European Penny Stocks To Watch In December 2025

As December 2025 unfolds, the European markets are showing a mix of cautious optimism and strategic anticipation, with the pan-European STOXX Europe 600 Index posting modest gains amid hopes for interest rate cuts in major economies like the U.S. and UK. In this climate of economic recalibration, investors are increasingly looking towards opportunities that might offer both stability and growth potential. Penny stocks, although an older term, continue to represent a fascinating segment of the market where smaller or less-established companies can present value prospects. By focusing on those with strong financial health and clear growth potential, investors may uncover promising opportunities in this niche area.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €83.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €219.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.02 | €64.06M | ✅ 3 ⚠️ 3 View Analysis > |

| Hultstrom Group (OM:HULT B) | SEK3.28 | SEK199.55M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.35 | €384.47M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.922 | €74.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.794 | €26.59M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 281 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Faes Farma (BME:FAE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Faes Farma, S.A. is involved in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials on an international scale, with a market cap of €1.50 billion.

Operations: Faes Farma generates revenue primarily from its Pharmaceutical Specialties and Healthcare segment, which accounts for €502.31 million, followed by the Nutrition and Animal Health segment at €70.90 million.

Market Cap: €1.5B

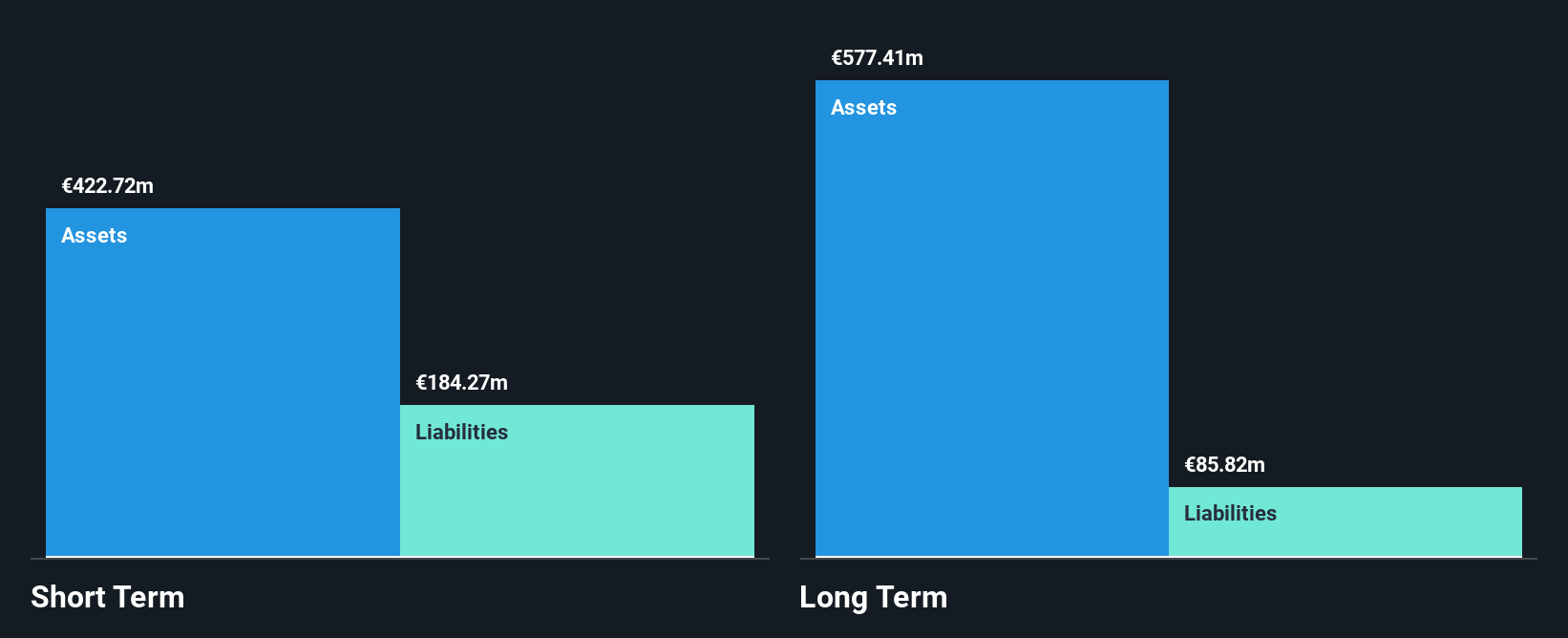

Faes Farma, S.A., with a market cap of €1.50 billion, shows solid financial health as its short-term assets (€422.7 million) surpass both short-term (€184.3 million) and long-term liabilities (€85.8 million). The company has experienced steady earnings growth of 7.8% annually over the past five years, though recent profit margins have slightly declined from 19.4% to 18.4%. While trading below estimated fair value and maintaining high-quality earnings, Faes Farma's debt levels remain manageable with cash exceeding total debt and interest well-covered by EBIT (64.5x). Recent nine-month revenue reached €454 million, up from €392.92 million year-over-year despite a dip in net income to €73.56 million from €79.84 million.

- Jump into the full analysis health report here for a deeper understanding of Faes Farma.

- Gain insights into Faes Farma's outlook and expected performance with our report on the company's earnings estimates.

Miliboo Société anonyme (ENXTPA:ALMLB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Miliboo Société anonyme designs and sells modular and customizable furniture in Paris and internationally, with a market cap of €11.34 million.

Operations: The company generates revenue of €38.98 million from its online retail operations.

Market Cap: €11.34M

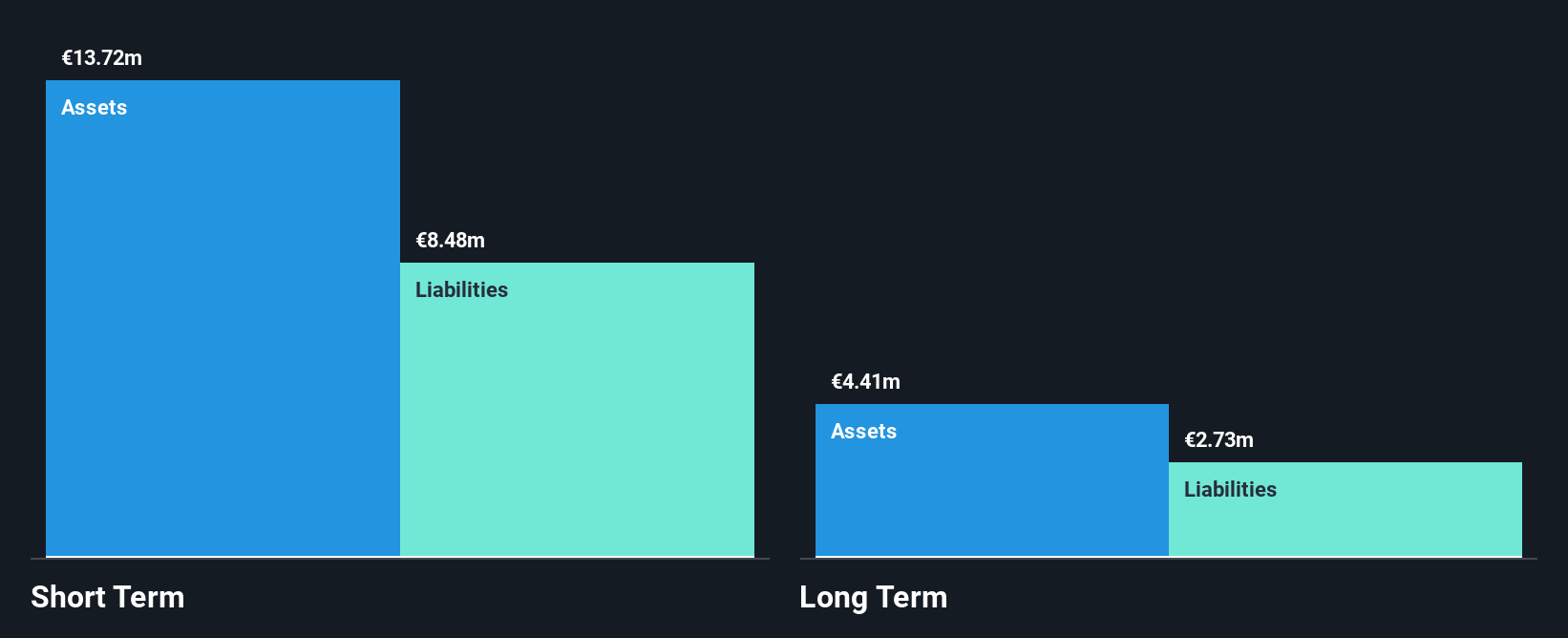

Miliboo Société anonyme, with a market cap of €11.34 million, operates in the modular furniture sector and generates €38.98 million in revenue through its online retail operations. Despite being unprofitable, the company has reduced its losses by 18.9% annually over five years and maintains positive shareholder equity after previously negative figures. Short-term assets (€11.5M) surpass both short-term (€7.4M) and long-term liabilities (€2M), indicating sound financial positioning relative to obligations. Although cash runway data is insufficient, Miliboo's board is experienced with an average tenure of 6.4 years, suggesting stability in governance amidst ongoing challenges.

- Get an in-depth perspective on Miliboo Société anonyme's performance by reading our balance sheet health report here.

- Gain insights into Miliboo Société anonyme's future direction by reviewing our growth report.

Acarix (OM:ACARIX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Acarix AB (publ) is a medical device company that develops AI-based solutions for the rapid rule-out of coronary artery disease, with a market cap of SEK356.09 million.

Operations: The company generates revenue primarily from its Diagnostic Kits and Equipment segment, amounting to SEK6.92 million.

Market Cap: SEK356.09M

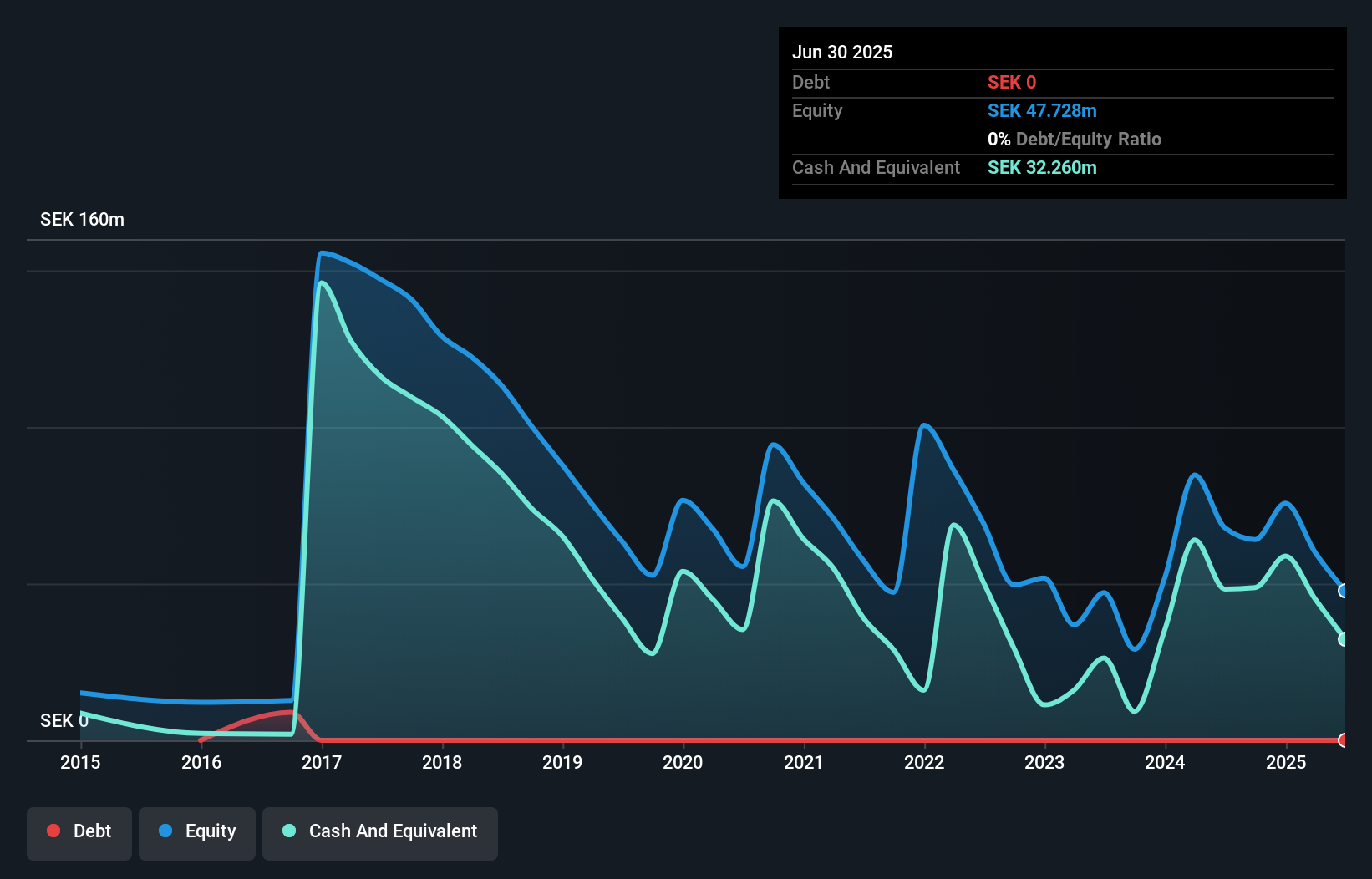

Acarix AB, with a market cap of SEK356.09 million, operates within the medical device sector but remains pre-revenue with sales under US$1 million. Despite being unprofitable and having a negative return on equity, its financial position is bolstered by no debt and short-term assets (SEK34.3M) exceeding liabilities (SEK3.6M). The company has less than a year of cash runway if current free cash flow trends persist. Recent developments include reimbursement coverage for its CADScor® System by HealthChoice and an extraordinary shareholders meeting to discuss changes in employee stock options, reflecting active corporate governance amidst financial challenges.

- Click here to discover the nuances of Acarix with our detailed analytical financial health report.

- Assess Acarix's future earnings estimates with our detailed growth reports.

Summing It All Up

- Gain an insight into the universe of 281 European Penny Stocks by clicking here.

- Want To Explore Some Alternatives? We've found 12 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal