Farmer Mac (AGM) Valuation Check After Appointing Matthew Pullins as New CFO and EVP-Treasurer

Federal Agricultural Mortgage (AGM) just reshuffled its finance leadership, naming Matthew M. Pullins as Chief Financial Officer and Executive Vice President Treasurer. This move could subtly reshape how investors think about Farmer Mac’s risk and growth profile.

See our latest analysis for Federal Agricultural Mortgage.

The timing of Pullins’ appointment comes as Farmer Mac’s 30 day share price return of 11.47% has started to claw back some of the 3 month share price pullback of 6.24%. Its 5 year total shareholder return of 197.04% still points to strong long term value creation.

If this kind of leadership shift has you rethinking your portfolio mix, it could be worth scouting fast growing stocks with high insider ownership as a way to uncover the next set of compelling ideas.

With shares still trading at a notable discount to analyst targets but recent returns turning choppy, is Farmer Mac quietly undervalued after the pullback, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 18.3% Undervalued

Compared to the last close of $184.54, the most followed narrative sees meaningful upside in Federal Agricultural Mortgage’s fair value, anchored to multi year growth assumptions.

Expansion into renewable energy, broadband, and infrastructure finance is driving significant new business volume and higher spreads, positioning Farmer Mac to benefit from increasing demand for financing related to sustainability and rural connectivity initiatives, which should support revenue and earnings growth going forward.

Curious how steady double digit top line growth, slightly slimmer margins, and a richer future earnings multiple can still add up to upside from here? The full narrative walks through the growth runway, profitability trade offs, and valuation bridge step by step so you can see exactly how those moving parts combine into today’s fair value call.

Result: Fair Value of $226 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on supportive policy and disciplined credit trends, and setbacks in renewable incentives or rising credit losses could quickly challenge that outlook.

Find out about the key risks to this Federal Agricultural Mortgage narrative.

Another View on Value

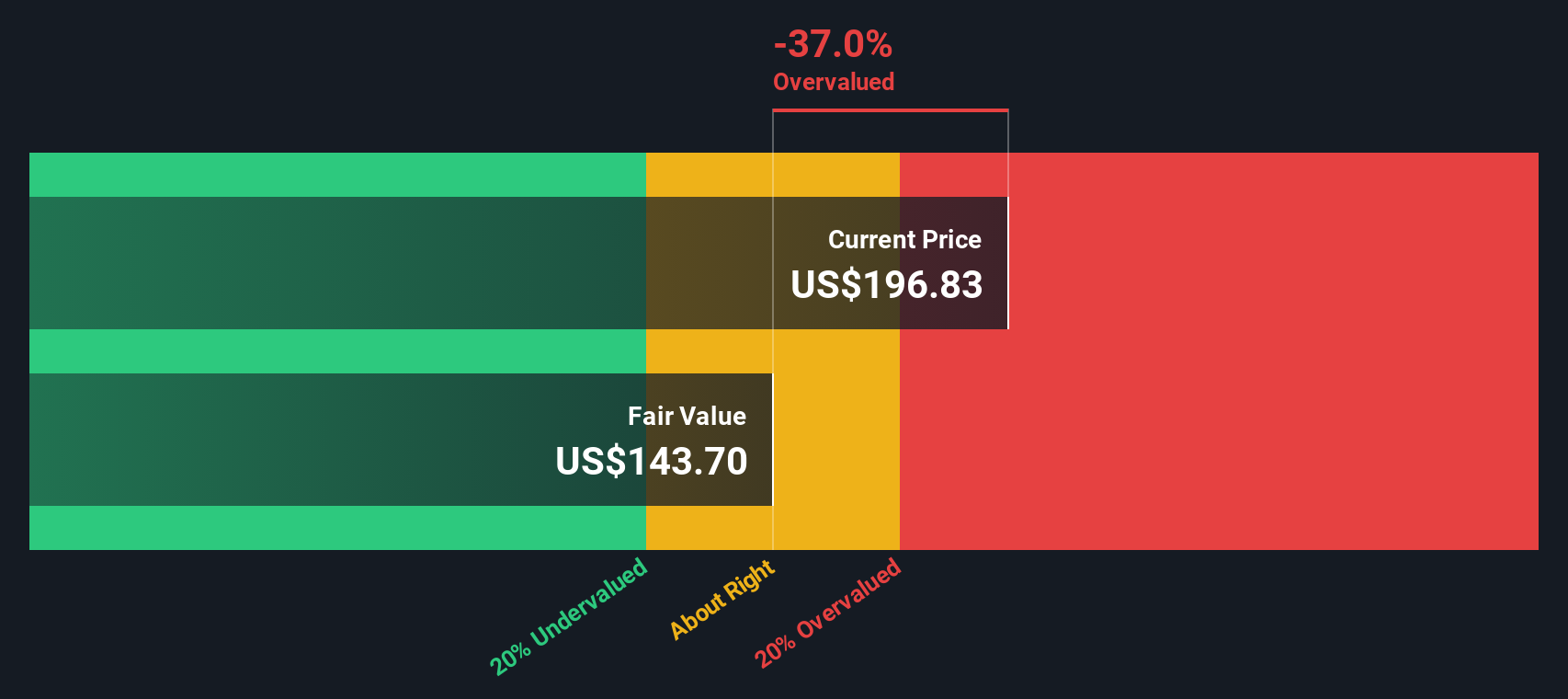

Our DCF model paints a more cautious picture, putting fair value for Federal Agricultural Mortgage closer to $135.90, which would make today’s $184.54 share price look overvalued rather than 18.3% undervalued. Is the market now paying up for growth that may already be in the price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Agricultural Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Agricultural Mortgage Narrative

If you see the story playing out differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way

A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investment move?

Do not stop at a single stock when the market is full of potential; use data driven screeners to uncover ideas others overlook and act before they do.

- Explore overlooked opportunities with these 907 undervalued stocks based on cash flows that show strong underlying cash flow support.

- Focus on income stability by using these 11 dividend stocks with yields > 3% to research yields above 3% over the long term.

- Follow the latest wave of innovation as these 25 AI penny stocks highlight companies that are reshaping how industries operate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal