TerraVest Industries (TSX:TVK) Valuation Check After Strong Q4 and Full-Year Earnings Growth

TerraVest Industries (TSX:TVK) just posted fourth quarter and full year results that turned heads, with revenue and net income climbing sharply year over year, giving investors fresh numbers to rethink the stock’s trajectory.

See our latest analysis for TerraVest Industries.

The earnings beat slots neatly into a strong year for TerraVest, with a 14.75% year to date share price return and a powerful 3 year total shareholder return of 413.30%, suggesting momentum is consolidating after a recent wobble.

If TerraVest’s run has you thinking about what else is working in the market, this could be a good moment to explore fast growing stocks with high insider ownership.

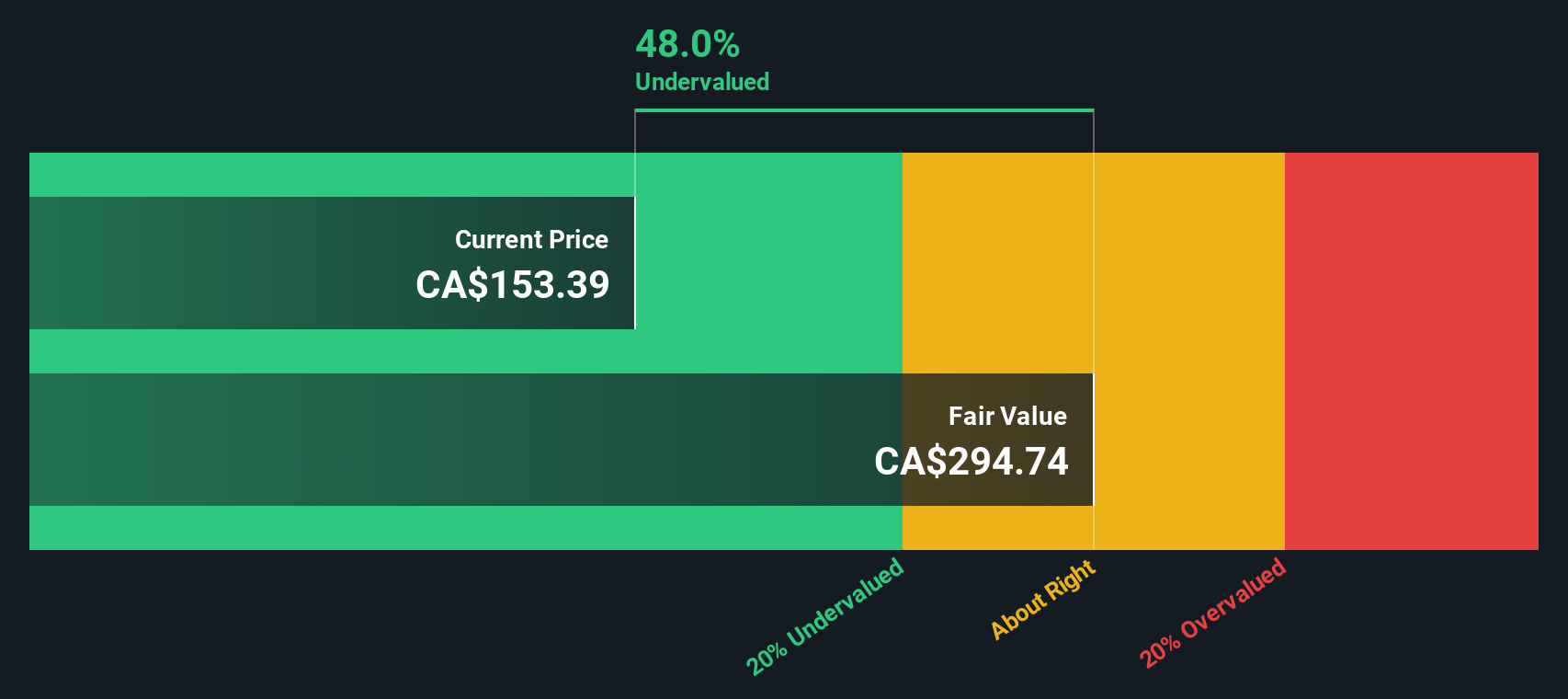

With earnings surging, a sizable intrinsic discount flagged and the share price still lagging its analyst target, the key debate now is simple: is TerraVest undervalued, or is the market already pricing in that future growth?

Price-to-Earnings of 34.8x: Is it justified?

TerraVest’s current share price of CA$128.37 equates to a 34.8x price-to-earnings multiple, placing it well above typical benchmarks and peer valuations.

The price-to-earnings ratio compares what investors pay today with the company’s current earnings. It is a quick gauge of how much growth and profitability the market is factoring into the share price. For an energy services name with accelerating earnings and strong revenue growth, a richer multiple can reflect confidence that those trends will continue rather than fade.

However, TerraVest’s 34.8x multiple stands far above both its direct peer average of 14.2x and the wider North American energy services industry average of 15.7x. This means investors are paying more than double the sector norm for each dollar of earnings. That gap signals the market is aggressively pricing in sustained outperformance, leaving less room for disappointment if growth or margins weaken from here.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 34.8x (OVERVALUED)

However, sharp multiple compression could follow if energy demand softens or if TerraVest’s recent revenue growth slows, which could challenge the market’s lofty expectations.

Find out about the key risks to this TerraVest Industries narrative.

Another Lens, Very Different Answer

While the earnings multiple screams expensive, our DCF model tells a different story, suggesting TerraVest is trading about 59% below its estimated fair value of roughly CA$314 per share. This is a large gap for a stock already priced for quality, so which signal do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TerraVest Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TerraVest Industries Narrative

If you see the picture differently or want to stress test the assumptions yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your TerraVest Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with one opportunity. Put the Simply Wall Street Screener to work and uncover focused ideas that could sharpen your next round of portfolio moves.

- Capture potential mispricings by targeting companies that look cheap on cash flows with these 909 undervalued stocks based on cash flows before the rest of the market catches up.

- Position yourself for structural growth by scanning innovative businesses reshaping automation and data with these 25 AI penny stocks.

- Strengthen your income stream by zeroing in on quality payers using these 12 dividend stocks with yields > 3% to seek yields that work harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal