Middle Eastern Dividend Stocks To Consider

As Gulf markets experience gains following the U.S. Federal Reserve's interest rate cut, investors in the Middle East are closely monitoring how these monetary policy shifts might impact their portfolios. With most regional currencies pegged to the dollar, this environment presents an opportunity to explore dividend stocks that offer potential income stability amidst fluctuating market dynamics.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.40% | ★★★★★★ |

| Turkiye Garanti Bankasi (IBSE:GARAN) | 3.15% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.07% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.54% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.63% | ★★★★★☆ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS) | 3.53% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 7.04% | ★★★★★☆ |

| Computer Direct Group (TASE:CMDR) | 7.92% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.34% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 5.79% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top Middle Eastern Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

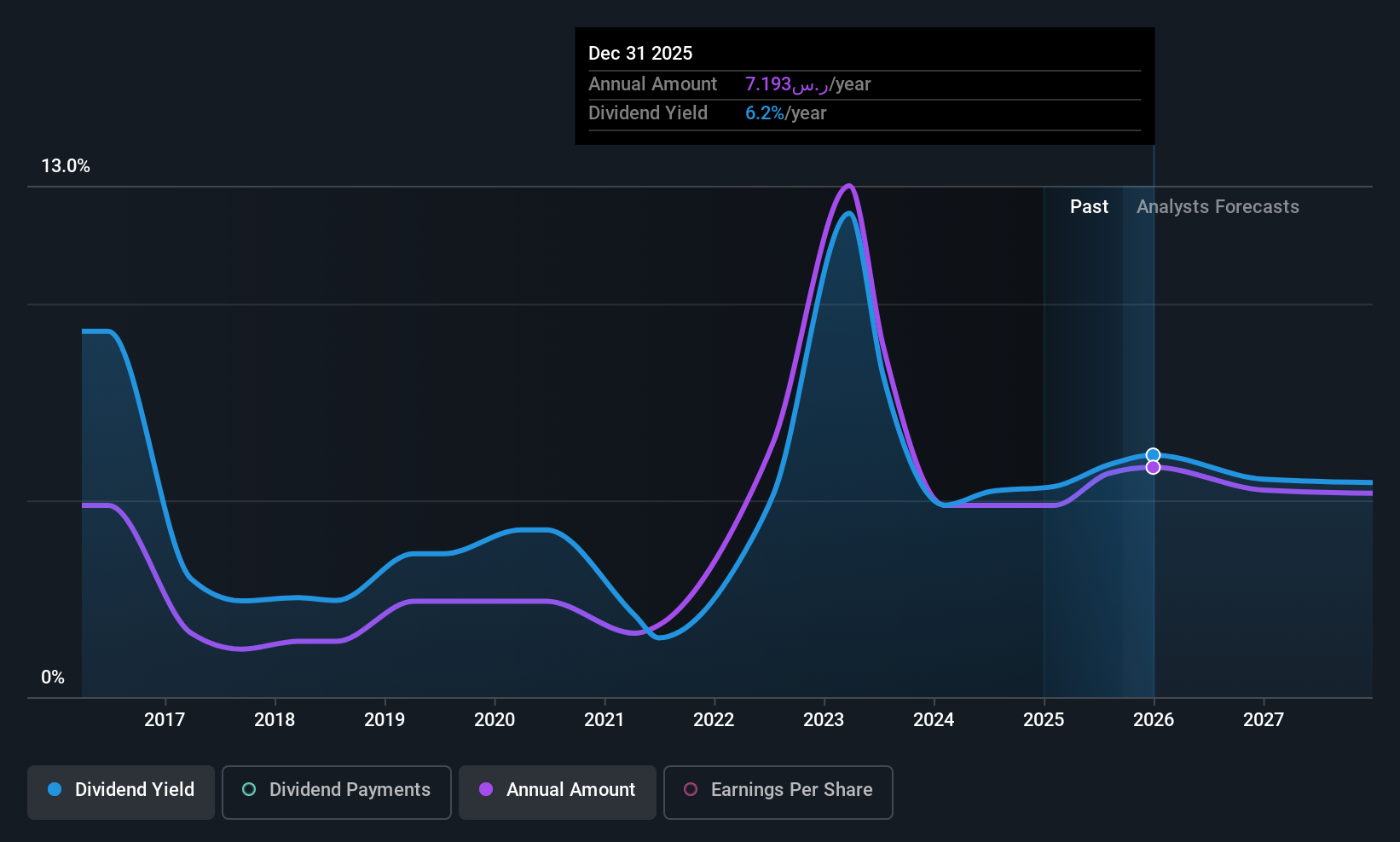

SABIC Agri-Nutrients (SASE:2020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SABIC Agri-Nutrients Company is involved in the production, conversion, manufacturing, marketing, and trade of agri-nutrients and chemical products across various countries including Singapore, the United States, India, and Saudi Arabia with a market cap of SAR55.27 billion.

Operations: SABIC Agri-Nutrients Company's revenue is primarily derived from agri-nutrients at SAR12.36 billion and petrochemicals at SAR542.49 million.

Dividend Yield: 6%

SABIC Agri-Nutrients offers a compelling dividend profile with its 2020 yield of 6.03%, ranking in the top 25% of Saudi Arabian dividend payers. Despite past volatility, dividends are covered by earnings and cash flows, with payout ratios at 72.1% and 78.7%, respectively. The company's price-to-earnings ratio of 12.9x suggests good value relative to peers, though future earnings may decline by an average of 3.2% annually over the next three years. Recent Q3 results showed strong sales growth to SAR 3.52 billion and net income increase to SAR 1.29 billion, indicating robust financial performance despite potential future challenges in maintaining dividend stability.

- Click to explore a detailed breakdown of our findings in SABIC Agri-Nutrients' dividend report.

- Upon reviewing our latest valuation report, SABIC Agri-Nutrients' share price might be too pessimistic.

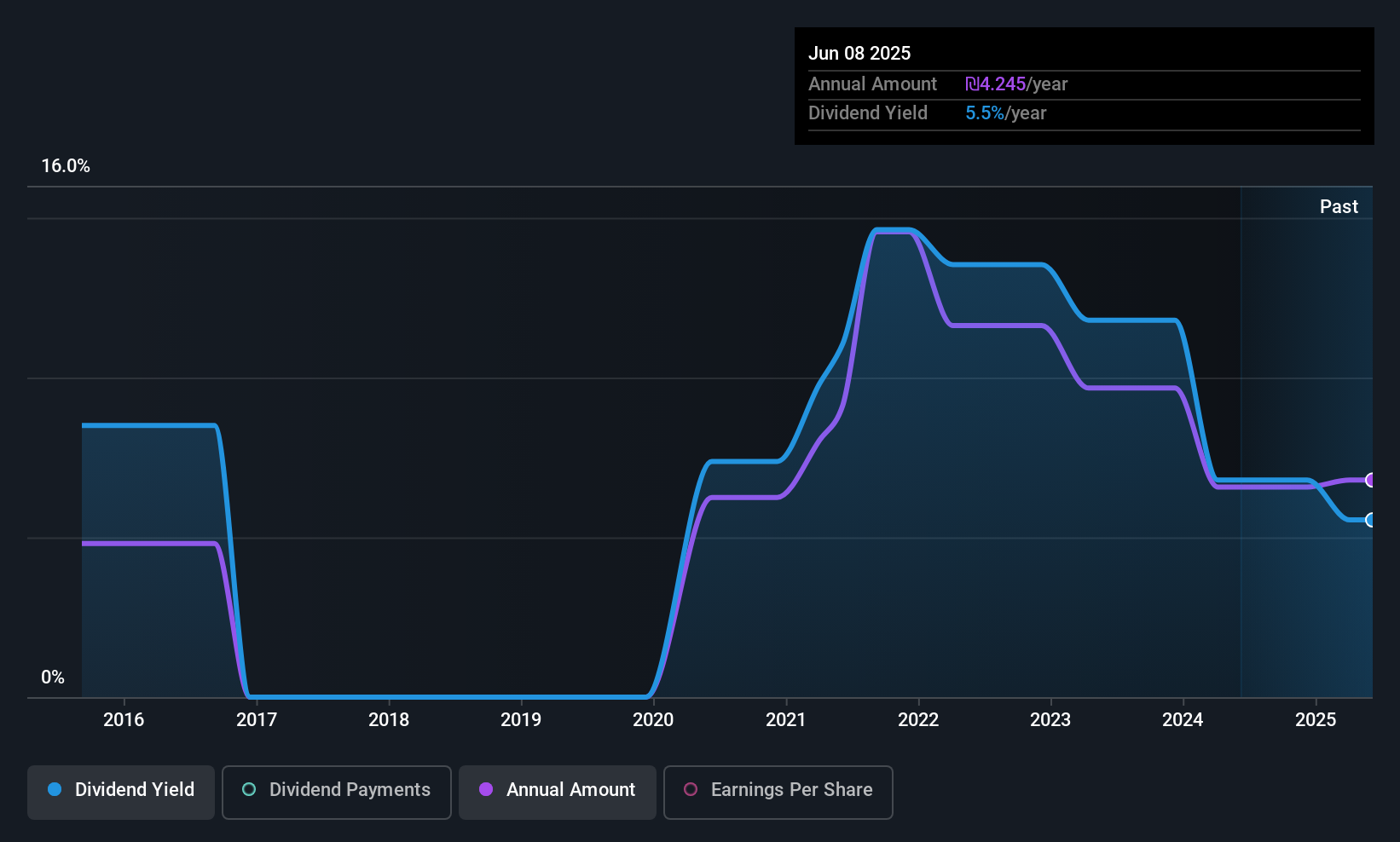

Atreyu Capital Markets (TASE:ATRY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atreyu Capital Markets Ltd operates through its subsidiaries to offer investment management services in Israel, with a market cap of ₪1.33 billion.

Operations: Atreyu Capital Markets Ltd generates revenue of ₪110.61 million from its investment management services in Israel.

Dividend Yield: 4.7%

Atreyu Capital Markets recently declared a cash dividend of ILS 2.11 per share, with earnings and cash flows sufficiently covering the payout at ratios of 79.9% and 88.9%, respectively. Despite an increase in past dividend payments, their volatility raises concerns about reliability. The company's price-to-earnings ratio of 12.5x offers value below the Israeli market average, while recent earnings growth reflects positively on its financial health amidst its inclusion in the S&P Global BMI Index.

- Take a closer look at Atreyu Capital Markets' potential here in our dividend report.

- According our valuation report, there's an indication that Atreyu Capital Markets' share price might be on the expensive side.

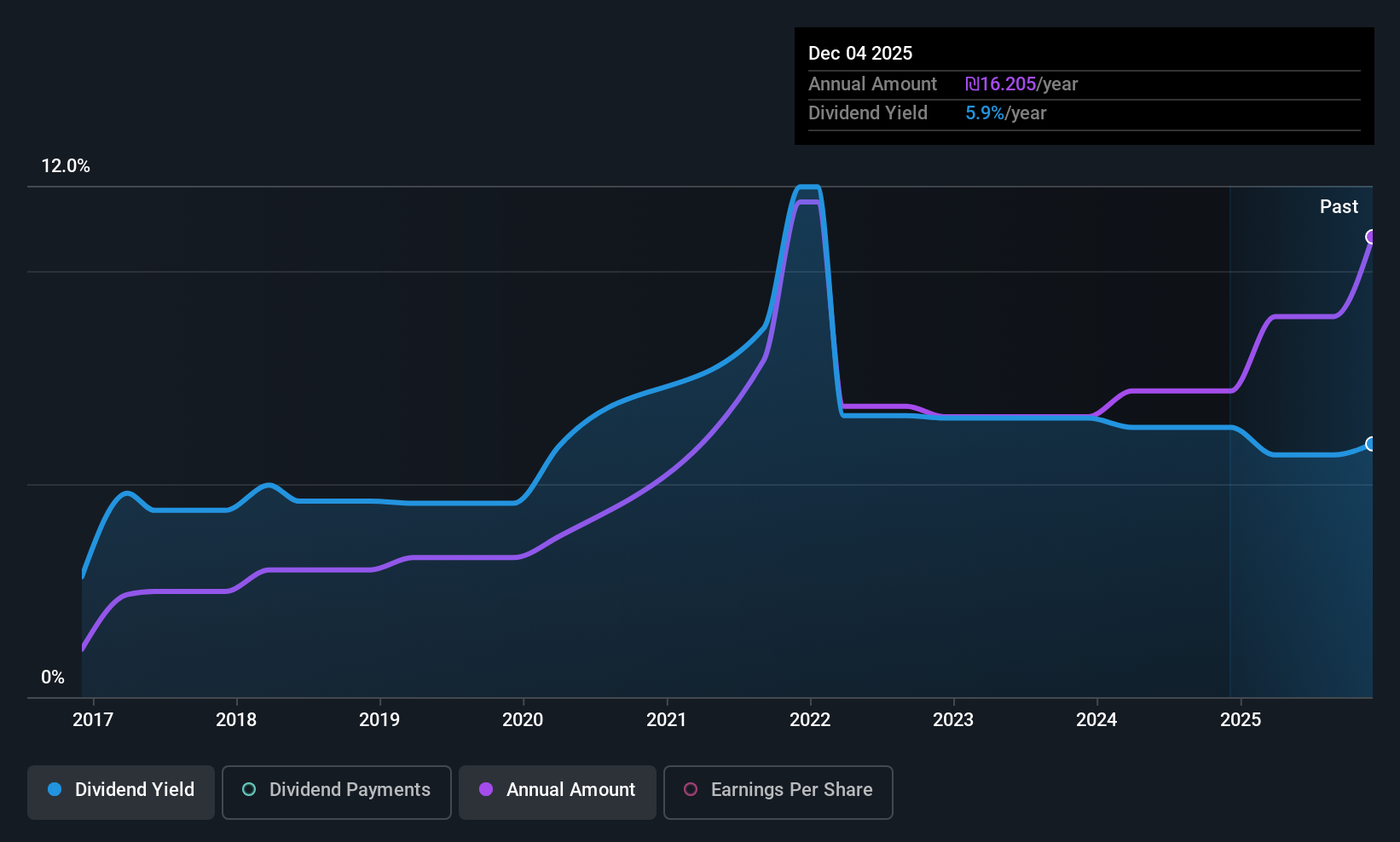

F.I.B.I. Holdings (TASE:FIBIH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: F.I.B.I. Holdings Ltd serves as the holding company for The First International Bank of Israel Ltd and has a market cap of ₪9.78 billion.

Operations: F.I.B.I. Holdings Ltd generates revenue through its primary operations as the holding entity for The First International Bank of Israel Ltd.

Dividend Yield: 5.9%

F.I.B.I. Holdings announced a cash dividend of ILS 5.92 per share, with a payout ratio of 42.4%, indicating dividends are well covered by earnings despite historical volatility and unreliable growth over the past decade. Trading at 20.9% below estimated fair value, it offers potential upside but lacks assurance for future payouts due to insufficient data on sustainability and coverage by earnings or cash flows, although its inclusion in the FTSE All-World Index is noteworthy.

- Get an in-depth perspective on F.I.B.I. Holdings' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of F.I.B.I. Holdings shares in the market.

Where To Now?

- Get an in-depth perspective on all 60 Top Middle Eastern Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal