Sotera Health (SHC): Reassessing Valuation After Major Secondary Share Sale and Earnings Beat

Sotera Health (SHC) just navigated a complicated one two punch as affiliates of Warburg Pincus and GTCR unloaded 30 million shares in a secondary offering while the company simultaneously delivered earnings that topped Wall Street expectations.

See our latest analysis for Sotera Health.

At around $16.90, Sotera Health’s solid quarterly beat and heavy secondary selling come after a strong run. Its year to date share price return of 24.08 percent and three year total shareholder return of 96.74 percent signal momentum rather than fatigue.

If Sotera’s move has you rethinking healthcare exposure, this is a good moment to explore other names using our curated screener of healthcare stocks for fresh ideas beyond SHC.

Yet with shares now near 52 week highs, trading at a sizable intrinsic discount but only modestly below analyst targets, investors have to ask: is Sotera still mispriced, or is the market already baking in the next leg of growth?

Most Popular Narrative: 10.7% Undervalued

With Sotera Health last closing at $16.90 versus a narrative fair value near $18.93, the valuation hinges on ambitious growth and margin assumptions playing out.

The analysts have a consensus price target of $16.0 for Sotera Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $14.0.

Want to see what kind of revenue climb, margin rebuild, and earnings surge are assumed to back this near double digit upside? The narrative’s core forecast may surprise you.

Result: Fair Value of $18.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors cannot ignore that tighter ethylene oxide regulations and elevated compliance capex could compress margins and slow the multiyear earnings ramp analysts expect.

Find out about the key risks to this Sotera Health narrative.

Another Lens on Valuation

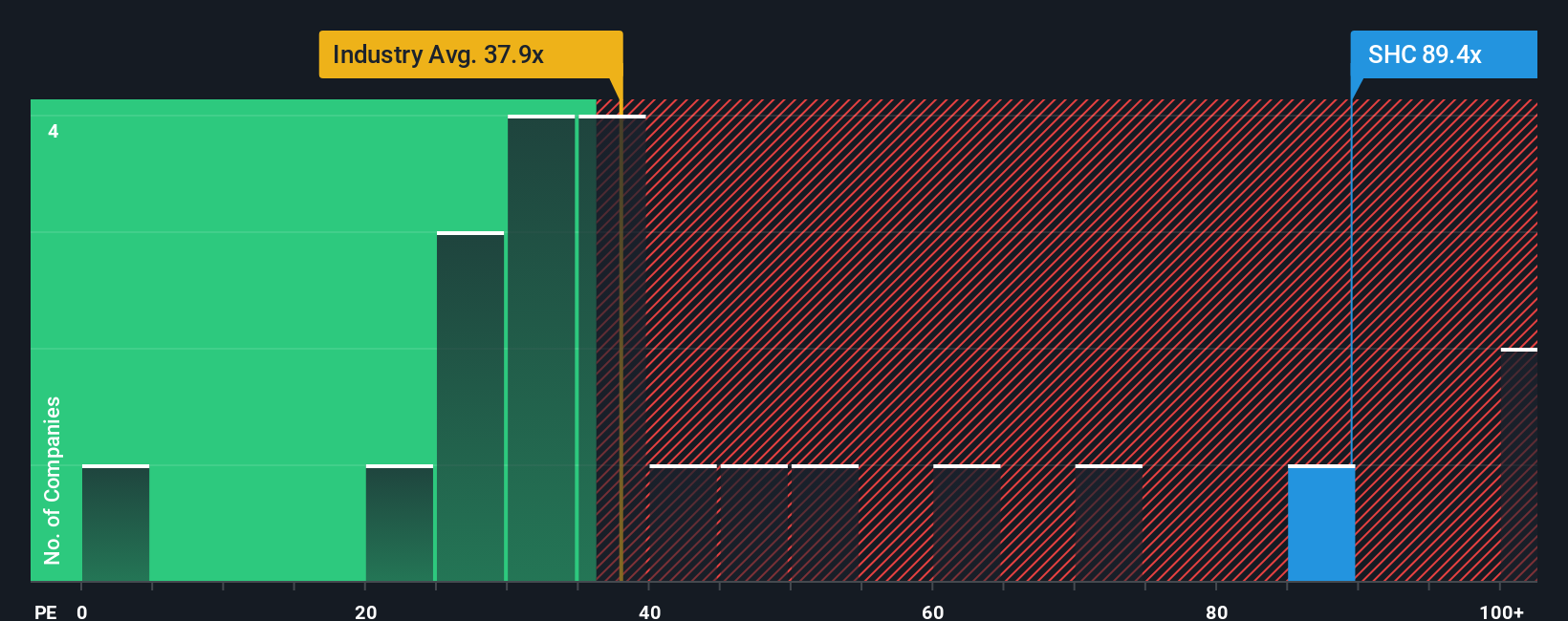

On earnings, the story looks very different. Sotera trades on a price to earnings ratio of 86.6 times, far richer than both the North American Life Sciences average of 34.3 times and a fair ratio of 33.2 times. This suggests meaningful downside risk if sentiment normalizes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sotera Health Narrative

If you want to dig into the numbers yourself or challenge these assumptions, you can quickly build a personalized view in just minutes, Do it your way.

A great starting point for your Sotera Health research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an information edge by scanning fresh opportunities on Simply Wall Street, where curated screens surface ideas you might otherwise miss.

- Capitalize on mispriced potential by targeting quality companies trading at attractive valuations through these 907 undervalued stocks based on cash flows that keep value front and center.

- Ride structural growth trends by focusing on innovation leaders using these 25 AI penny stocks shaping the future with real world artificial intelligence solutions.

- Strengthen your income game by filtering for reliable payouts across these 11 dividend stocks with yields > 3% that can help reinforce long term portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal