Is AeroVironment’s Recent Surge Still Justified After Sharp Pullback In 2025?

- If you are wondering whether AeroVironment’s huge run makes it too late to buy, or if there is still value on the table, you are not alone.

- The stock has pulled back sharply in the short term, down 13.1% over the last week and 23.9% over the past month, but it is still up 59.6% year to date and 62.3% over the last year, with gains of 183.6% over three years and 192.3% over five.

- Behind these moves is a growing focus on AeroVironment’s role in unmanned aerial systems and defense technology, as investors reassess which companies could benefit from evolving defense priorities and higher spending. Ongoing contract wins and its positioning in strategic military programs have kept the company firmly on the radar of growth minded investors.

- Despite that backdrop, AeroVironment only scores 1/6 on our valuation checks, so we will break down what different valuation methods say about the stock, and then circle back at the end with a more holistic way to think about what it is really worth.

AeroVironment scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AeroVironment Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting those back into today’s dollars, based on the risk and timing of those cash flows.

For AeroVironment, the latest twelve months show free cash flow of roughly $244.7 million in the red, reflecting heavy investment and volatility in cash generation. Analysts and model projections, however, indicate a sharp improvement, with free cash flow expected to reach about $236.7 million by 2028. Beyond the analyst horizon, Simply Wall St extrapolates further gains, with discounted free cash flow estimates rising through 2035 as the business scales.

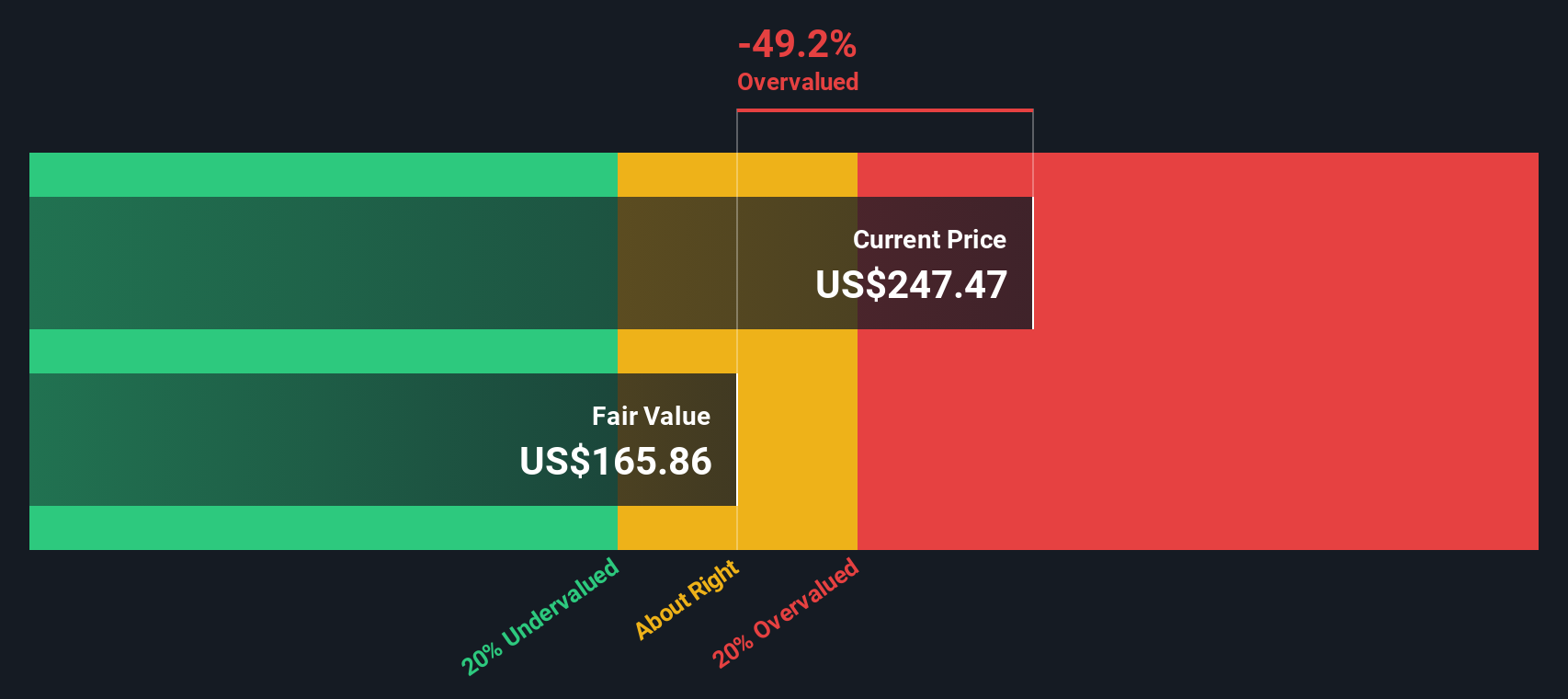

Putting all those projected cash flows together, the 2 Stage Free Cash Flow to Equity model arrives at an intrinsic value of about $204.94 per share. Based on this calculation, the DCF suggests AeroVironment shares are roughly 21.9% overvalued relative to the current market price, which indicates that a lot of future growth is already priced in.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AeroVironment may be overvalued by 21.9%. Discover 905 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: AeroVironment Price vs Sales

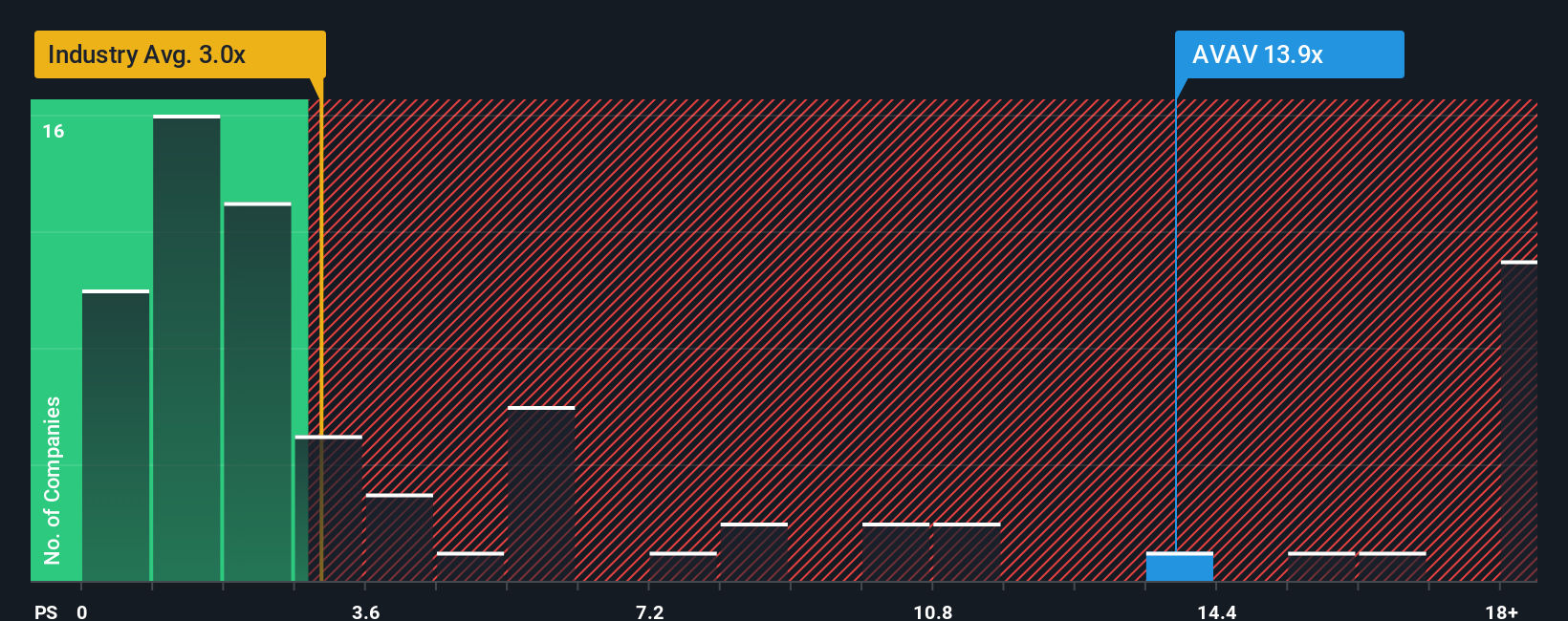

For companies like AeroVironment that are still normalizing profitability and reinvesting heavily, the price to sales ratio is often a cleaner way to compare valuation because revenue tends to be more stable than earnings. Investors usually accept a higher price to sales multiple when they expect stronger growth and lower risk, while slower or more uncertain businesses typically trade on lower multiples.

AeroVironment currently trades at about 9.06x sales, which is well above the Aerospace and Defense industry average of roughly 3.10x and also higher than its peer group average of around 6.16x. Simply Wall St’s Fair Ratio framework goes a step further by estimating what multiple would be appropriate given AeroVironment’s growth outlook, profitability profile, industry, size and risk factors. On that basis, the model suggests a Fair Ratio of about 3.36x sales, which indicates that the stock’s present valuation is materially above where it would be expected to trade once those fundamentals are fully reflected.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AeroVironment Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of AeroVironment’s future with the numbers behind its revenue, earnings and margins. A Narrative is your story about the company, translated into a financial forecast and then into a Fair Value, so you can see how your expectations compare to the current share price. On Simply Wall St, Narratives sit inside the Community page used by millions of investors, and they make it easy to test different assumptions, see the implied Fair Value, and decide whether AeroVironment looks like a buy, hold or sell today. Because Narratives update dynamically as new news, earnings or guidance arrive, you are not locked into a static view; your fair value moves as the facts change. For example, one AeroVironment Narrative might assume strong contract wins, margin recovery and a Fair Value closer to the upper analyst range. A more cautious Narrative might focus on budget risk, integration challenges and a Fair Value near the low end of recent targets. Comparing both to the live price helps you choose which story you believe.

Do you think there's more to the story for AeroVironment? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal