Asian Stocks Trading Below Estimated Value In December 2025

As 2025 draws to a close, Asian markets are navigating a complex landscape marked by economic slowdowns in key regions like China and Japan, while investor sentiment is cautiously optimistic amid hopes for interest rate adjustments. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that offer potential value despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.90 | CN¥301.88 | 49% |

| Visional (TSE:4194) | ¥9969.00 | ¥19638.66 | 49.2% |

| Last One MileLtd (TSE:9252) | ¥3450.00 | ¥6848.65 | 49.6% |

| KoMiCo (KOSDAQ:A183300) | ₩84700.00 | ₩166235.75 | 49% |

| JUSUNG ENGINEERINGLtd (KOSDAQ:A036930) | ₩28700.00 | ₩57169.43 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥5560.00 | ¥10890.52 | 48.9% |

| H.U. Group Holdings (TSE:4544) | ¥3300.00 | ¥6592.59 | 49.9% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩445500.00 | ₩890508.57 | 50% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥261.75 | CN¥511.07 | 48.8% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.26 | CN¥55.81 | 49.4% |

Let's explore several standout options from the results in the screener.

Mobvista (SEHK:1860)

Overview: Mobvista Inc., along with its subsidiaries, provides advertising and marketing technology services to support the development of the mobile internet ecosystem globally, with a market cap of approximately HK$25.14 billion.

Operations: Mobvista generates revenue through its advertising and marketing technology services aimed at enhancing the mobile internet ecosystem for a global clientele.

Estimated Discount To Fair Value: 46.8%

Mobvista is trading at HK$16.41, significantly below its estimated fair value of HK$30.83, suggesting it may be undervalued based on cash flows. Despite a volatile share price and recent net losses of US$54.53 million in Q3 2025, the company shows promising growth prospects with earnings expected to grow nearly 100% annually and revenue projected to outpace the Hong Kong market significantly at 22.9% per year.

- The growth report we've compiled suggests that Mobvista's future prospects could be on the up.

- Click here to discover the nuances of Mobvista with our detailed financial health report.

Wuxi Zhenhua Auto PartsLtd (SHSE:605319)

Overview: Wuxi Zhenhua Auto Parts Co., Ltd. manufactures and sells auto parts in China, with a market cap of CN¥7.20 billion.

Operations: Wuxi Zhenhua Auto Parts Co., Ltd. generates its revenue from the manufacture and sale of automotive components within the Chinese market.

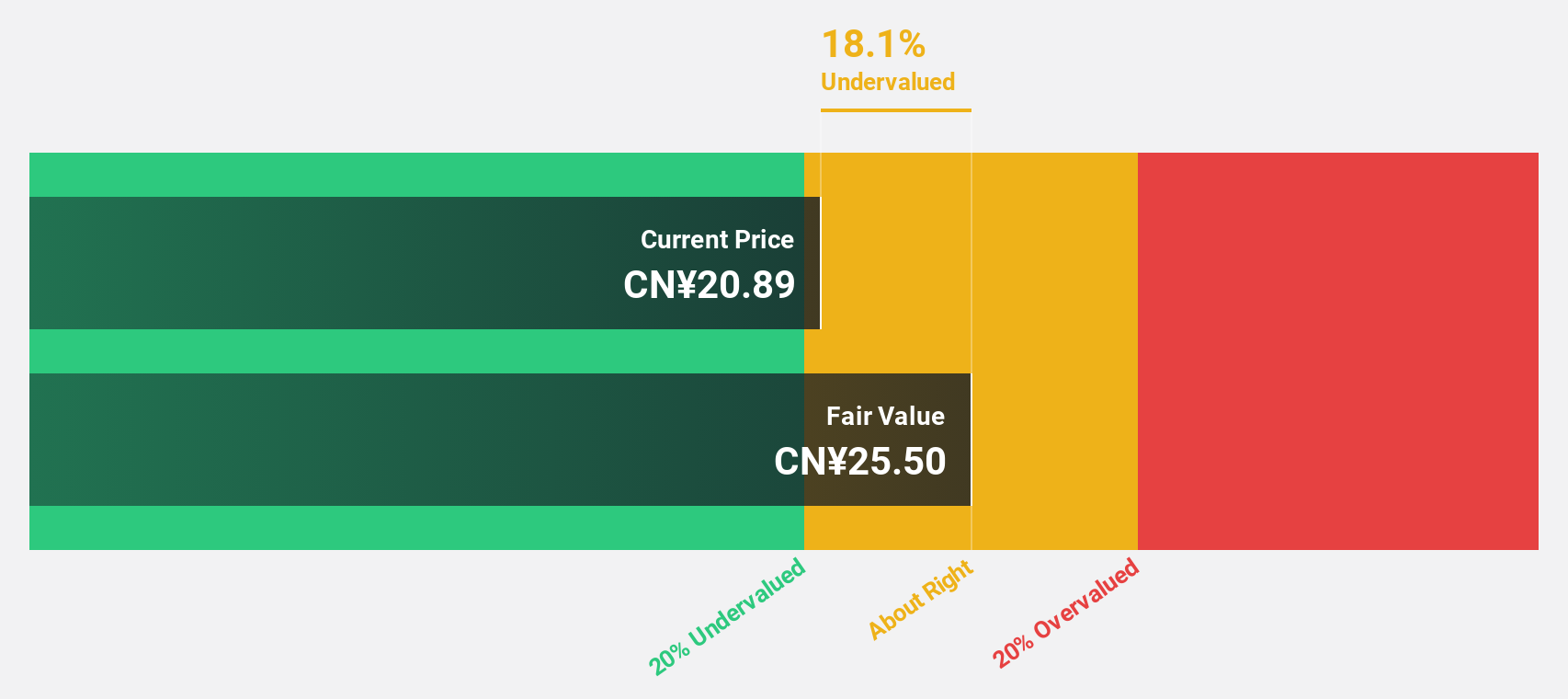

Estimated Discount To Fair Value: 17.8%

Wuxi Zhenhua Auto Parts is trading at CNY 20.94, slightly below its estimated fair value of CNY 25.47, presenting an opportunity based on cash flows despite modest undervaluation. Recent earnings show net income growth to CNY 318.48 million from last year's CNY 250.42 million, with revenue increasing to CNY 1.99 billion from CNY 1.73 billion a year ago. While earnings are expected to grow significantly at over 20% annually, dividend coverage remains weak against free cash flows.

- Insights from our recent growth report point to a promising forecast for Wuxi Zhenhua Auto PartsLtd's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Wuxi Zhenhua Auto PartsLtd.

Innodisk (TPEX:5289)

Overview: Innodisk Corporation engages in the research, development, manufacture, and sale of industrial embedded storage devices across Taiwan and globally, with a market cap of NT$45.10 billion.

Operations: The company's revenue segment from the research and development of various industrial memory storage devices amounts to NT$11.68 billion.

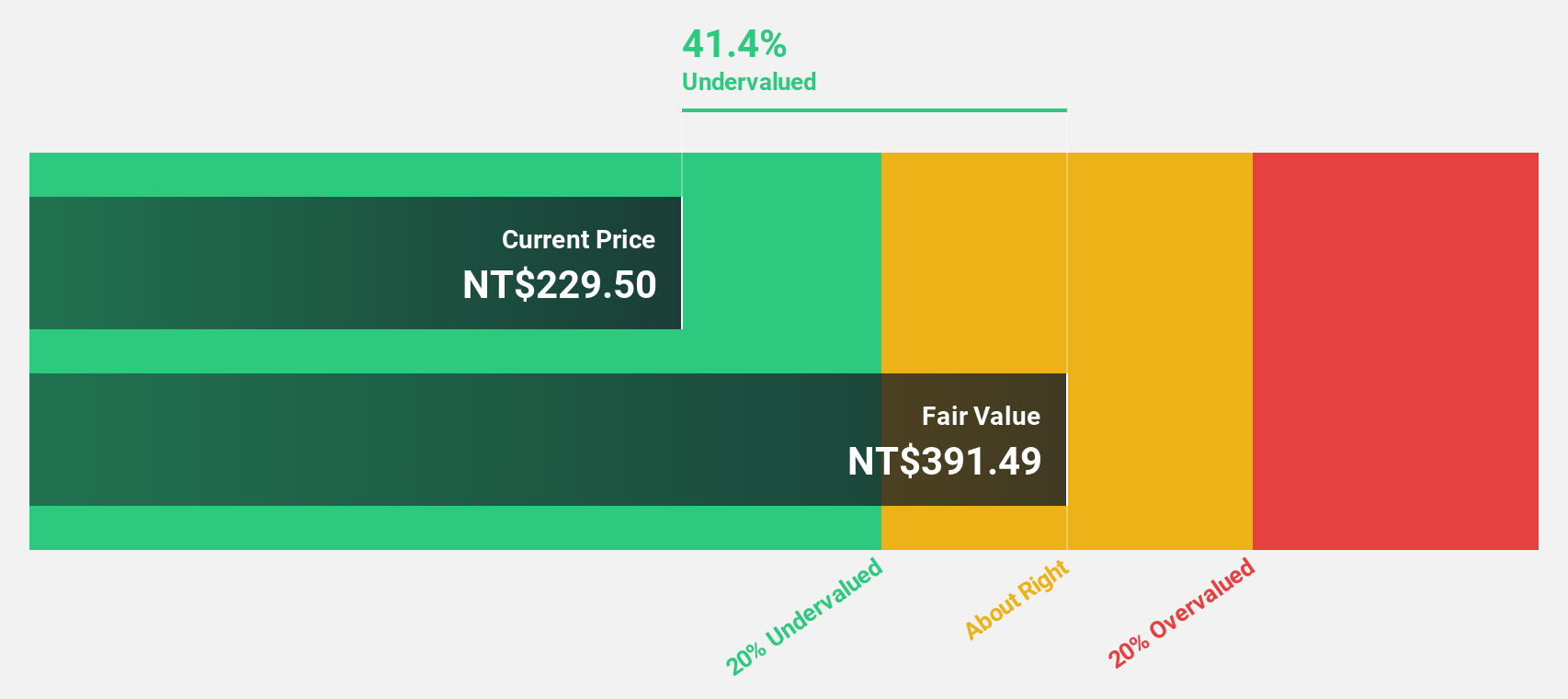

Estimated Discount To Fair Value: 10.5%

Innodisk Corporation's recent earnings report reveals a substantial increase in net income to TWD 643.04 million from TWD 188.62 million year-over-year, with revenue rising to TWD 3,807.4 million. The stock is trading at NT$473, below its estimated fair value of NT$528.38, suggesting undervaluation based on cash flows despite high volatility and insufficient dividend coverage by free cash flows. Earnings are projected to grow significantly faster than the Taiwan market over the next three years.

- Our earnings growth report unveils the potential for significant increases in Innodisk's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Innodisk.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 276 Undervalued Asian Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal