Block (SQ) Valuation Recheck After Q3 Earnings Miss and Mixed Signals From Recent Growth Trends

Block (SQ) is back in the spotlight after its third quarter earnings missed expectations on both revenue and adjusted EPS, sending investors back to reassess the story behind the growing fintech ecosystem.

See our latest analysis for Block.

Those Q3 misses and the new credit scoring push land against a tough backdrop, with a roughly 27% year to date share price return decline and a 1 year total shareholder return of about negative 32%. This suggests sentiment is still cautious despite ecosystem growth.

If Block’s latest move has you rethinking fintech exposure, it may be worth exploring other high growth tech and digital finance names through high growth tech and AI stocks to see what else fits your strategy.

With shares trading below analyst targets despite resilient Cash App and Square momentum, the real question now is whether Block is quietly undervalued or if the market is already discounting all of its future growth.

Most Popular Narrative Narrative: 24.3% Undervalued

With Block closing at $63.61 versus a narrative fair value near $84, the gap suggests markets are discounting a growth and margin story that consensus still backs.

The analysts have a consensus price target of $85.158 for Block based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $104.0, and the most bearish reporting a price target of just $35.0.

Curious what earnings path and profit profile could justify a richer valuation despite muted headline growth? The narrative leans on evolving margins, share count shifts, and a higher future earnings multiple. The full breakdown shows exactly how these levers combine to support that fair value.

Result: Fair Value of $84.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could be knocked off course if Cash App growth stalls or credit losses from Borrow and BNPL spike in a weaker macro backdrop.

Find out about the key risks to this Block narrative.

Another Way To Look At Value

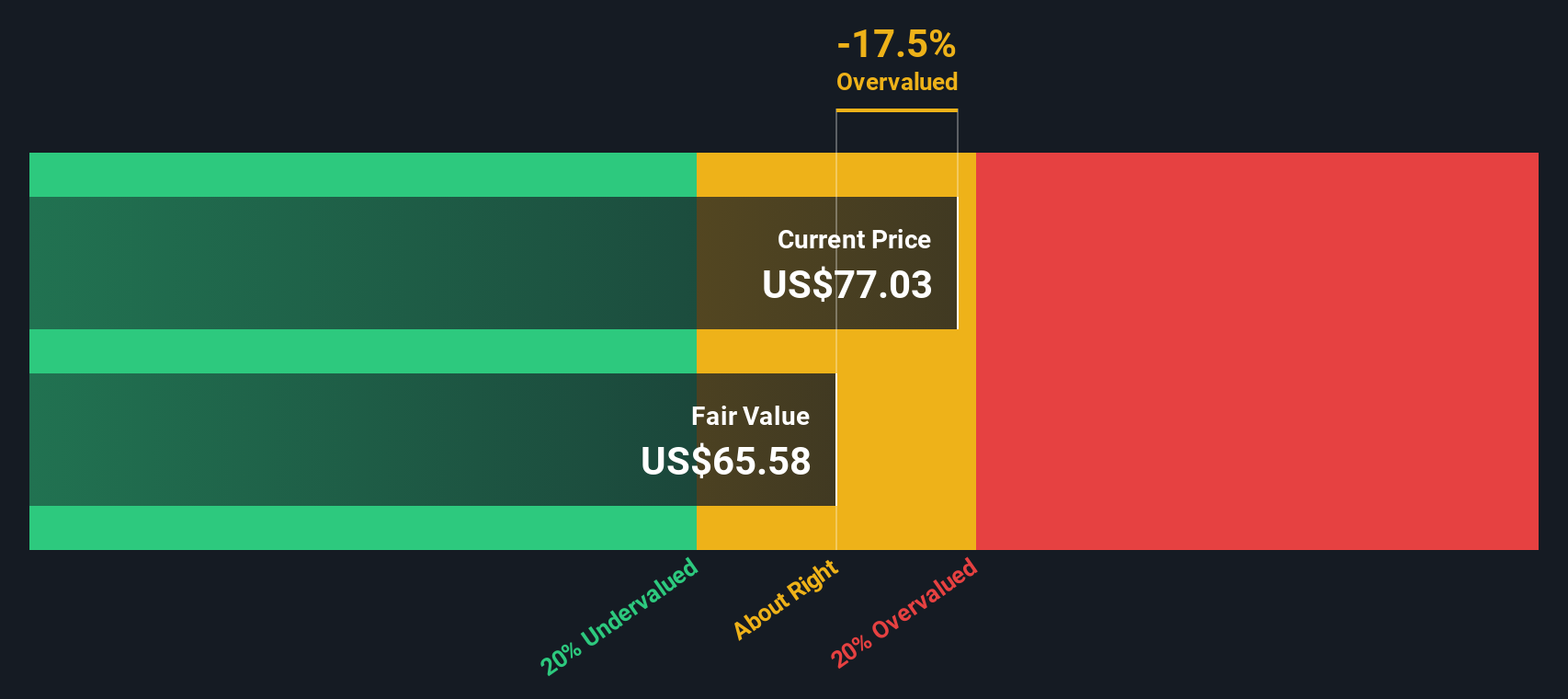

While the analyst narrative points to roughly 24% upside, our DCF model is more conservative and suggests Block’s fair value is nearer $56.65, below the current $63.61. If cash flows disappoint, could today’s “discount” actually be a premium in disguise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Block for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Block Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Block research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, put your research to work by scanning fresh stock ideas tailored to different strategies so you are not leaving potential returns on the table.

- Target potential future multibaggers early by scanning these 3609 penny stocks with strong financials, where solid balance sheets meet higher-risk, higher-reward opportunities.

- Explore the AI theme by tracking these 25 AI penny stocks, which focus on companies developing or applying artificial intelligence technologies.

- Look for income opportunities by focusing on these 12 dividend stocks with yields > 3%, which highlights dividend-paying stocks that can complement an income strategy during periods of volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal