MercadoLibre (NasdaqGS:MELI): Evaluating Valuation After New AI Humanoid Robotics Partnership with Agility Robotics

MercadoLibre (NasdaqGS:MELI) just took a very real step toward sci fi logistics by rolling out Agility Robotics Digit humanoid robots in its San Antonio fulfillment center to automate repetitive, physically demanding warehouse tasks.

See our latest analysis for MercadoLibre.

The humanoid robot rollout lands at an interesting moment for MercadoLibre, with the latest share price at $2019.81 and a year to date share price return of 14.44% but a softer 90 day share price return of minus 13.66%. The three year total shareholder return of 141.87% still points to strong long term wealth creation as investors weigh capital intensive logistics upgrades, fresh investment grade debt issuance and ongoing competitive and credit risks.

If this kind of robotics driven story has your attention, it might be worth exploring other tech enabled platforms through high growth tech and AI stocks to see what else is reshaping the way commerce and infrastructure run.

Yet with the stock trading well below analyst targets despite robust revenue and earnings growth, investors now face a familiar dilemma: is MercadoLibre quietly undervalued, or is the market already baking in its next leg of expansion?

Most Popular Narrative: 29.1% Undervalued

With MercadoLibre last closing at $2019.81 against a fair value near $2847, the leading narrative frames today’s price as a sizable discount that hinges on operating leverage and earnings expansion over the next few years.

Analysts expect earnings to reach $5.1 billion (and earnings per share of $107.05) by about September 2028, up from $2.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $3.9 billion.

Want to see what kind of revenue trajectory, margin lift and future earnings multiple are baked into that fair value gap, and how bold those projections really are? The narrative unpacks an aggressive growth runway, rising profitability and a premium valuation framework that could surprise you when you see how each piece feeds into the final number.

Result: Fair Value of $2847.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising credit losses or heavier than expected competitive spending could squeeze margins and delay the operating leverage that this optimistic valuation narrative depends on.

Find out about the key risks to this MercadoLibre narrative.

Another View: Rich Multiples, Different Story

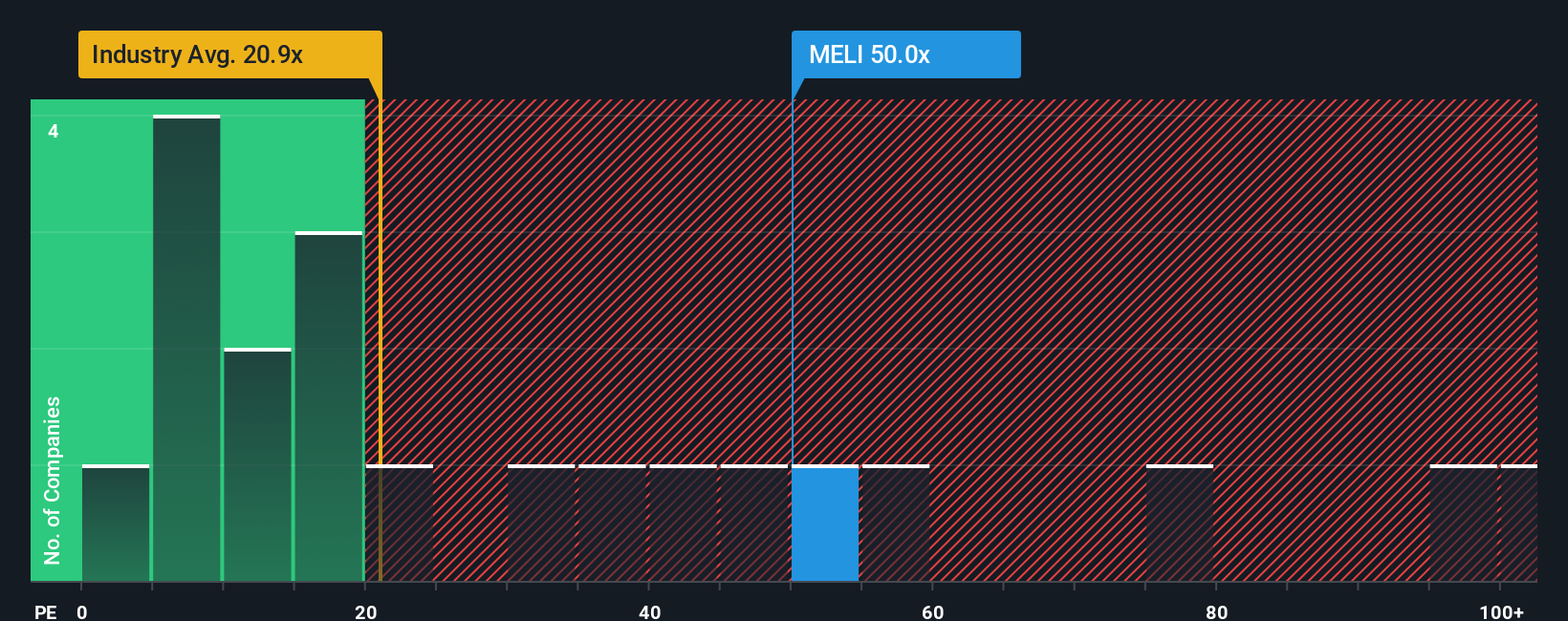

While the narrative leans on earnings growth to argue for upside, today’s price tells a tougher story, with MercadoLibre trading at about 49.3 times earnings versus a fair ratio closer to 34 times and a global multiline retail average near 19.8 times. That premium leaves less room for execution slips or macro surprises. How comfortable are you paying up for this kind of growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MercadoLibre Narrative

If this reading does not quite match your view, or you would rather dig into the numbers yourself, you can build a complete narrative from scratch in just a few minutes: Do it your way.

A great starting point for your MercadoLibre research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, identify a few fresh stock candidates by putting the Simply Wall St Screener to work on themes you do not want to miss.

- Target reliable income with these 12 dividend stocks with yields > 3% that can strengthen your portfolio with cash flow while you wait for growth stories to play out.

- Position yourself for the next wave of innovation by reviewing these 25 AI penny stocks shaping how businesses and consumers use intelligent technology every day.

- Explore potential mispriced opportunities through these 905 undervalued stocks based on cash flows that combine solid fundamentals with the possibility of meaningful upside as the market reassesses their value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal