Daktronics (DAKT): Reassessing Valuation After Strong Q2 Momentum and Leadership Transition

Daktronics (DAKT) just stacked several important updates into one quarter, combining solid Q2 sales and order growth with a deeper product backlog, a new CEO on deck, and expanded manufacturing capacity.

See our latest analysis for Daktronics.

That operational momentum is starting to show up in the market too, with the share price at around $20.51 and a robust year to date share price return of roughly 23%, building on a remarkable three year total shareholder return above 700%.

If Daktronics has you thinking about where growth plus execution can really compound, it is worth scanning high growth tech and AI stocks for other tech names that are gaining traction with investors.

With shares still trading at a steep discount to the average analyst price target, despite strong execution and a swelling backlog, is Daktronics quietly undervalued or has the market already started pricing in its next leg of growth?

Most Popular Narrative Narrative: 25.4% Undervalued

With Daktronics last closing at $20.51 versus a most popular narrative fair value of $27.50, the narrative is leaning toward meaningful upside from here.

The accelerating adoption of digital displays in sectors like retail, sports, transportation, and public spaces is expanding Daktronics' addressable market, as seen in strong order growth, record high school recreation bookings, and increasing live events projects, creating a substantial revenue tailwind and supporting long-term topline growth.

Want to know what kind of revenue and margin reset sits behind that upside case? The narrative leans on ambitious, multi year earnings compounding and a future valuation multiple that undercuts many sector peers. Curious how those moving parts combine into that fair value math? Dive in to see the specific growth and profitability assumptions doing the heavy lifting.

Result: Fair Value of $27.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on resilient end markets and manageable tariffs, as weaker capital spending or higher trade costs could quickly pressure margins and cash flows.

Find out about the key risks to this Daktronics narrative.

Another View on Valuation

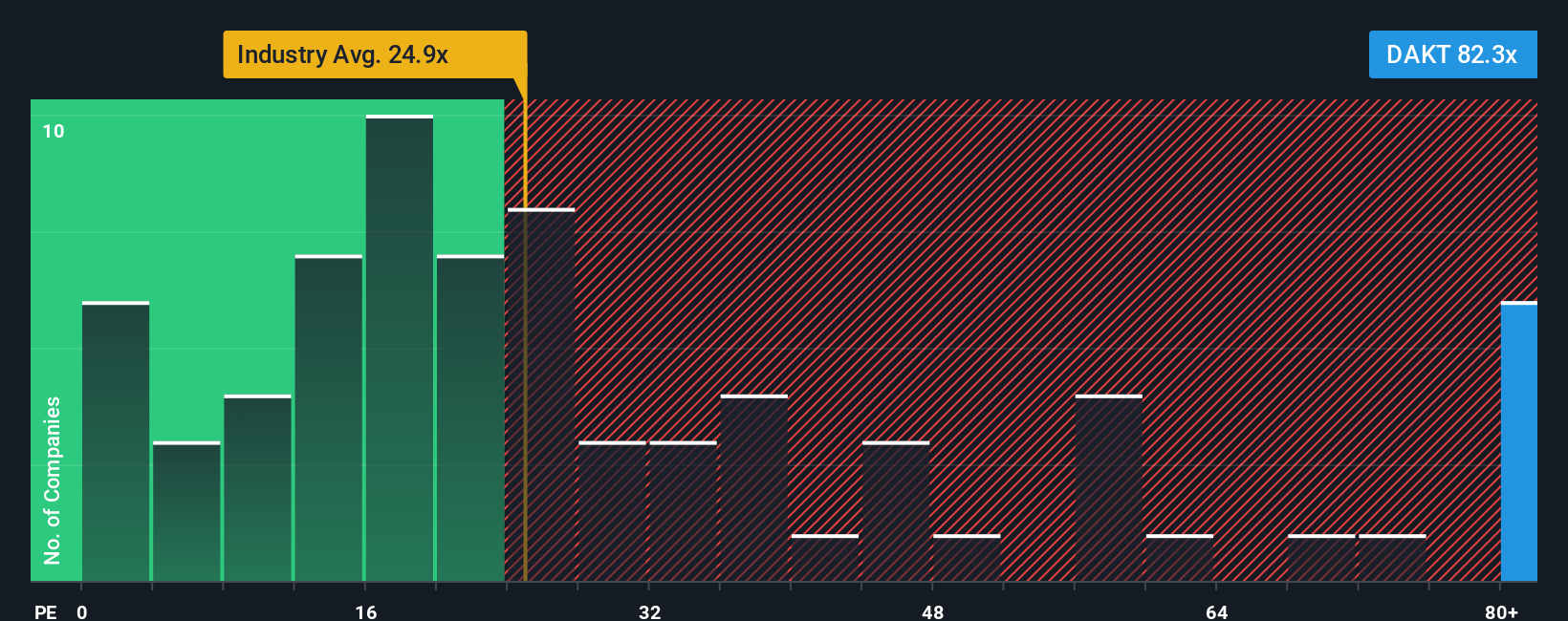

While the narrative suggests Daktronics is around 25% undervalued, a simple earnings lens tells a very different story. At roughly 135.7 times earnings versus about 25.4 times for the US Electronic industry and 34.1 times for peers, the stock looks richly priced and carries clear de rating risk if growth expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daktronics Narrative

If you want to stress test these assumptions yourself and challenge the consensus view, you can build a tailored narrative in under three minutes: Do it your way.

A great starting point for your Daktronics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Daktronics. Sharpen your edge by running targeted screens on Simply Wall Street and line up your next wave of high conviction ideas today.

- Capture potential multi baggers early by scanning these 3609 penny stocks with strong financials where smaller names with improving fundamentals could become tomorrow's standout winners.

- Position yourself at the heart of technological disruption by reviewing these 25 AI penny stocks and focusing on businesses turning AI innovation into real revenue growth.

- Strengthen your portfolio's income engine by checking these 12 dividend stocks with yields > 3% and zeroing in on companies that reward shareholders with consistent cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal