Equifax’s New Income Qualify Tool Might Change The Case For Investing In Equifax (EFX)

- Earlier this month, Equifax launched Income Qualify, a tool that uses verified income and employment data from The Work Number to help mortgage lenders assess borrowers earlier in the prequalification and pre-approval process.

- By pairing Equifax credit files with upfront income verification and offering lower-priced VantageScore mortgage scores, the company is pushing deeper into lenders’ workflow and cost decisions.

- We’ll now examine how earlier access to verified income data for mortgage lenders could influence Equifax’s existing investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Equifax Investment Narrative Recap

To own Equifax, you generally need to believe that its data and analytics platform, especially The Work Number, can deepen integration into key lending and government workflows while absorbing legal, regulatory and macro shocks. The Income Qualify launch reinforces this data-led thesis by pulling Equifax further into the mortgage decision process, but it does not materially change the nearer term swing factors, which still look most influenced by litigation costs and mortgage and hiring volumes.

The most connected recent announcement is Equifax’s move to offer VantageScore 4.0 mortgage scores at more than 50% below FICO 2026 pricing, with a two year US$4.50 VantageScore commitment and a free VantageScore bundled with each FICO score. Alongside Income Qualify, this puts price and product pressure directly into lenders’ workflows, tying the company’s short term catalysts more tightly to how successfully it can compete on both data richness and pricing while protecting margins.

Yet investors should be aware that rising competition in credit scoring and verification could compress pricing and margins at the very moment when...

Read the full narrative on Equifax (it's free!)

Equifax’s narrative projects $7.8 billion revenue and $1.3 billion earnings by 2028. This requires 9.9% yearly revenue growth and an earnings increase of about $660 million from $639.7 million today.

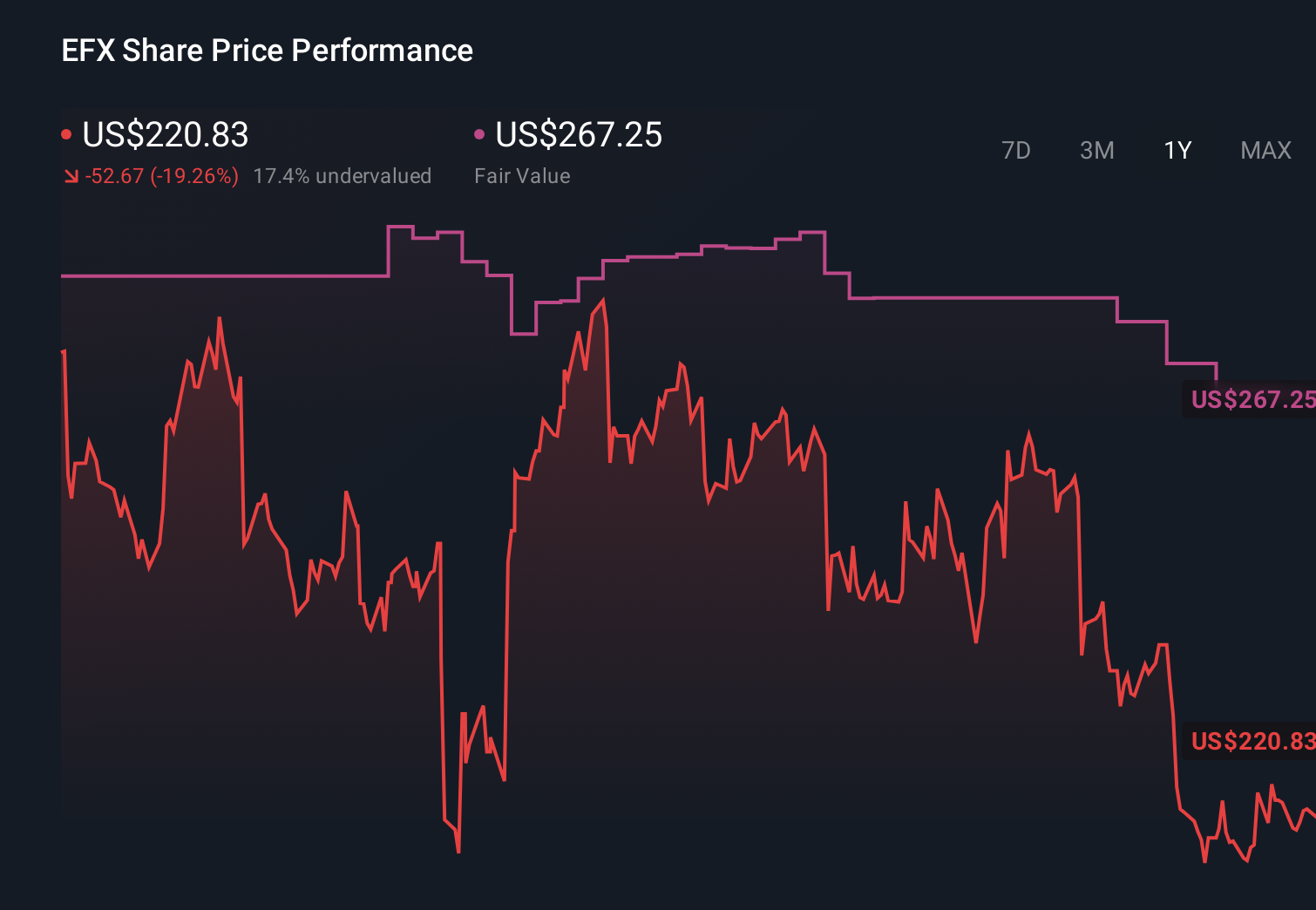

Uncover how Equifax's forecasts yield a $267.25 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span roughly US$256.57 to US$546.12, showing how far apart individual views can be. You can set those against the catalyst of deeper lender workflow integration through products like Income Qualify, which could influence how Equifax converts its data assets into future earnings power.

Explore 6 other fair value estimates on Equifax - why the stock might be worth over 2x more than the current price!

Build Your Own Equifax Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Equifax research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Equifax research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Equifax's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal