3 Undiscovered European Gems To Consider For Your Portfolio

As European markets navigate a landscape marked by mixed returns and fluctuating economic indicators, the pan-European STOXX Europe 600 Index has shown resilience, ending slightly higher amid hopes of interest rate cuts in the U.S. and UK. In this environment, identifying promising stocks involves looking for companies that not only demonstrate strong fundamentals but also have the potential to thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative (ENXTPA:CRLO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a range of banking products and services to diverse customer segments in France, with a market cap of approximately €754.07 million.

Operations: CRLO generates revenue primarily from its local banking operations in France (€240.36 million) and leasing activities (€151.48 million). The company's business model focuses on serving a wide array of customer segments through these core financial services.

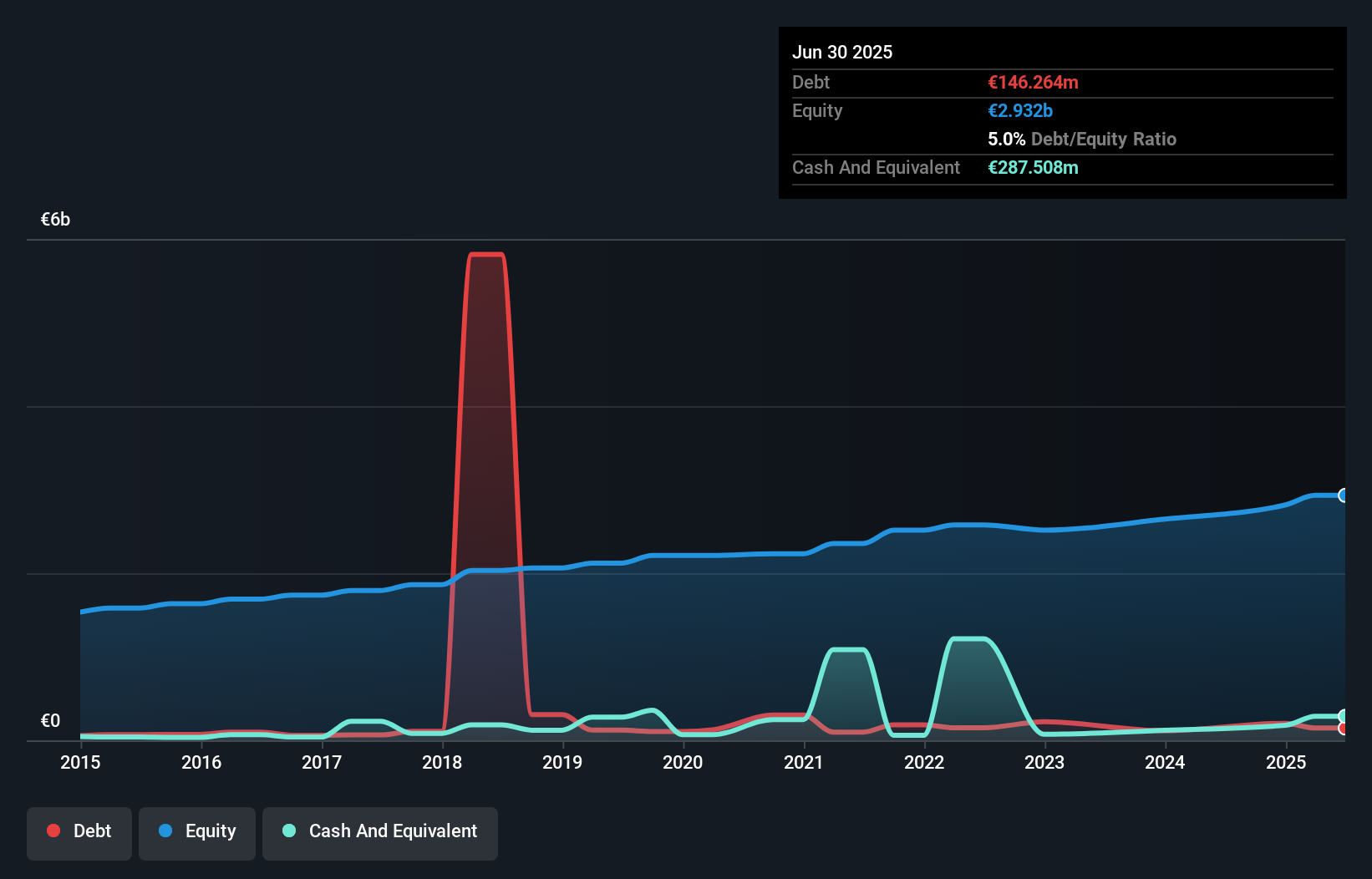

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire, with total assets of €15.5B and equity of €2.9B, shows a complex financial landscape. It boasts a price-to-earnings ratio of 9.4x, undercutting the broader French market's 16x, suggesting potential undervaluation. Despite earnings growing by 10.1% last year, its allowance for bad loans sits low at 79%, while non-performing loans are high at 3.1%. Total deposits stand at €11.9B against loans of €12.5B, indicating solid customer reliance for funding as liabilities are primarily low-risk sources (95%). Recent half-year net income rose to €50M from €48M the previous year.

Raisio (HLSE:RAIVV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Raisio plc, along with its subsidiaries, is involved in the production and sale of food and food ingredients across Finland, the United Kingdom, Ireland, Belgium, and the Netherlands with a market capitalization of €417.76 million.

Operations: Raisio's revenue model focuses on the production and sale of food and food ingredients. The company's financial data indicates a segment adjustment of €264.40 million, which significantly impacts its reported figures.

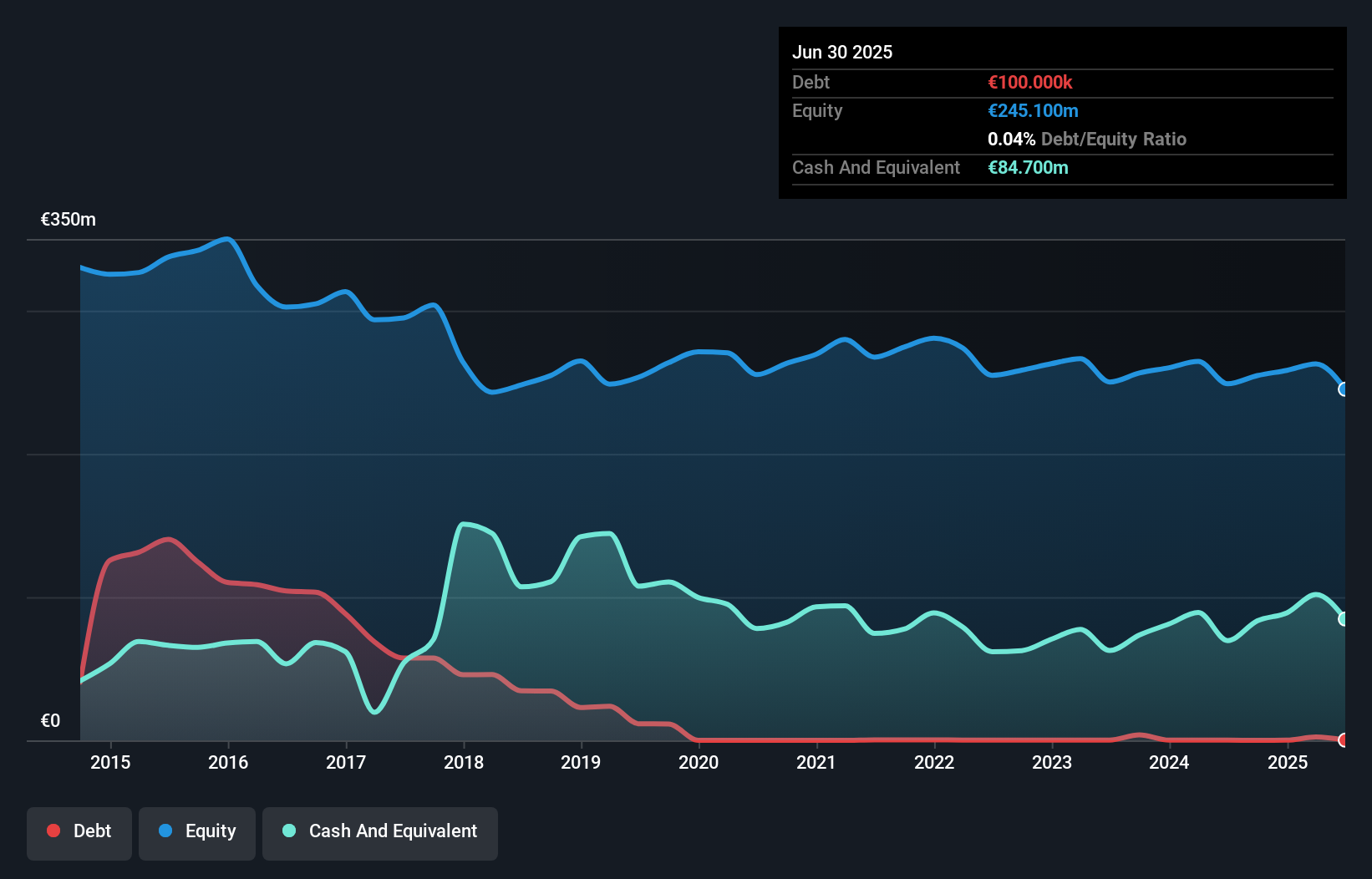

Raisio, a notable player in the food industry, has been trading at 33.4% below its estimated fair value, presenting an intriguing opportunity. Over the past year, earnings grew by 19.7%, outpacing the industry's -6.1%. The company's debt-to-equity ratio increased to 6.5% over five years but remains manageable with more cash than total debt. Raisio's Q3 2025 results showed net income of €7.2 million compared to €4.9 million last year on sales of €56.7 million versus €59.1 million previously, reflecting improved profitability despite slightly lower revenue figures and indicating potential for future growth as projected EBIT is expected to rise in 2025.

- Delve into the full analysis health report here for a deeper understanding of Raisio.

Evaluate Raisio's historical performance by accessing our past performance report.

Apotea (OM:APOTEA)

Simply Wall St Value Rating: ★★★★★★

Overview: Apotea AB (publ) operates an online pharmacy in Sweden with a market capitalization of SEK9.14 billion.

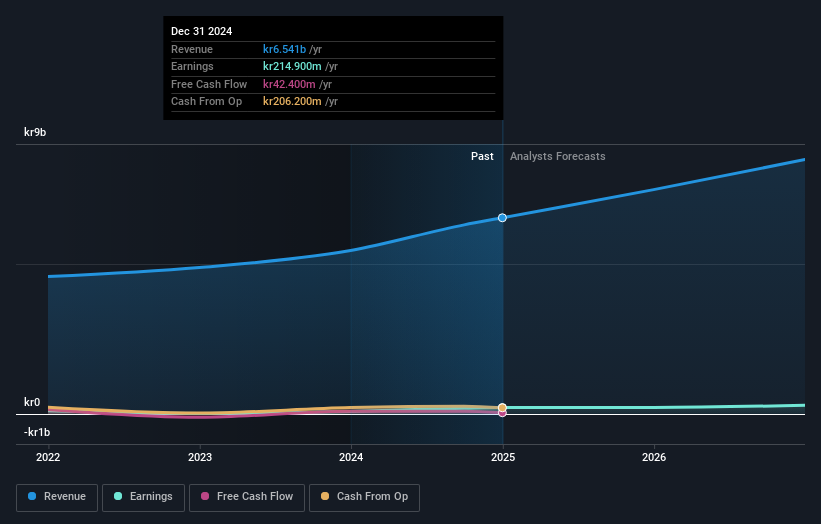

Operations: With a primary revenue stream from online retailers amounting to SEK7.09 billion, Apotea focuses on digital sales channels. The company's financial performance is influenced by its gross profit margin trends.

Apotea, a nimble player in the consumer retailing sector, has shown impressive financial health with no debt over the past five years. The company reported a 36.6% earnings growth last year, outpacing the industry average of -5.1%. Trading at 25.1% below estimated fair value suggests potential undervaluation. Recent results highlight sales of SEK 1,769 million for Q3 2025 compared to SEK 1,625 million last year and net income rising to SEK 69.6 million from SEK 56.2 million. Earnings per share stood at SEK 0.67 for the quarter, indicating solid profitability and high-quality earnings prospects ahead.

- Click to explore a detailed breakdown of our findings in Apotea's health report.

Explore historical data to track Apotea's performance over time in our Past section.

Turning Ideas Into Actions

- Gain an insight into the universe of 311 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal