide.

Ready for more investment ideas?

Before you move on, consider identifying your next opportunity by scanning a few focused stock ideas now, rather than waiting until the market has moved.

- Capitalize on mispriced potential by reviewing these 903 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully recognized yet.

- Explore the next wave of intelligent automation by targeting these 30 healthcare AI stocks that are transforming diagnostics, treatment pathways and hospital efficiency.

- Position yourself in digital finance trends by focusing on these 80 cryptocurrency and blockchain stocks that are building businesses around blockchain innovation and scalable payment infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal