Is Deckers Outdoor Now an Opportunity After a 50% Slide and Modest Valuation Discount?

- If you are wondering whether Deckers Outdoor is a beaten down bargain or a value trap, you are in the right place. We are going to unpack what the current price is really implying.

- The stock has bounced about 5.3% over the last week and 22.5% over the past month, but that is still against a bruising year to date slide of roughly 50.4% and a 50.2% drop over the last 12 months, on the back of what had been strong 3 and 5 year gains of 61.1% and 102.1% respectively.

- Recent headlines have focused on how Deckers is navigating shifting consumer demand in footwear and apparel, including investor debate around whether its flagship brands can sustain their momentum in a tougher spending environment. At the same time, analysts and commentators have been revisiting the long term growth story and margin profile, which helps explain why sentiment and the share price have both been recalibrating.

- On our checks, Deckers scores a 4 out of 6 valuation score, suggesting it looks undervalued on several fronts. Next, we will walk through the main valuation approaches investors are using today while flagging a smarter way to tie them all together at the end of this article.

Find out why Deckers Outdoor's -50.2% return over the last year is lagging behind its peers.

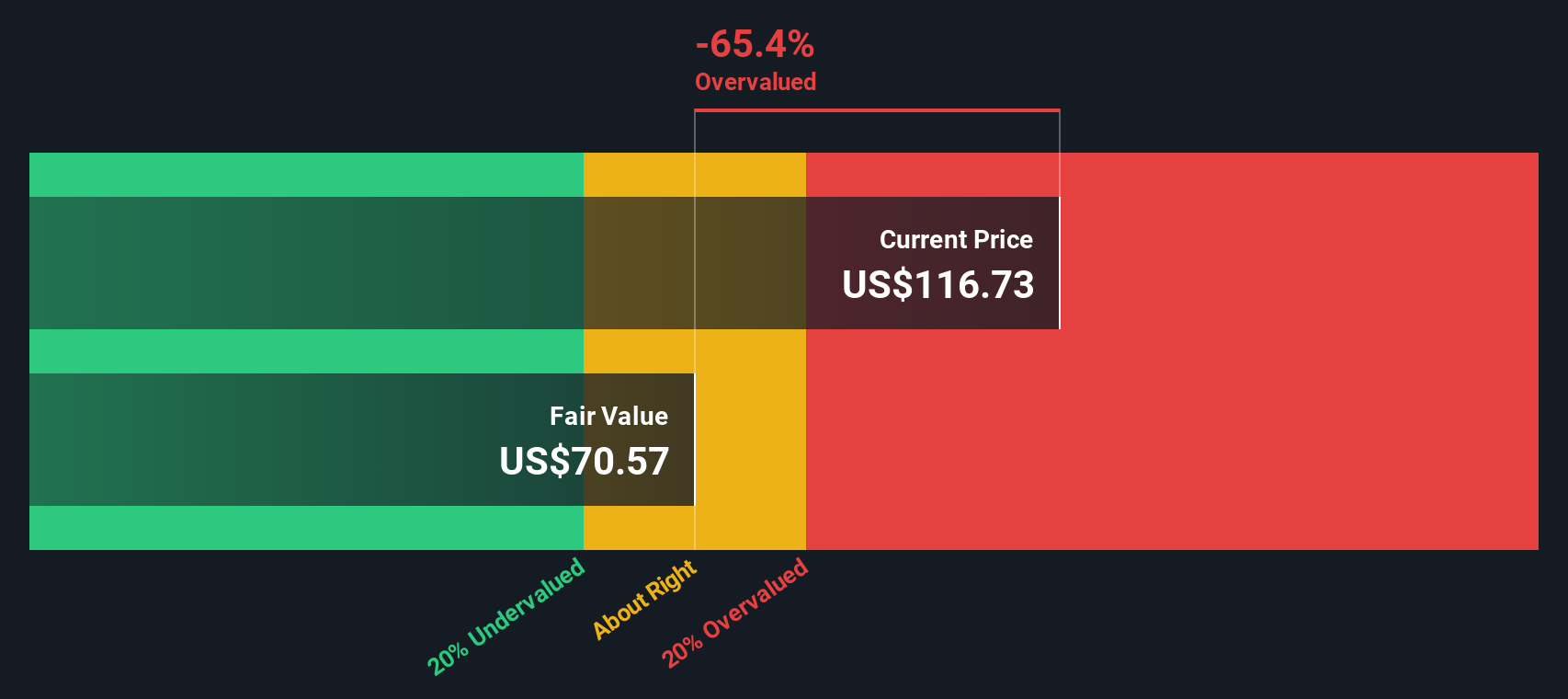

Approach 1: Deckers Outdoor Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model takes the cash a company is expected to generate in the future and then discounts those projections back into today's dollars to estimate what the business is worth right now.

For Deckers Outdoor, the latest twelve month Free Cash Flow stands at about $961 Million. Analysts provide detailed forecasts for the next few years, with Simply Wall St extending those projections further out. On this basis, Deckers' Free Cash Flow is expected to be around $1.04 Billion by 2030, with interim years generally showing steady growth before moderating into the longer term.

Running these cash flows through a 2 Stage Free Cash Flow to Equity model produces an estimated intrinsic value of roughly $105.20 per share. Compared with the current share price, this implies the stock is trading at about a 3.7% discount to its DCF based fair value, which is a modest margin of undervaluation rather than a deep bargain.

Result: ABOUT RIGHT

Deckers Outdoor is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

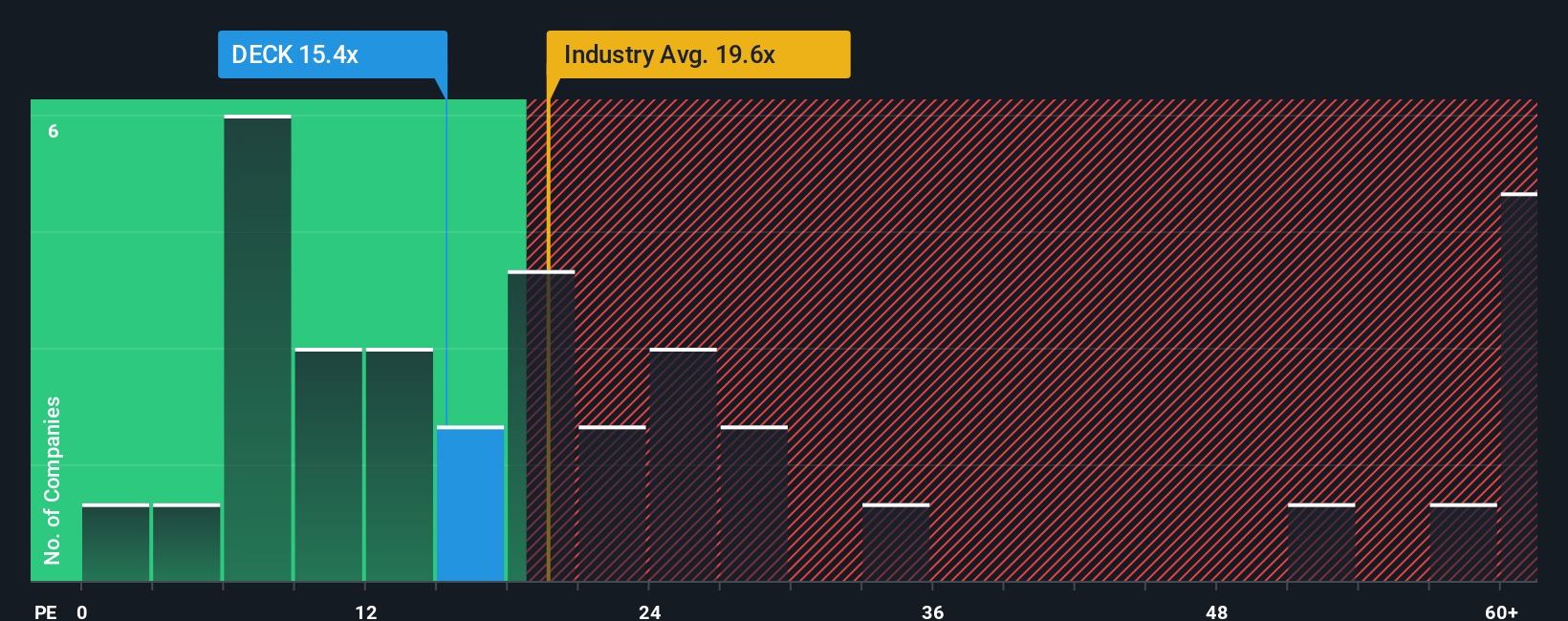

Approach 2: Deckers Outdoor Price vs Earnings

For consistently profitable businesses like Deckers, the Price to Earnings (PE) ratio is often the go-to valuation gauge because it directly links what investors are paying to the profits the company is generating today. In general, faster-growing and lower-risk companies tend to have higher PE multiples, while slower or more uncertain businesses tend to trade on lower, more conservative ratios.

Deckers currently trades on a PE of about 14.5x, which is well below the Luxury industry average of roughly 22.3x and far under the broader peer group average of around 41.1x. On the surface, that gap could suggest the market is pricing Deckers more cautiously than many of its rivals despite its solid track record.

To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio framework, which estimates what a reasonable PE should be after accounting for factors like Deckers earnings growth outlook, profit margins, risk profile, industry positioning and market cap. This approach is more nuanced than lining the stock up against raw peer or sector averages that may not share the same fundamentals. For Deckers, the Fair PE Ratio is about 17.4x, modestly above the current 14.5x, pointing to a degree of undervaluation rather than outright exuberance.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Deckers Outdoor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. These are simply your story about a company, translated into assumptions about its future revenue, earnings, margins and fair value, all linked together in one place on Simply Wall St's Community page where millions of investors share and refine their views.

A Narrative connects three things: what you believe about Deckers Outdoor’s business, how that belief flows into a financial forecast, and what fair value those numbers imply. This helps you quickly see whether the current share price looks attractive, fully valued or stretched.

Because Narratives live on the platform, they update dynamically when new information like earnings, guidance or news is released. This can help you decide whether to buy, hold or sell as your fair value estimate moves relative to the market price.

For example, one Narrative on Deckers might lean bullish, assuming revenue grows closer to the optimistic analyst path, margins stay robust and the stock is valued closer to the higher end of analyst price targets around $158. A more cautious Narrative might assume slower growth, some margin pressure and a fair value closer to the lower end near $97. Seeing both side by side can make it easier to choose which story you actually find more reasonable.

Do you think there's more to the story for Deckers Outdoor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal