Assessing Kalmar (HLSE:KALMAR) Valuation After Strategic Expansion Into DC Charging Infrastructure

Kalmar Oyj (HLSE:KALMAR) just expanded beyond machines into charging infrastructure, unveiling a new DC charging lineup co developed with Kempower and SINEXCEL that targets large scale electrification across global logistics hubs.

See our latest analysis for Kalmar Oyj.

The stock has quietly built strong momentum this year, with a year to date share price return of roughly 26 percent and a one year total shareholder return near 29 percent, as investors warm to Kalmar Oyj's growth and electrification push.

If Kalmar's move into charging infrastructure has you thinking bigger about logistics and industrial upgrades, it might be worth scanning fast growing stocks with high insider ownership for other under the radar compounders.

Yet with the shares up strongly this year, trading only slightly below analyst targets but still at a sizable discount to estimated intrinsic value, is Kalmar Oyj quietly undervalued or already pricing in its next leg of electrification-driven growth?

Most Popular Narrative: 3.1% Overvalued

With the narrative fair value sitting just below the last close, the story leans mildly cautious while still assuming steady progress on growth and margins.

Analysts expect earnings to reach €211.3 million (and earnings per share of €3.29) by about September 2028, up from €136.5 million today. The analysts are largely in agreement about this estimate.

Curious how a moderate growth outlook can still support a richer future earnings multiple than the wider machinery sector, even as margins edge higher and share count drifts lower? The narrative quietly incorporates a profitability reset, a disciplined capital structure, and a valuation anchor that depends on where investors are willing to price those upgraded earnings. Want to see exactly how those moving parts combine to justify today’s fair value call?

Result: Fair Value of €39.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent U.S. demand softness and intensifying AMEA price competition could easily upset those carefully modeled margin and earnings improvements.

Find out about the key risks to this Kalmar Oyj narrative.

Another View: Market Ratios Tell a Different Story

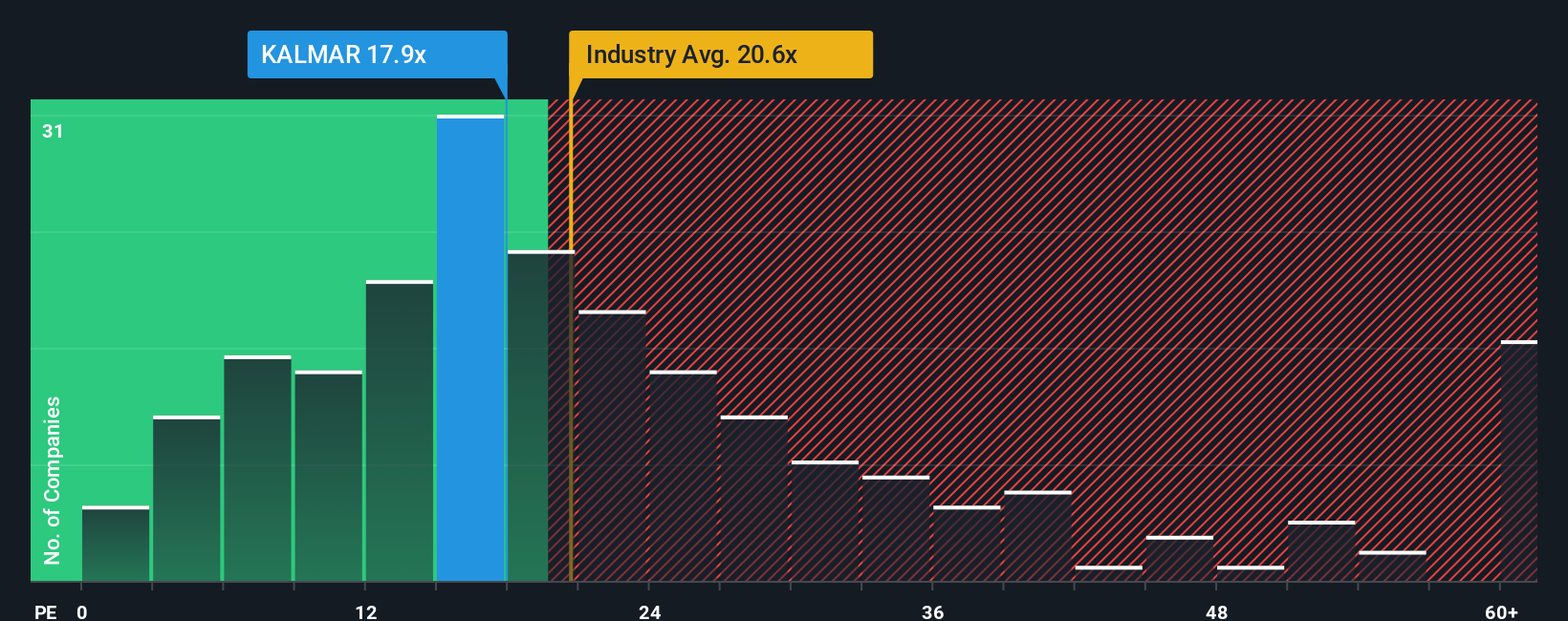

While the narrative fair value points to slight overvaluation, the earnings multiple suggests more breathing room. Kalmar trades on 17.9 times earnings versus a fair ratio of 19.6 times, and both peers and the wider machinery sector sit above 22 times. Is the market underpricing its quality and growth stability, or just being cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kalmar Oyj Narrative

If you see the story differently or prefer to stress test the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kalmar Oyj.

Ready for your next investing move?

Before you move on, lock in your momentum by scanning a few hand picked stock ideas on Simply Wall St that could sharpen your portfolio edge today.

- Capture potential mispricings by reviewing these 904 undervalued stocks based on cash flows that strong cash flow analysis flags as trading below their estimated worth.

- Position yourself early in structural growth trends through these 30 healthcare AI stocks harnessing data to reshape diagnostics, treatment, and hospital efficiency.

- Boost your income stream with these 12 dividend stocks with yields > 3% that pair attractive yields with fundamentals built to support long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal