Is Schneider Electric (ENXTPA:SU) Undervalued After Its Recent Share Price Lift?

Schneider Electric (ENXTPA:SU) has quietly pushed higher, with the stock up around 2% over the past week and roughly 3% in the past 3 months, despite a slightly negative year-to-date performance.

See our latest analysis for Schneider Electric.

Zooming out, that recent lift in Schneider Electric’s share price to about €239 sits against a modestly negative year to date share price return, while a much stronger multi year total shareholder return hints that long term momentum is still broadly intact.

If Schneider Electric’s steady compounding appeals to you, this could be a good moment to see what else is working in industrials via aerospace and defense stocks.

With earnings still growing, a modest pullback year to date and analysts seeing upside from today’s price, the key question now is straightforward: is Schneider Electric undervalued or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 9.5% Undervalued

With Schneider Electric last closing at €239.15 against a narrative fair value of about €264, the valuation case leans on ambitious growth and margin assumptions in the years ahead.

The company's transition toward software and recurring digital services (notably EcoStruxure, AVEVA SaaS, and EcoCare), now representing 60% of revenues and growing at double-digit rates, is expected to drive higher margins and recurring earnings, with further upside potential as AVEVA's SaaS conversion completes by 2027.

Want to see what happens when steady electrification demand meets a fast expanding software engine and a premium earnings multiple that rivals sector leaders? The full narrative sets out the growth runway, the margin profile, and the profit characteristics that support this higher fair value view.

Result: Fair Value of $264.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could be challenged by persistent margin pressure from weaker automation demand and ongoing softness in key European construction markets.

Find out about the key risks to this Schneider Electric narrative.

Another Lens On Valuation

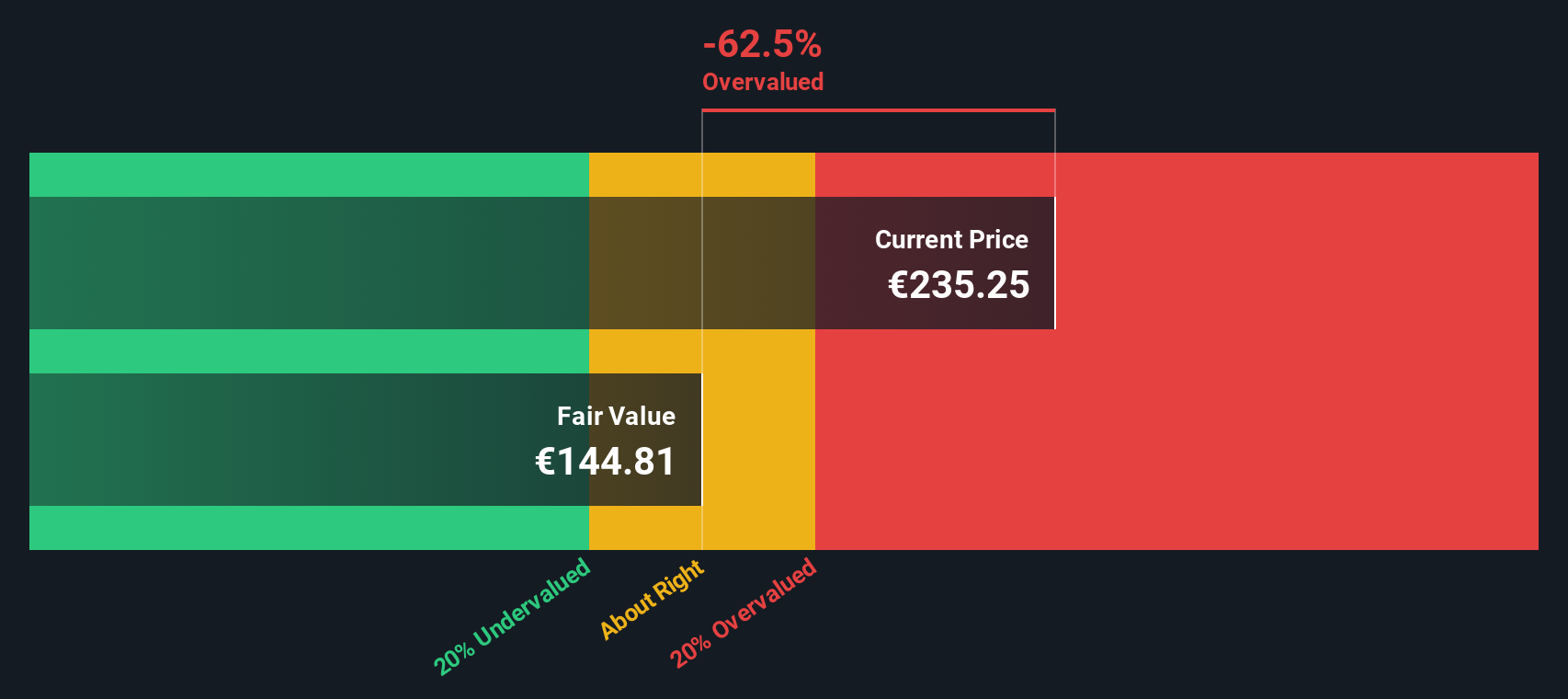

Analysts see Schneider Electric as roughly 9.5% undervalued on a growth driven earnings outlook, but our SWS DCF model paints a cooler picture, with fair value closer to €142. That implies the shares might already be pricing in a lot of good news. Which view feels more realistic to you?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Schneider Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Schneider Electric Narrative

If you see the story differently or prefer digging into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Schneider Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Schneider Electric might fit your strategy, but you will miss bigger opportunities if you stop here. Put Simply Wall Street’s powerful stock screeners to work next.

- Capture mispriced opportunities early by scanning these 904 undervalued stocks based on cash flows that pair solid fundamentals with attractive discounts to intrinsic value.

- Capitalize on structural shifts in medicine by targeting these 30 healthcare AI stocks transforming diagnostics, treatment, and operational efficiency.

- Supercharge your income strategy by filtering these 12 dividend stocks with yields > 3% that combine meaningful yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal