Zhejiang Jolly PharmaceuticalLTD And 2 Other Undiscovered Gems In Asia

As global markets remain attentive to potential interest rate cuts and economic indicators show mixed signals, the Asian market continues to offer intriguing opportunities for investors seeking growth in small-cap stocks. In this dynamic environment, identifying promising companies like Zhejiang Jolly Pharmaceutical LTD can be crucial, as such undiscovered gems often possess unique strengths and growth potential that align well with current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Yashima Denki | 2.28% | 2.70% | 25.81% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| New Asia Construction & Development | 42.25% | 8.68% | 50.79% | ★★★★★★ |

| Saha-Union | 0.70% | 0.67% | 18.29% | ★★★★★★ |

| Woojin | 1.02% | 8.91% | -11.74% | ★★★★★★ |

| Shangri-La Hotel | NA | 33.29% | 66.13% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| Anhui Huaren Health Pharmaceutical | 55.17% | 17.65% | 10.18% | ★★★★★☆ |

| ITCENGLOBAL | 63.28% | 18.49% | 32.80% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181)

Simply Wall St Value Rating: ★★★★★★

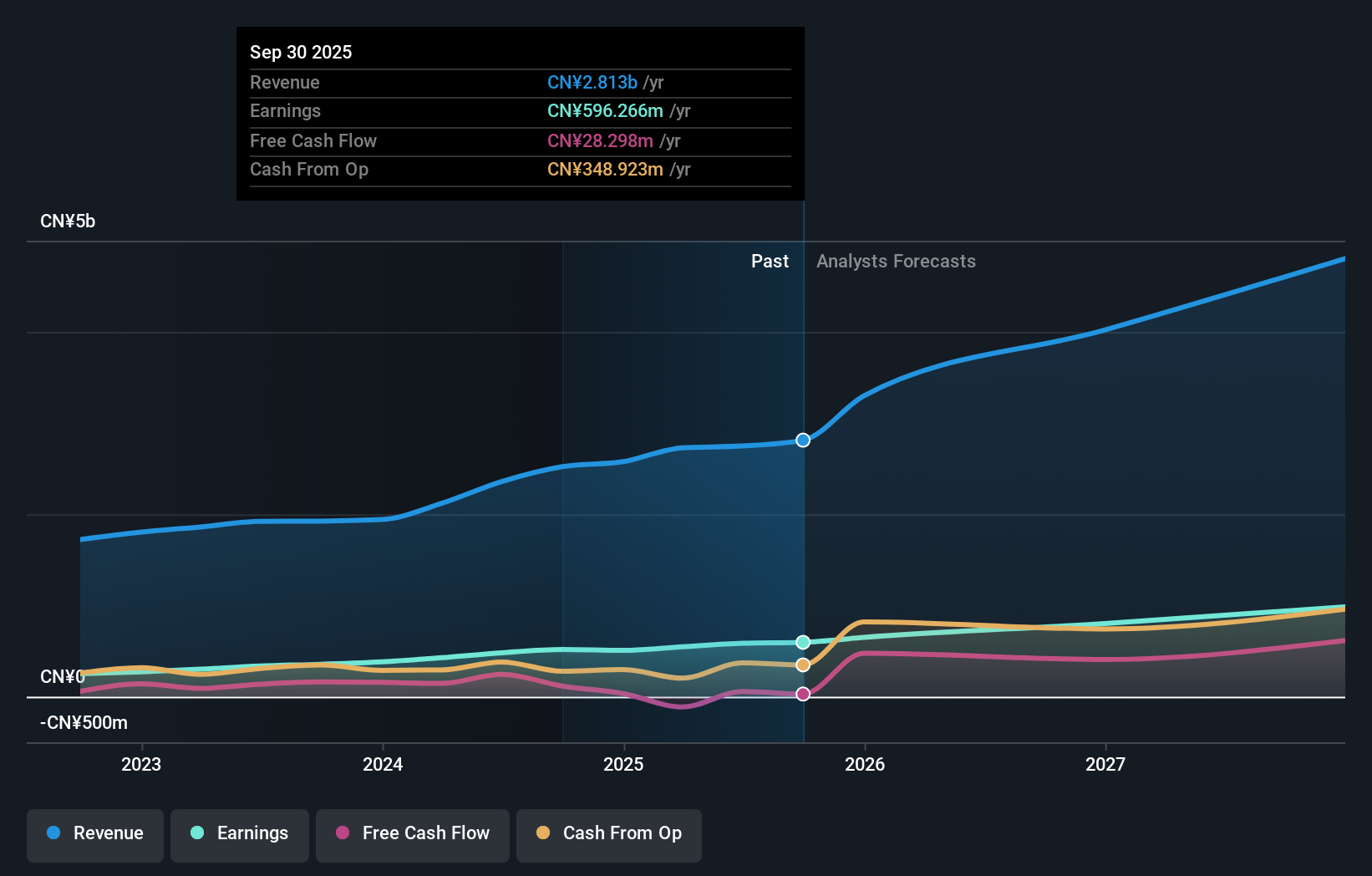

Overview: Zhejiang Jolly Pharmaceutical Co., LTD is involved in the research, production, and marketing of Chinese medicinal products both domestically and internationally, with a market capitalization of CN¥12.79 billion.

Operations: Zhejiang Jolly Pharmaceutical Co., LTD generates revenue primarily from its Chinese medicinal products. The company has a market capitalization of CN¥12.79 billion, reflecting its significant presence in both domestic and international markets.

Zhejiang Jolly Pharmaceutical, a small player in the pharmaceutical industry, is making waves with its impressive earnings growth of 15.2% over the past year, outpacing the industry's 3.8%. The company trades at 43.2% below its estimated fair value, suggesting potential upside for investors. With net income reaching CNY 509.97 million for nine months ending September 2025 and basic earnings per share rising to CNY 0.7271 from CNY 0.6018, it shows robust financial health. Additionally, their debt-to-equity ratio improved from 23.8% to 20.3% over five years, highlighting prudent financial management and positioning them well for future growth opportunities in Asia's dynamic market.

Nichidenbo (TWSE:3090)

Simply Wall St Value Rating: ★★★★☆☆

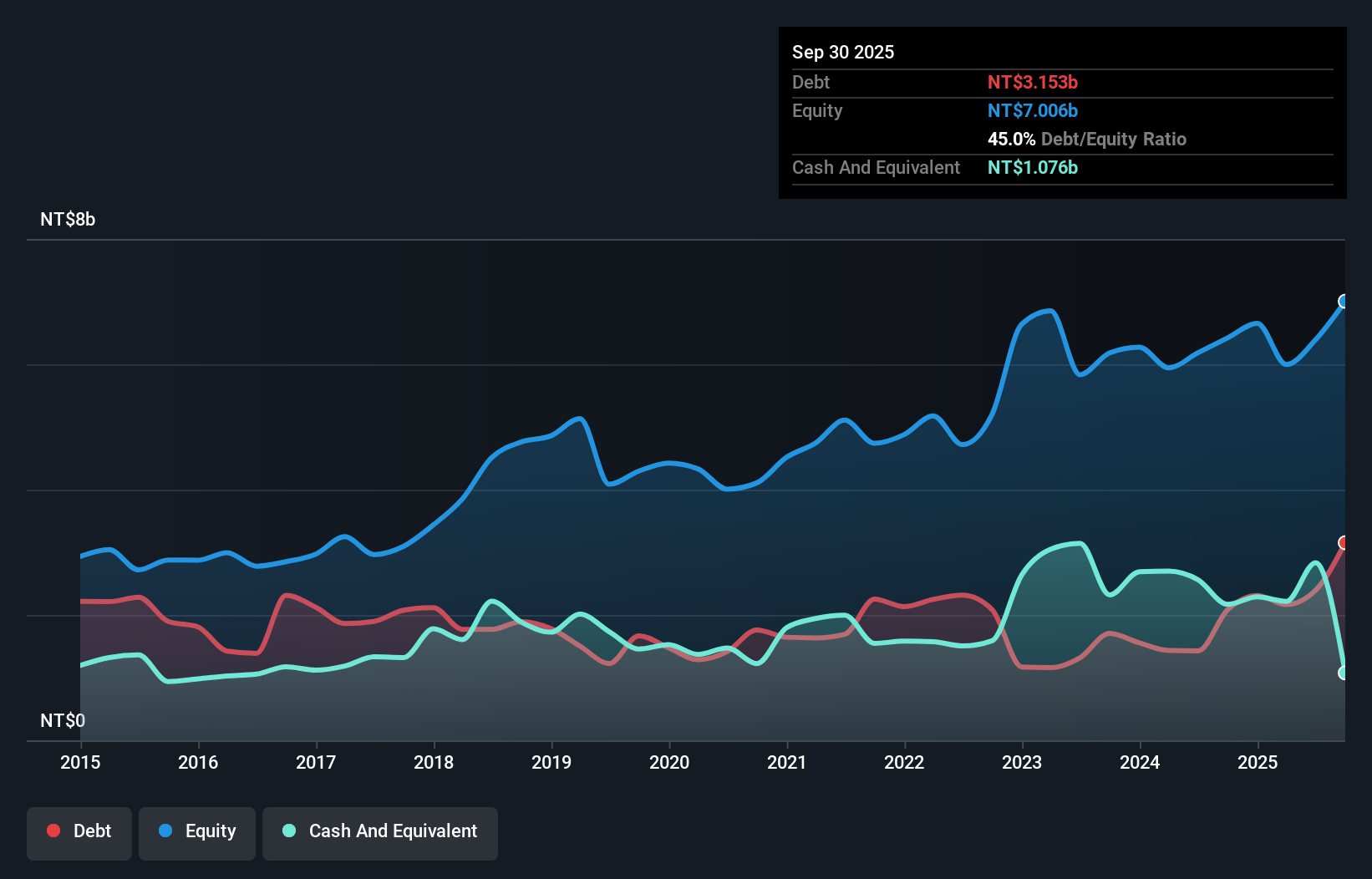

Overview: Nichidenbo Corporation specializes in the global distribution of electronic components with a market capitalization of NT$22.96 billion.

Operations: Nichidenbo generates revenue primarily from Taiwan, contributing NT$16.71 billion, while other regions add NT$856.47 million. The company's net profit margin is an important financial metric to consider when evaluating its profitability.

Nichidenbo, a promising player in the electronics sector, showcases a solid growth trajectory with earnings rising 29.6% over the past year, outpacing the industry average of 6.6%. The company's price-to-earnings ratio stands at 21x, slightly below the industry benchmark of 21.7x, suggesting potential value for investors. Despite an increase in debt to equity from 42.9% to 45% over five years, its net debt to equity remains satisfactory at 29.6%. Recent results highlight robust sales growth to TWD 4 billion for Q3 and net income climbing to TWD 417 million from TWD 260 million year-over-year.

Topoint Technology (TWSE:8021)

Simply Wall St Value Rating: ★★★★★☆

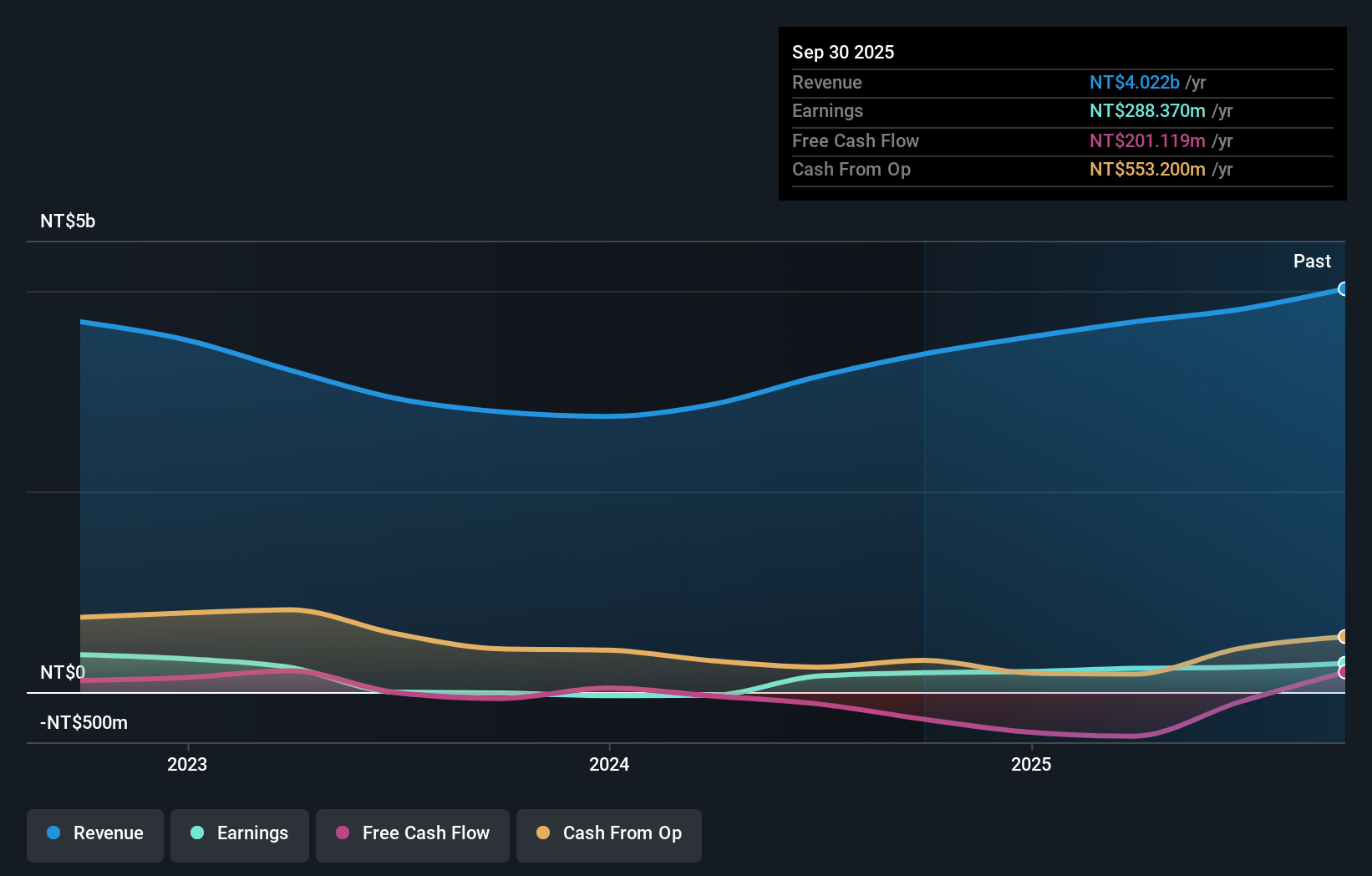

Overview: Topoint Technology Co., Ltd. manufactures and markets micro-drills, numerically controlled drilling machines, and peripheral equipment for printed circuit boards (PCBs) across Taiwan, Mainland China, and internationally with a market capitalization of NT$23.54 billion.

Operations: The company's primary revenue streams are from Taiwan and Mainland China, with Mainland China contributing NT$2.81 billion and Taiwan NT$2.32 billion.

Topoint Technology, a nimble player in the electronics sector, has shown impressive growth with earnings surging 48.8% over the past year, outpacing the industry average of 6.6%. The company reported third-quarter sales of TWD 1.17 billion and net income of TWD 109 million, marking a substantial rise from last year's figures. Despite its small size, Topoint's financial health appears robust; it has more cash than total debt and earns more interest than it pays. However, its debt-to-equity ratio increased to 13.9% over five years, which might warrant attention moving forward as they navigate market volatility.

- Click here to discover the nuances of Topoint Technology with our detailed analytical health report.

Evaluate Topoint Technology's historical performance by accessing our past performance report.

Summing It All Up

- Access the full spectrum of 2496 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal