The 3.8% return this week takes Megaport's (ASX:MP1) shareholders three-year gains to 93%

Megaport Limited (ASX:MP1) shareholders have seen the share price descend 13% over the month. But don't let that distract from the very nice return generated over three years. In fact, the company's share price bested the return of its market index in that time, posting a gain of 93%.

The past week has proven to be lucrative for Megaport investors, so let's see if fundamentals drove the company's three-year performance.

Megaport wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years Megaport has grown its revenue at 23% annually. That's well above most pre-profit companies. While the compound gain of 25% per year over three years is pretty good, you might argue it doesn't fully reflect the strong revenue growth. So now might be the perfect time to put Megaport on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

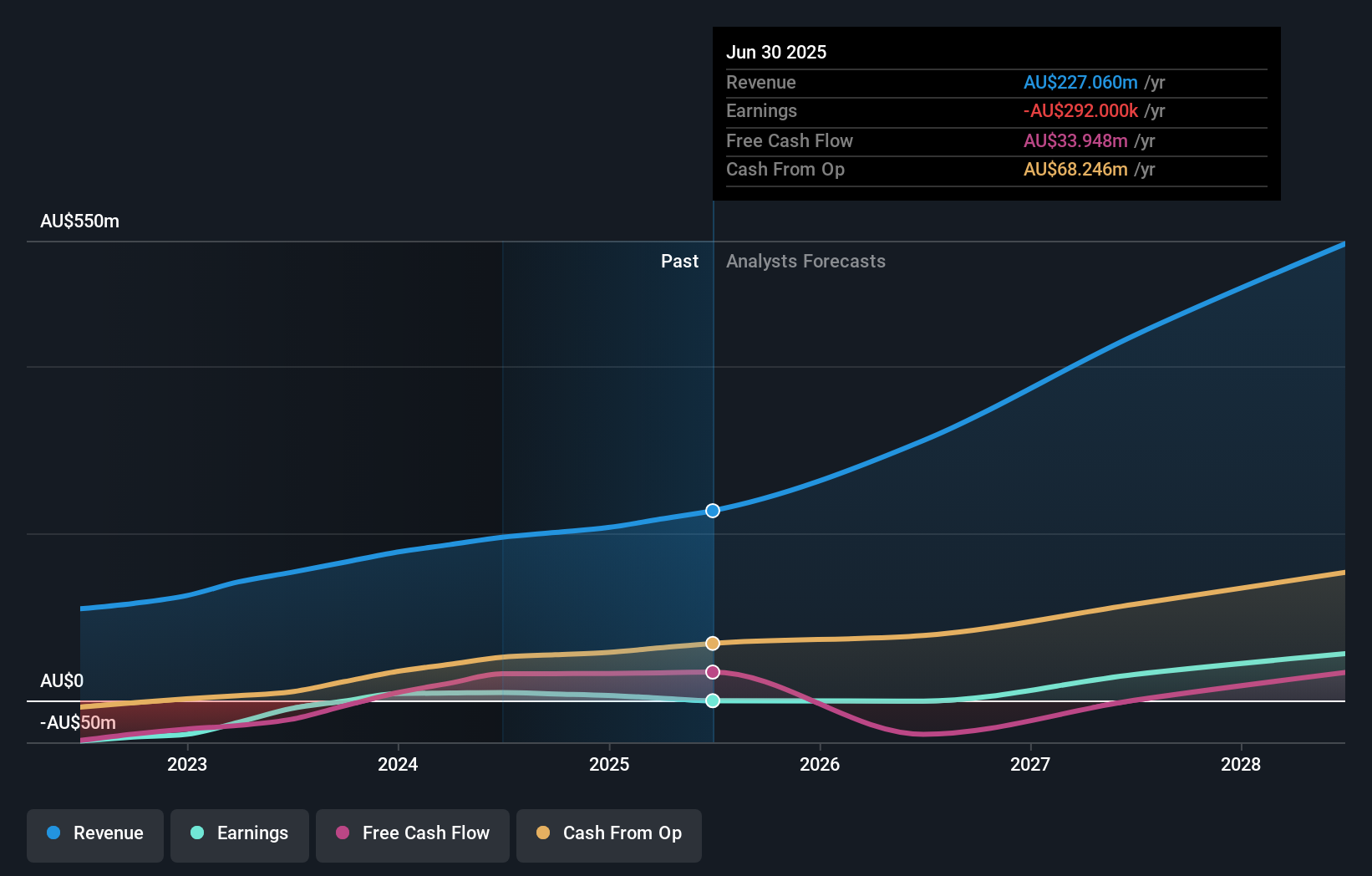

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Megaport is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Megaport stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's nice to see that Megaport shareholders have received a total shareholder return of 74% over the last year. Notably the five-year annualised TSR loss of 1.3% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal