Top Asian Growth Stocks With Insider Ownership December 2025

As global markets navigate the anticipation of interest rate decisions and mixed economic signals, Asia's stock markets have been capturing investor attention with their unique blend of challenges and opportunities. In this environment, growth companies with high insider ownership stand out as potentially compelling options, offering a combination of promising expansion prospects and aligned management interests that can be particularly appealing amid the current economic landscape.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Bora Pharmaceuticals (TWSE:6472) | 11.9% | 20.3% |

We're going to check out a few of the best picks from our screener tool.

d'Alba Global (KOSE:A483650)

Simply Wall St Growth Rating: ★★★★★★

Overview: d'Alba Global Co., Ltd. is involved in the manufacturing and sale of perfumes and cosmetic products both in South Korea and internationally, with a market cap of approximately ₩1.85 trillion.

Operations: d'Alba Global Co., Ltd. generates its revenue through the production and distribution of perfumes and cosmetic products across domestic and international markets.

Insider Ownership: 20.8%

Revenue Growth Forecast: 32.8% p.a.

d'Alba Global's earnings are forecast to grow significantly, outpacing the KR market. Its revenue growth is also expected to exceed market averages. Analysts agree on a potential stock price increase of 48.1%. Despite high non-cash earnings quality, the dividend yield of 2.98% isn't well covered by free cash flows. The stock trades at a significant discount to its estimated fair value, but recent insider trading activity is unavailable for further insights.

- Delve into the full analysis future growth report here for a deeper understanding of d'Alba Global.

- The valuation report we've compiled suggests that d'Alba Global's current price could be quite moderate.

Yangtze Optical Electronic (SHSE:688143)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Yangtze Optical Electronic Co., Ltd. focuses on the R&D, production, and sale of special optical fibers and cables, optical devices, new materials, high-end equipment, and photoelectric systems in China with a market cap of CN¥5.74 billion.

Operations: The company's revenue segments include special optical fiber and cables, special optical devices, new materials, high-end equipment, and photoelectric systems in China.

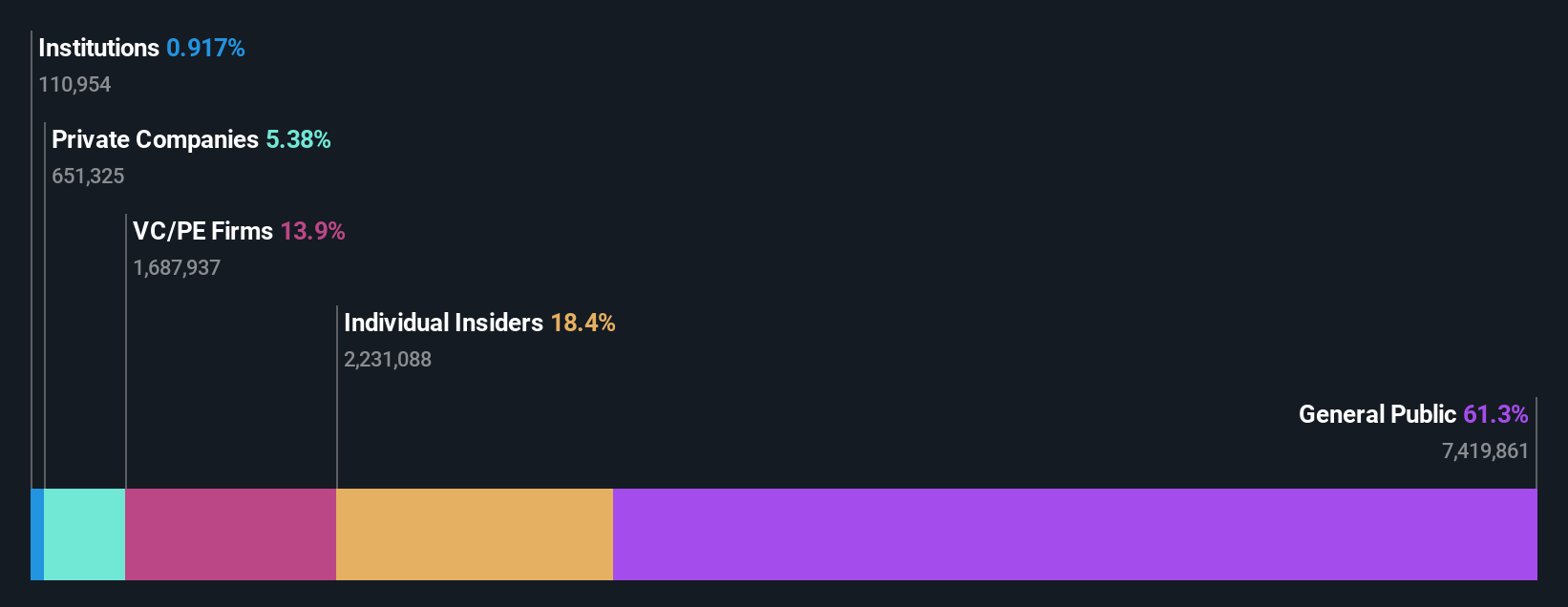

Insider Ownership: 29.6%

Revenue Growth Forecast: 38.8% p.a.

Yangtze Optical Electronic's revenue and earnings are forecast to grow significantly, surpassing the broader Chinese market. Recent earnings showed a strong turnaround with net income of CNY 30.79 million compared to a loss last year, highlighting robust operational performance. Despite this growth trajectory, the stock has experienced high volatility recently. While insider trading data is unavailable for the past three months, substantial insider ownership aligns management interests with shareholders' long-term value creation goals.

- Click to explore a detailed breakdown of our findings in Yangtze Optical Electronic's earnings growth report.

- Upon reviewing our latest valuation report, Yangtze Optical Electronic's share price might be too optimistic.

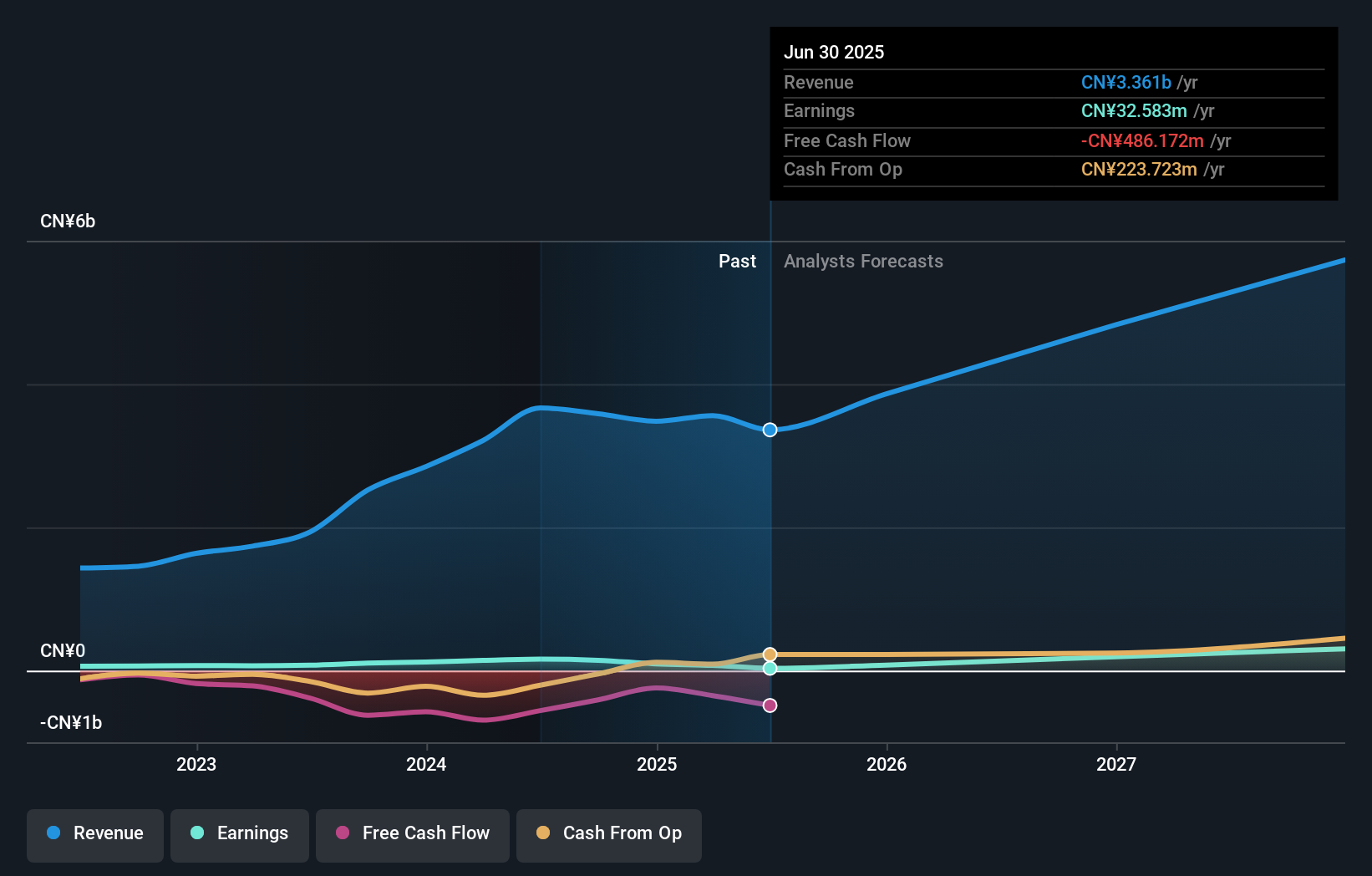

Wetown Electric Group (SHSE:688226)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wetown Electric Group Co., Ltd. is involved in the research, development, production, and sale of electrical products both in China and internationally with a market cap of CN¥7.08 billion.

Operations: Wetown Electric Group Co., Ltd. generates revenue through its activities in research, development, production, and sale of electrical products across domestic and international markets.

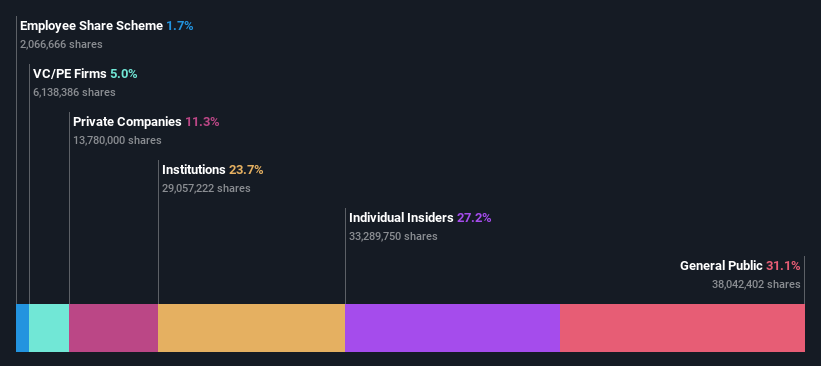

Insider Ownership: 18.9%

Revenue Growth Forecast: 23.1% p.a.

Wetown Electric Group's revenue is projected to grow at 23.1% annually, outpacing the Chinese market average of 14.6%. Despite recent earnings showing a decline in net income to CNY 13.66 million, the company is expected to achieve profitability within three years with an 89.37% annual earnings growth forecast. However, shareholder dilution and high share price volatility pose risks. Insider ownership remains substantial, aligning management interests with shareholder value creation goals amidst financial challenges like insufficient interest coverage by earnings.

- Click here to discover the nuances of Wetown Electric Group with our detailed analytical future growth report.

- Our valuation report here indicates Wetown Electric Group may be overvalued.

Where To Now?

- Dive into all 636 of the Fast Growing Asian Companies With High Insider Ownership we have identified here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal