Has Carlyle’s 2025 Share Price Rally Already Baked In Its Growth Story?

- Many investors are asking whether Carlyle Group at around $60 is still a smart buy or if most of the upside is already reflected in the price, and that is exactly what we are going to unpack here.

- The stock has climbed 6.9% over the last week, 11.7% over the past month, and is now up 18.6% year to date, adding to an increase of 123.1% over three years and 126.2% over five years.

- Recent headlines have focused on Carlyle sharpening its emphasis on core private equity, credit, and infrastructure strategies, along with reshuffling leadership in key business lines. This signals a push to streamline and scale its flagship platforms. At the same time, the broader alternative asset management space has been back in favor as some investors look for yield and diversification, which has helped support valuations across the sector.

- Despite that strength, Carlyle currently scores just 0/6 on our valuation checks. This suggests the market may be pricing in a lot of optimism and makes it important to examine how different valuation methods compare. Later on we will look at an even more nuanced way to think about what this stock may be worth.

Carlyle Group scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Carlyle Group Excess Returns Analysis

The Excess Returns model estimates value by asking how much profit Carlyle can generate above the required return on shareholders’ equity, and then capitalizing those surplus profits into today’s price per share.

For Carlyle, the starting point is a Book Value of $15.60 per share, with a Stable Book Value of $15.70 per share based on the median over the past five years. Analysts expect Stable EPS of $3.70 per share, derived from weighted future return on equity forecasts from four analysts. With an Average Return on Equity of 23.58% and a Cost of Equity of $1.52 per share, the model estimates an Excess Return of $2.18 per share. This suggests Carlyle is expected to earn well above its cost of capital on a sustained basis.

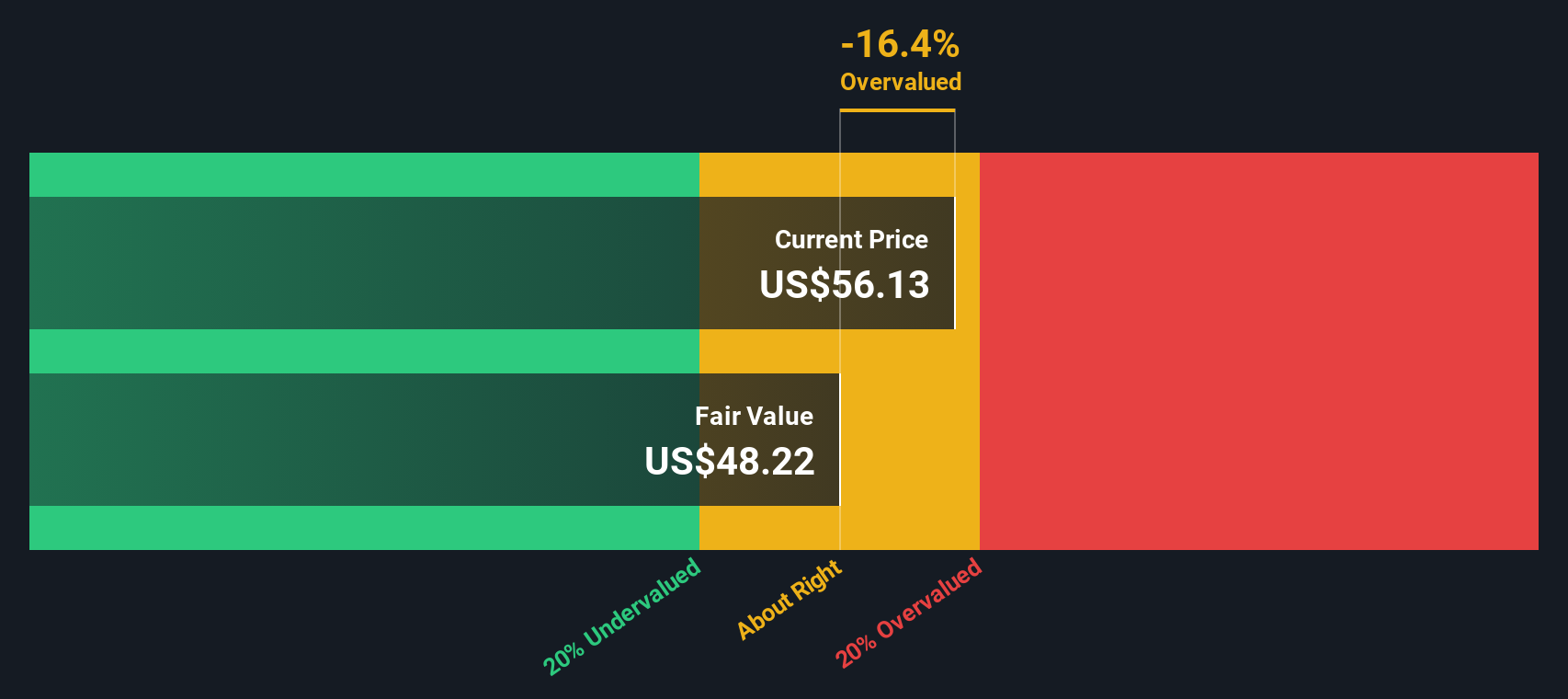

Translating these inputs into an intrinsic value, the Excess Returns model arrives at a fair value of about $49.72 per share. This implies the stock is roughly 21.0% overvalued versus the current market price near $60. On this framework, investors are paying a premium for growth and profitability that already look fully priced in.

Result: OVERVALUED

Our Excess Returns analysis suggests Carlyle Group may be overvalued by 21.0%. Discover 904 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Carlyle Group Price vs Earnings

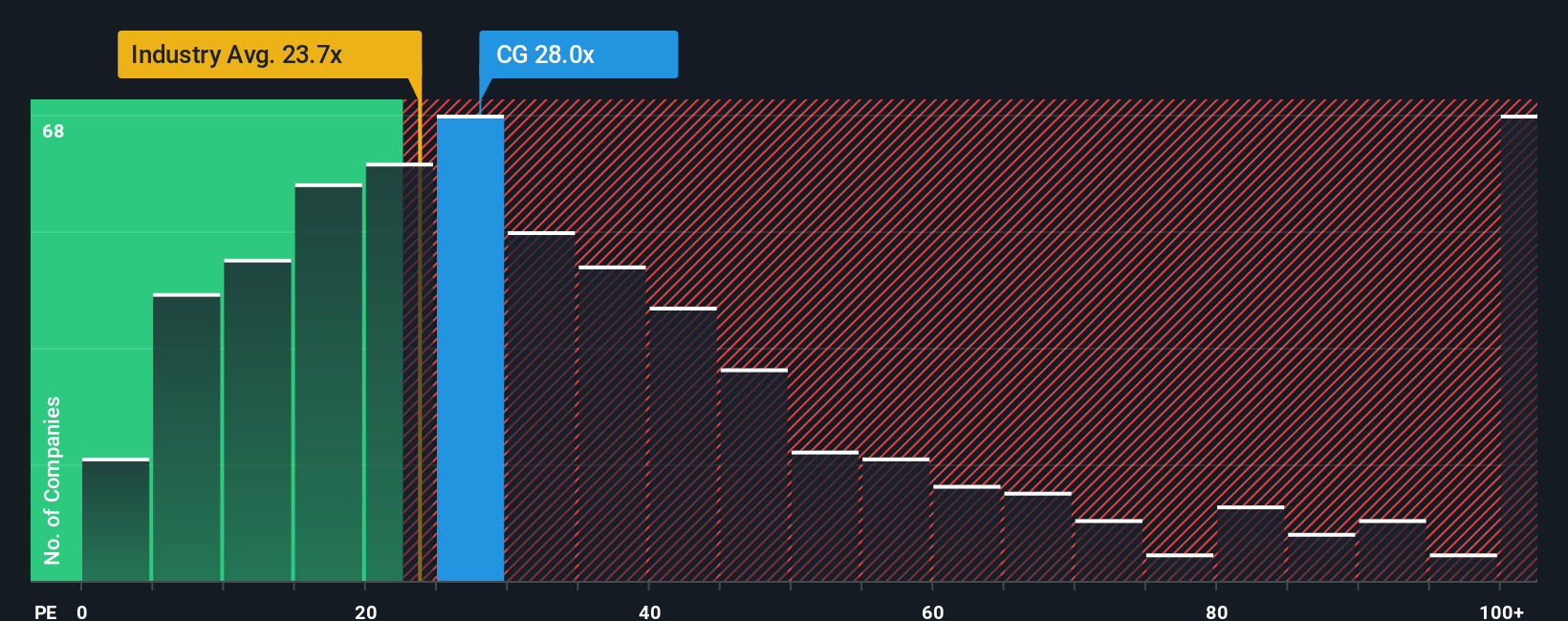

For a profitable asset manager like Carlyle, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. It links directly to the bottom line that ultimately supports dividends and buybacks, so it is often a primary yardstick for established, earnings-generating businesses.

In general, faster and more reliable earnings growth can justify a higher PE, while more cyclical, risky, or low-growth profits may trade on a lower multiple. Against that backdrop, Carlyle currently trades on about 32.79x earnings, which is higher than both the broader Capital Markets industry average of roughly 25.87x and the peer average of about 16.55x. That suggests the market is already assigning Carlyle a premium for its growth profile and franchise quality.

Simply Wall St also uses a Fair Ratio, its proprietary estimate of what Carlyle’s PE could be once factors like expected earnings growth, profitability, risk, industry, and market cap are all taken into account. For Carlyle, this Fair Ratio is 19.06x, below the current 32.79x. Because the market multiple sits significantly above this tailored benchmark, the stock screens as materially overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Carlyle Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple idea where you write the story you believe about a company and connect it directly to the numbers you think are realistic for its future revenue, earnings, and margins to arrive at your own fair value. A Narrative on Simply Wall St links what is happening in the real world, such as Carlyle’s global fundraising, private credit growth, regulation, or deal pipeline, to a transparent financial forecast and then to a fair value estimate that you can easily compare against today’s share price to decide whether you see it as a buy, a hold, or a sell. Narratives are available in the Community section of Simply Wall St, used by millions of investors, and they automatically update as fresh news, earnings, or analyst revisions come in so your view stays current with minimal effort. For example, one investor might build a bullish Carlyle Narrative that assumes a fair value of around $80 per share based on accelerating global deal activity, while another might adopt a more cautious story that sees fair value closer to $56, reflecting execution and regulatory risks.

Do you think there's more to the story for Carlyle Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal