When the AI infrastructure frenzy and storage supercycle hit ASML.US (ASML.US)'s “100% share” moat getting stronger

The EUV lithography machine launched by Dutch-based lithography giant ASML Holding NV (ASML Holding NV) can be said to be an unprecedented global AI boom since 2023. Under the global AI boom, the largest chipmakers such as TSMC and Samsung Electronics have created essential semiconductor devices that provide the most core driving force for the world's most cutting-edge AI applications such as ChatGPT and Claude. It is also in the current macro context of the “storage supercycle” that may continue until 2027, storage giants such as SK Hynix and Micron Technology Machine systems necessary to build core storage devices such as HBM storage systems and data center enterprise-grade SSD/DDR.

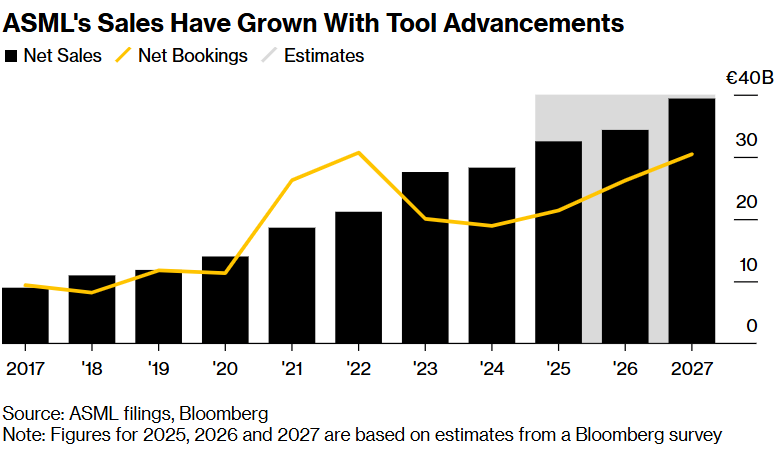

Fueled by the global AI boom, the AI infrastructure arms race is still in full swing, and the company's management is optimistic about the impact of rare earth regulations and performance growth expectations from 2026 to 2030. According to the latest results, Asmack's third-quarter orders totaled 5.4 billion euros, higher than the market's general forecast of 4.9 billion euros, with orders for extreme ultraviolet lithography machines (EUV) reaching the highest level in nearly seven quarters; Asmack CEO Christophe Fouquet (Christophe Fouquet) reiterated in the performance statement that, with the help of the AI boom, the company's annual net sales volume will increase sharply from €28.3 billion last year to a long-term performance growth target of 60 billion euros.

The latest strong performance of Asmack, which has the title of “the pinnacle of human technology”, and an optimistic outlook for the future — in particular, the strong growth expectations given by Asmack's management until 2030 have greatly strengthened the market expectation that “the boom in the AI computing power industry chain continues strongly”.

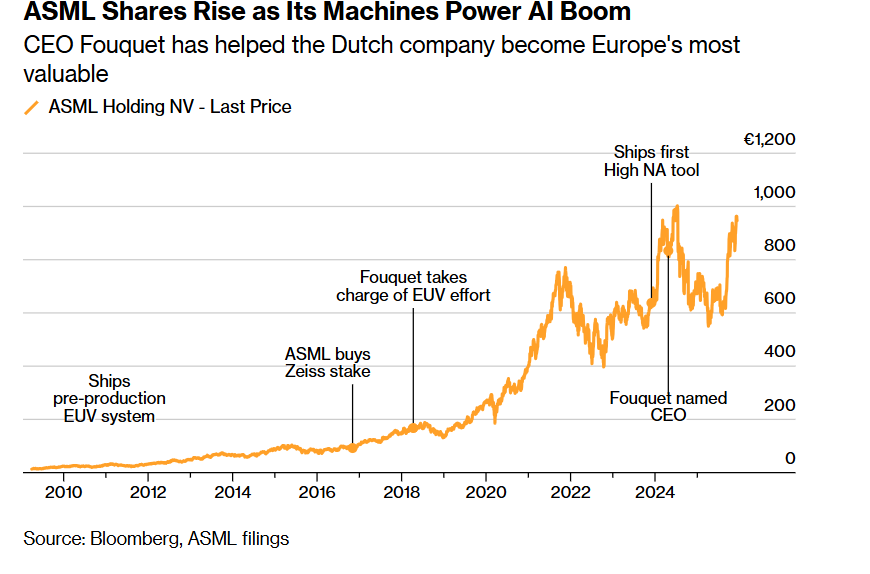

Since September, Asma's stock price has significantly entered an upward trajectory due to “a new generation of more expensive EUV lithographers - high-NA lithographers - from laboratory verification to chip manufacturing side deployment” and investment in Mistral AI, and recently the stock price has reached record highs many times. In September, ASML.US stock ADR (ASML.US) recorded its best monthly performance in 20 years, with a cumulative increase of 60% since 2025, with a sharp rise of more than 45% since September. The core logic behind it is that investors expect that accelerated artificial intelligence infrastructure projects will drive chip manufacturers such as TSMC to drastically expand advanced AI chip production capacity at 3nm and below, which will also drive SK Hynix to expand enterprise storage capacity for HBM and data centers, which in turn will drive a surge in semiconductor equipment orders.

As shown in the chart above, with the sharp rise in Asmack's stock price, the Dutch company has once again become the most valuable company in Europe based on European stock market capitalization.

Nvidia and its long-standing rival Intel, as well as Nvidia's major collaboration with OpenAI, AMD, and OpenAI, can be described as an alliance that pushes “data center CPU+GPU platformization” to a higher level. Demand and production capacity for advanced process AI chips at 3nm and below will follow the trend to a stronger growth trajectory, and segments such as EDA software/semiconductor manufacturing equipment/package testing/high-speed connectivity can be described as the first to benefit.

According to Wall Street giants Morgan Stanley, Citi, Loop Capital, and Wedbush, the global AI infrastructure investment wave with AI computing power hardware at the core is far from over and is only at the beginning. Driven by an unprecedented “AI inference computing power demand storm”, the scale of this round of AI infrastructure investment, which will continue until 2030, is expected to reach 3 trillion to 4 trillion US dollars.

Wall Street financial giant Wells Fargo (Wells Fargo) recently released a bullish research report on the semiconductor equipment industry. The agency said that as the global AI infrastructure construction process led by tech giants such as Microsoft, Google, and Meta becomes more intense, comprehensively helping the expansion of advanced process chips at 3nm and below and the expansion of advanced packaging production capacity, the long-term bull market logic in the semiconductor equipment sector is still very strong. Asmaine is one of the semiconductor equipment stocks that Wells Fargo has been optimistic about for a long time.

Wells Fargo said that all the news about catalyzing AI chip production capacity for advanced processes is positive and positive for semiconductor devices. The CPU/GPU package heterogeneity (based on NVLink interconnection and advanced chiplet packages such as COWos/Emib/FoverOS) will greatly boost the structural requirements for EUV/high-NA lithographs, advanced packaging equipment, and inspection and measurement, which is beneficial to semiconductor equipment manufacturers such as Asmack, Applied Materials, and Kelei.

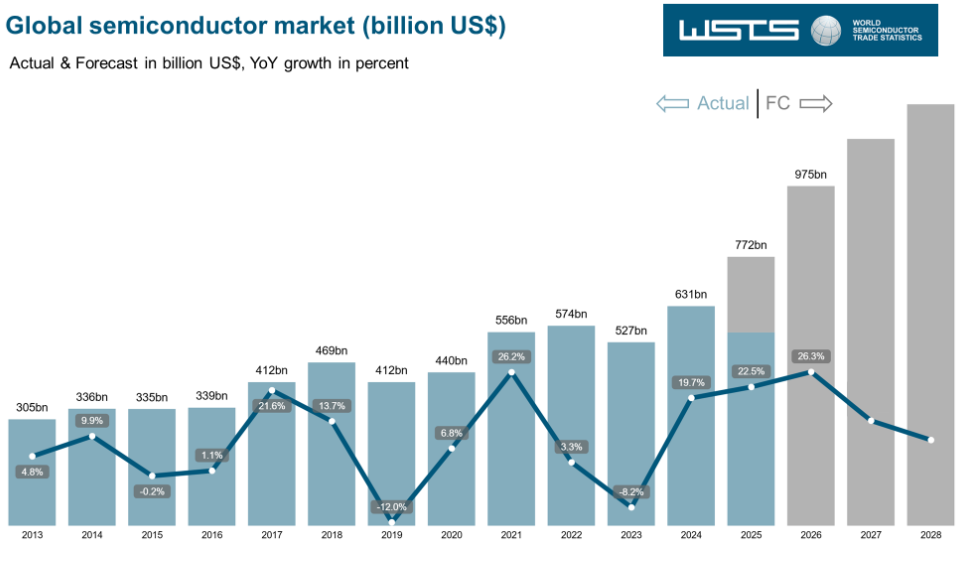

According to the latest semiconductor industry outlook data recently released by the World Semiconductor Trade Statistics Organization (WSTS), the recovery in global chip demand is expected to continue to be strong in 2026, and MCU chips and analog chips, where demand has continued to weaken since the end of 2022, are also expected to enter a strong recovery curve.

WSTS expects that after a strong rebound in 2024, the global semiconductor market will grow by 22.5% in 2025, with a total value of 772.2 billion US dollars, higher than the forecast given by WSTS in spring; in 2026, the total semiconductor market value is expected to expand to 9755 billion US dollars, which is close to the market size target of 1 trillion US dollars in 2030 predicted by SEMI, which means it is expected to increase 26% year over year.

WSTS said that this strong growth trend for two consecutive years will be mainly due to continued strong momentum in the logic chip field dominated by AI GPUs and the storage sector dominated by HBM storage systems, DDR5 RDIMM, and enterprise data center NAND. Both fields are expected to achieve extremely strong double-digit growth, thanks to continued strong expansion demand in fields such as artificial intelligence inference systems, cloud computing infrastructure, and cutting-edge consumer electronics.

How will Asmack achieve a major expansion in performance amidst the world's ever-soaring demand for AI computing power?

When Christophe Fouquet (Christophe Fouquet) was interviewed for a job at ASML Holding NV (ASML Holding NV) in 2007, he made an unusual request: could he accept a position one level lower than that offered by this Dutch semiconductor equipment company? He wants to study the technical details of new chip-making machines sold by Asmack to tech giants such as Intel and Samsung Electronics Co. (Samsung Electronics Co.). After being hired the following year, he spent weeks studying the product catalog until he was able to fluently recap the key features and functions.

“Even today, when I meet with customers, we talk about very specific things,” said the 52-year-old Asmack CEO. He became CEO of Asmat in 2024. “You need to understand what they're doing. You need to be able to explain what you're doing to solve their problem. That's why I said, 'Give me some time to learn. '”

Today, whether Fukai and its leader Asmack can navigate the cutting edge of AI chip technology is at stake. Over the past few years, Asmack has become a symbol of the global AI boom — in fact, a large part of the technology industry is based on its lithography machines. It makes the lithography machines needed to produce Nvidia's most advanced AI chips, which in turn run artificial intelligence models from OpenAI, Microsoft, and almost every other AI application competitor. In the field of high-end lithography machines in this market, Asmack's share has steadily reached 100%, which is higher than Nvidia's share in AI chips, and also higher than OpenAI's share in AI chatbots.

At Asmer's campus in Veldhoven (Veldhoven), there is a royal blue runway between the manufacturing clean room and the executive office. Fukai explains why no other company can do what Asmack does. The company conducts intense scientific research, tests the limits of physics, and continues to achieve breakthroughs in lasers, glass, and other components through long-term partnerships with the world's top suppliers. All of this must be precisely orchestrated to such a level of detail: Asmack can promise to successfully deliver the next generation of more advanced machines after five years, and these machines will be able to produce more advanced semiconductors that meet the needs of Nvidia and Apple. As semiconductor equipment insiders like to say: this isn't rocket science; it's harder than rocket science.

“Asmer is irreplaceable,” Chris Miller (Chris Miller), professor of international history at Tufts University and author of “Chip War” (Chip War), said in an interview. “Without them, it would be impossible to produce the world's most advanced semiconductors.”

Under the unprecedented boom in AI deployment by global companies, the semiconductor industry has never been as important as it is now. AI fans such as Nvidia CEO Hwang In-hoon and OpenAI's Sam Altman (Sam Altman) have set off a frenzy of investment in data centers and other core infrastructure related to AI computing power in order to compete for competitive advantage. Ultraman alone outlined a plan to invest 1.4 trillion US dollars to build a large-scale AI data center.

Wall Street analysts who are most optimistic about the AI investment frenzy in the global stock market generally believe that if this AI boom continues for a long time, Asma's revenue scale may increase by about 35% between this year and 2027, to more than 43 billion euros (about 50 billion US dollars). Or, if this AI infrastructure frenzy bursts, growth may stall.

As shown in the chart above, Asmack's sales increased dramatically with the advancement of lithography tool technology and the development of AI chip technology.

Needless to say, some investors who love popular AI technology stocks such as Nvidia, TSMC, and SK Hynix are also starting to get nervous. Nvidia's total market capitalization has evaporated around $700 billion since it peaked six weeks ago, as skeptics question whether such a staggering AI spend is worth it. One major unknown is whether Nvidia can continue to create technologically groundbreaking AI chips, and this progress depends in part on lithography machines at the Veldhoven campus in the Netherlands.

Fukai is confident that the semiconductor equipment company he leads will be able to successfully deliver the next generation of lithographs. He said that Asmack's work in the field of lithography — using light beams to depict the most complex chip design patterns in human history on silicon wafers — has laid the foundation for the chip industry, enabling it to keep up with Hwang In-hoon and Ultraman's ambitious vision of artificial intelligence.

“We generally know what to do for our customers over the next 10 to 15 years,” he said in an interview in the company's board room. “Better lithography means better resolution, better accuracy, and greater productivity. And we're basically going to spend many, many years of hard work on these three axes.”

The next major test — high-NA

Asmat is taking advantage of two major trends in the global technology industry. As chips are integrated into electric vehicles, consumer electronics, and other applications other than computers and smartphones, demand for semiconductors is growing steadily. Subsequently, with the launch of ChatGPT at the end of 2022 and rapid global popularity, tech giants accelerated the construction of large-scale AI data centers equipped with the most advanced AI chips and memory chips, making Asmack's highest-end equipment production capacity even more critical. According to WSTS forecasts, the global semiconductor market is expected to grow 22% to 772 billion US dollars this year, and more than 25% to 975 billion US dollars next year.

Chipmakers are also diversifying geographically. Western governments are increasingly concerned about excessive concentration of chip manufacturing in Taiwan and South Korea, so they are not hesitating to spend huge sums of money to push Asian chipmakers such as Samsung Electronics, TSMC, and SK Hynix to build large-scale chip manufacturing plants in Japan, India, Europe, and North America. For example, the US government is providing multi-billion dollar cash subsidies to encourage TSMC, Samsung, etc. to build large-scale fabs in the US. The more newly built fabs around the world, the more Asmack lithography machines they will need, of course.

According to Wall Street's general expectations, Asmack's overall revenue is likely to increase by about 15% to 32.5 billion euros this year, while profits are expected to increase 27% to 9.6 billion euros. Its ADR share price in the US stock has risen by about 60% so far this year, pushing its market capitalization to about 430 billion US dollars, making it the company with the highest market capitalization in Europe. When Fukai joined 17 years ago and was still an “obscure” company at the time, its market capitalization was less than $10 billion.

The next major test facing Fukai is whether it can lead Asmack's smooth transition from so-called extreme ultraviolet lithography (EUV) technology to high numerical aperture (that is, High NA EUV). Asmat launched EUV machines — and is still the only company that can manufacture them — to help customers advance the process from 7nm to the 3nm advanced process used by Nvidia and Apple. The High NA EUV machine is designed to advance the geometric size to 2 nm or less. Smaller circuitry on a chip means more powerful performance.

For TSMC and the 2nm and below node manufacturing technology currently being developed by Intel and Samsung Electronics, Asmack's high-NA EUV lithography machine can be described as very important. High-NA's 0.55 NA plus unequal magnification optics brings new boundaries in resolution, mask and process integration, so High-NA can be described as a “powerful tool” to accelerate advanced nodes, reduce multiple graphics, and improve line width/overlap.

Large customers such as Intel and SK Hynix are testing these epoch-making new machines. They will make chip components more capable of running advanced applications in AI and other fields, and Fukai said they are gradually moving towards commercial production.

“The breakthrough lithography improvements we've designed for these tools have been validated,” he emphasized. “The final images were excellent and the resolution was excellent. We are now working with them to finalize the maturity of the lithography system.”

Asmack will actively cooperate with major customers such as Intel to bring the high-NA EUV lithography machine to the point where it can operate with minimal downtime by next year, while Fukai is expected to achieve high-volume manufacturing in 2027 and 2028. Sometime in the next decade, Asmat will launch a more advanced lithography technology, temporarily known internally as Hyper NA. Fukai said that research on this step has already begun.

Fukai's early technical knowledge is critical to this collaborative work with customers. He presides over senior review meetings with CEOs of chip manufacturers such as Intel and TSMC twice a year, and also attends semi-annual technical review meetings. At the conference, chip makers will outline production roadmaps for the next 10 years. Asmack in turn explained the technical specifications of its upcoming lithography machine, giving both parties an opportunity to discover technical gaps or mismatches many years ago.

One pressing issue is the market's endless demand for stronger AI capabilities. The traditional pace of the chip industry is to double the number of transistors on a chip every two years — this is Moore's Law (Moore's Law) — and Nvidia's vision is much faster than Moore's Law.

“They want the number of transistors to grow 16 times every two years,” Fukai said. “So the industry started breaking away from Moore's Law.”

At the same time, Asmer, led by Fouquet, must also deal with the complexity of the American-dominated geopolitical situation. Last year, China was Asmack's largest market because China was making a big push to build a local chip industry, but the company was banned from selling all types of EUV and its most advanced DUV to the Chinese market. The lithography equipment sold by Asma to Chinese customers is now eight generations behind the latest high-NA lithography equipment.

A high-risk bet, and a monopoly moat

Asmack's success stems from a bet it made about 30 years ago on a key lithography technology—even the company's own engineers feared it might completely lose to Nikon and Canon. Dutch conglomerate Philips (Philips) and chip equipment manufacturer ASM International NV established a joint venture called ASM Lithography in 1984 to develop lithography systems. ASM Lithography was the original name of ASM.

At the time, competition from Japanese competitors, including Canon Inc. (Canon Inc.) and Nikon Corp. (Nikon Corp.), was extremely intense, and Asmack was struggling. ASM International opted out and sold its shares to Philips.

In the 1990s, a European coalition of Asmack and a group of companies supported by the Japanese government competed to create — and then control — a new type of UV light to more accurately engrave circuits on semiconductors, or EUV. By the early 2000s, after about ten years of testing and initial trial production work, the Japanese side chose to “unplug” due to high costs and lack of progress.

“It was considered too risky at the time,” said David Dai, a senior analyst at Bernstein (Bernstein). “No one knows how long it will take to succeed.”

Asmer persevered. The effort was so important to the global chip industry that the Dutch company received financial support from major chipmakers including Intel, TSMC, and Samsung. They needed EUV — a wavelength that only naturally occurs on the surface of the sun — to keep the circuit smaller and the processor more powerful. They also need extremely flat reflectors and lenses to focus this light, creating a narrower electrical line width.

“Without a breakthrough in EUV technology, the entire advanced semiconductor manufacturing process would stagnate for decades.” Dai displayed.

Asmack finally delivered the EUV prototype in the mid-2000s, enabling it to be shared with external researchers. The technology uses a laser to hit tin droplets to form plasma, which emits an EUV beam with a wavelength of only 13.5 nanometers — far less than the previous generation's 193 nm deep ultraviolet light (deep ultraviolet light). For the first time, Asmack proved that the technology can be commercialized on a large scale in chip manufacturing, even though it took more than 10 years for the machine to have high-yield manufacturing capabilities.

For Asmack, the rewards of this technology are amazing. Bernstein analyst Dai said that Asma's share of the lithography market increased from less than 40% when competing with Nikon and Canon to over 90% last year.

Early commercialization of EUV was inseparable from the collaboration of about 1,000 suppliers. Tongkuai provided a laser system that bombarded molten tin 50,000 times per second (targeting at least 125 wafers per hour) and solved the “dirt deposition” problem caused by tin pollution; Asmack also invested capital and shares in key suppliers such as ZEISS to promote process upgrades. In 2018, Fukai was appointed to take charge of the EUV project. Asmat's orders more than tripled in the four years up to 2021, and EUV equipment accounted for about half of that year's orders.

After Asmack sells a new machine, it often takes 2 to 3 years to improve mass production stability and cost efficiency by deploying a large number of engineers; the yield difference can be described as extremely critical: about 90% of TSMC is regarded as an industry benchmark, while 30% yield means that the cost is three times higher. Asmack also uses contracts to guarantee equipment availability (mature technology is usually higher than 90%) and uses a 7×24 on-site “first response” mechanism to quickly handle faults. With this unique technology and a model that locks in the supply chain and is deeply tied to customers, there is no doubt that the market believes that Asmack has the most stable monopoly moat in the semiconductor industry.

Sandeep Deshpande, a senior analyst at Wall Street financial giant J.P. Morgan Chase, has just listed Asmack as the bank's preferred target for the semiconductor sector and raised its forecast for overall revenue growth in 2027 to 29%. “We think the only risk with this prediction is whether semiconductor manufacturers have sufficient production capacity to build chip-grade cleanrooms,” he wrote in the research report.

According to a recent research report released by Wall Street giant Morgan Stanley, Asmack is experiencing a double boost in demand for advanced logic chips such as DRAM storage and GPUs, and its growth momentum in the 2026-2027 fiscal year was more positive than the agency's previous expectations. Damo said that iterations in DRAM technology are critical to improving lithography intensity. Every evolution of technology nodes will “lead to an increase in the number of EUV lithography layers. At the same time, TSMC's 3nm and 2nm production capacity expansion, and even more advanced 1.8 nm and 1.6 nm production capacity have brought a strong growth trend to Asmack.

Asma does have rivals, but their research progress in lithography technology still lags far behind Asmack's. Substrate, a San Francisco-based startup supported by Peter Thiel (Peter Thiel), the “father of venture capital in Silicon Valley,” announced plans to challenge Asmack's lithography machines with X-ray-based technology, but production is still a few years away.

“Will we see anyone else try to do lithography? Of course,” Fukai said as the Veldhoven interview came to an end. “But that was very difficult. Moreover, the entire ecosystem is highly dependent on each other who have been working together for many years. So it's not just the lithography itself, but also how our lithography is integrated into the customer's entire process.” “Of course, it's still a very challenging technology, and it's very difficult to replace it.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal