Rockwool (CPSE:ROCK B) Valuation Check as New Share Buy-Back Programme Signals Management Confidence

Rockwool (CPSE:ROCK B) just kicked off a year long share buy back programme of up to 150 million euros. This move typically signals management confidence and can quietly reshape the stock’s risk reward profile.

See our latest analysis for Rockwool.

The buy back lands after a choppy stretch, with a 1 month share price return of 5.95 percent, a year to date share price decline of 14.27 percent, and a still impressive 3 year total shareholder return of 50.26 percent. This suggests longer term momentum remains intact even if sentiment has cooled lately.

If Rockwool’s move has you rethinking where capital and confidence are lining up, it could be a good moment to explore fast growing stocks with high insider ownership.

With Rockwool’s shares down double digits this year but still boasting a strong three year track record and a buy back under way, some investors may be asking whether this is a mispriced quality compounder or whether the market is already factoring in its next leg of growth.

Most Popular Narrative: 12.8% Undervalued

With Rockwool last closing at DKK218.10 against a narrative fair value closer to DKK250, the current buy back sits against a perceived valuation gap.

Ongoing and near term capacity expansions in key growth markets (U.S., Romania, India, West Coast U.S., France), including new electrified production lines, position Rockwool to capitalize on surging demand from tighter building codes and energy efficiency mandates. This supports both top line growth and higher utilization driven margin leverage over the medium

to long term.

Want to see what kind of revenue ramp, margin shape, and future earnings multiple are baked into that fair value, and how aggressively buy backs tilt the equation? Explore the full narrative to unpack the numbers behind this upside case.

Result: Fair Value of $250.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro uncertainty and potential overcapacity in new plants could delay demand recovery, mute margin gains, and challenge today’s undervaluation narrative.

Find out about the key risks to this Rockwool narrative.

Another Angle on Value

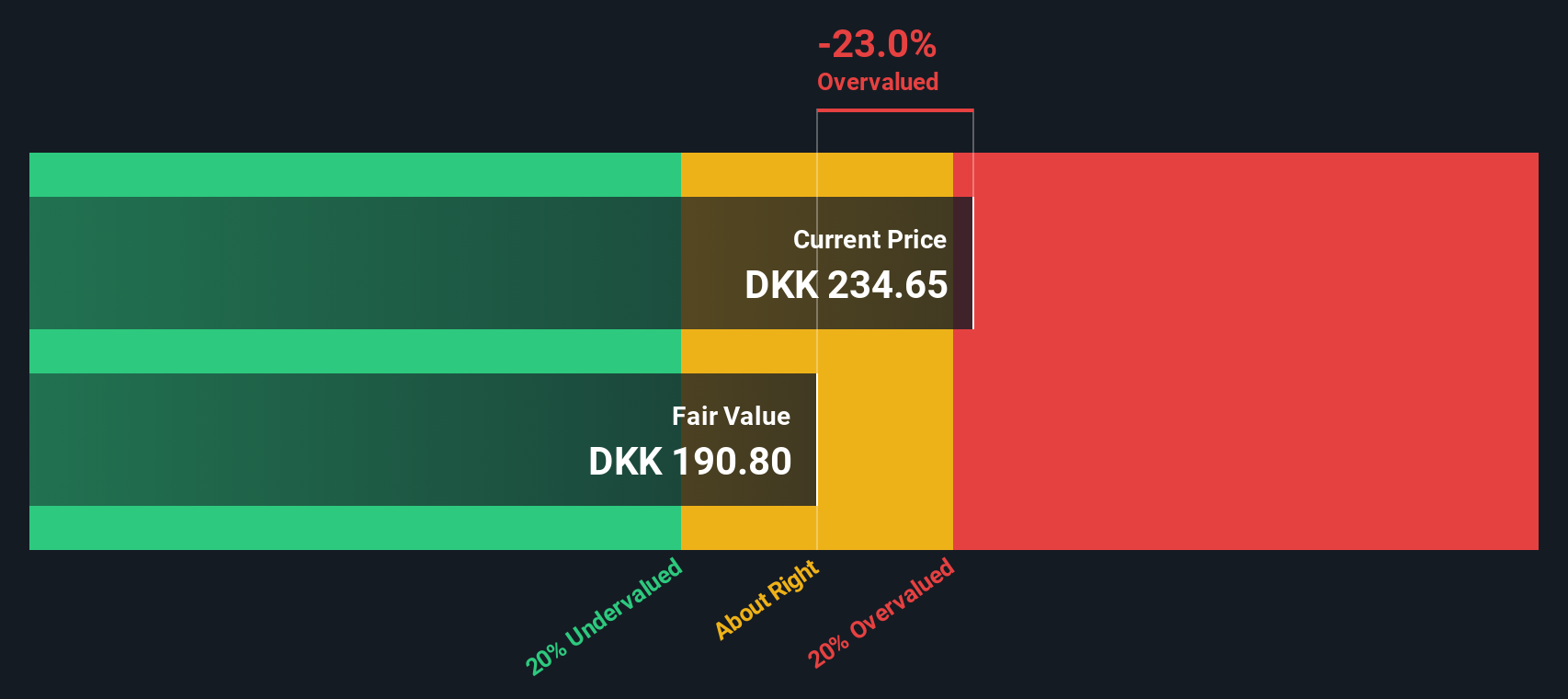

While the narrative fair value points to upside, our DCF model paints a cooler picture, suggesting Rockwool is slightly overvalued at today’s price. The gap is not huge, but it raises a simple question: is the market already paying up for that recovery story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rockwool for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rockwool Narrative

If you want to stress test these assumptions yourself and lean on your own research, you can build a complete narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rockwool.

Ready for your next investing move?

Rockwool might be compelling, but smart portfolios never stand still. Use the Simply Wall Street Screener today so you do not miss tomorrow’s stand out opportunities.

- Target resilient income and let these 12 dividend stocks with yields > 3% help you spot companies sharing meaningful cash flows with shareholders.

- Position ahead of the next wave in digital innovation by scanning these 80 cryptocurrency and blockchain stocks shaping finance and infrastructure.

- Ride structural growth in automation and data by checking these 25 AI penny stocks poised to benefit from accelerating AI adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal