Target (TGT): Rethinking Valuation After a Recent Share Price Rebound

Target (TGT) has been grinding higher recently, with the stock up about 6% over the month and 8% in the past 3 months, even as its 1 year return remains negative.

See our latest analysis for Target.

The recent bounce, including a roughly 5.9% 1 month share price return, suggests sentiment is cautiously improving, even though the 1 year total shareholder return is still firmly negative and long term holders remain under water.

If Target’s move has you rethinking retail exposure, this could be a good moment to explore fast growing stocks with high insider ownership for fresh stock ideas with strong backing.

Still, with the shares trading near analyst targets yet showing a sizable modeled intrinsic discount, investors now face a key question: Is Target undervalued after years of lagging returns, or is the market already pricing in a comeback?

Most Popular Narrative: 0.5% Overvalued

With Target’s fair value estimate sitting just below the recent close, the most followed narrative frames today’s price as only slightly ahead of fundamentals.

The analysts have a consensus price target of $103.688 for Target based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $82.0.

Want to see how modest revenue growth, thinner margins, and a richer future earnings multiple combine to support this valuation view? The full narrative unpacks the math.

Result: Fair Value of $96.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Target’s tech investments and strong owned brands could unlock better margins and growth, challenging the view that today’s price risks are ahead of fundamentals.

Find out about the key risks to this Target narrative.

Another Lens on Value

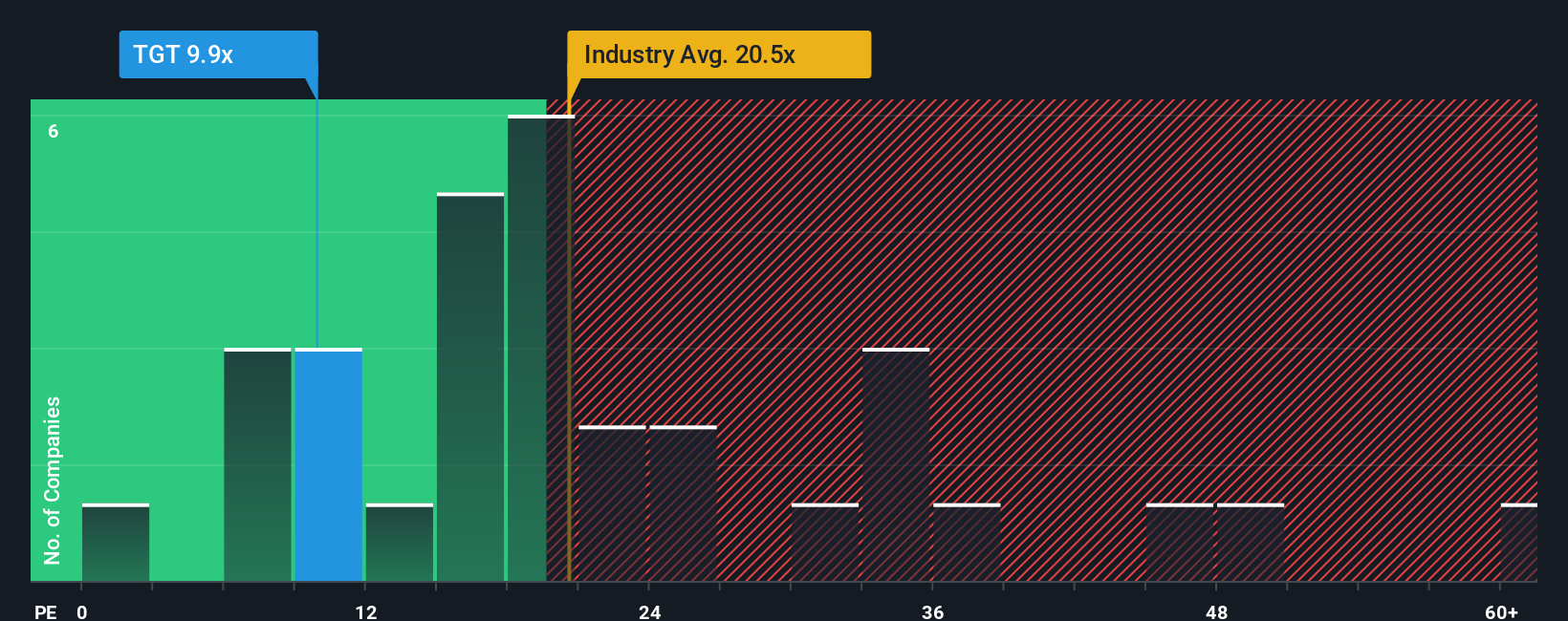

Looked at through its earnings multiple, Target tells a different story. The shares trade on a price to earnings ratio of about 11.7 times, while peers average 28.9 times and our fair ratio sits near 19.5 times, implying meaningful upside if sentiment normalizes.

That discount could reflect real growth risks or an overly pessimistic market. Investors are left to decide whether this gap is a value trap or a patient buying opportunity.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Target Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized view of Target in minutes: Do it your way.

A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Target is just one opportunity, and you will stay ahead of the crowd by using powerful screeners to uncover stocks that match your strategy with precision.

- Capture powerful cash flow bargains by reviewing these 904 undervalued stocks based on cash flows that the market has yet to fully recognize.

- Supercharge growth potential by focusing on these 25 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Lock in reliable income streams by targeting these 12 dividend stocks with yields > 3% that can support long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal