Assessing J. M. Smucker’s Valuation After Pausing a Coffee Price Hike to Absorb Tariff Costs

J. M. Smucker (SJM) has paused a planned third coffee price increase this year, choosing instead to absorb roughly $75 million in tariff-related costs after green coffee was spared from new U.S. tariffs.

See our latest analysis for J. M. Smucker.

That decision comes after a tough stretch for investors, with a roughly 8 percent 1 year total shareholder return decline and a double digit negative year to date share price return, signaling fading momentum as markets reassess Smucker’s margin profile and growth prospects.

If this kind of defensive move has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential higher growth alternatives.

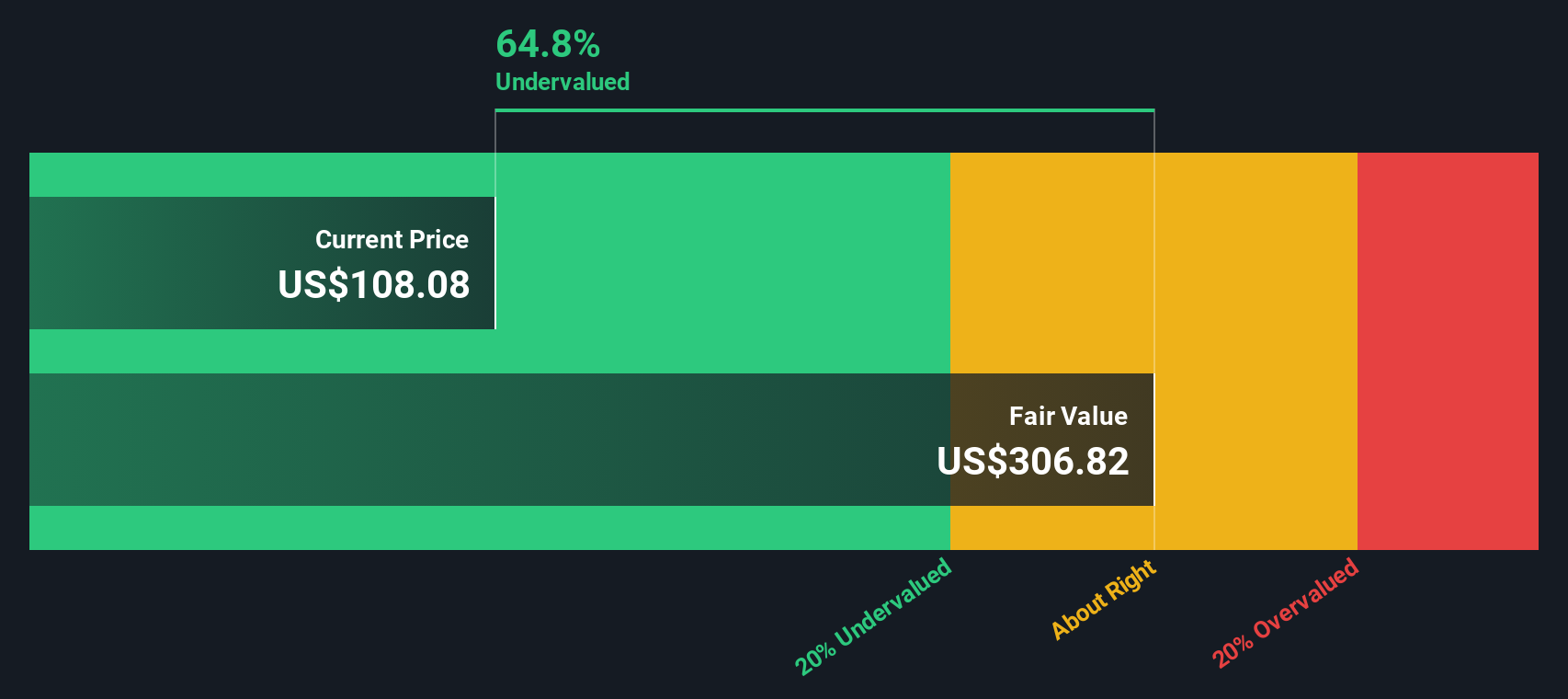

With shares down sharply over three years, yet trading at a hefty intrinsic discount and below analyst targets, is Smucker now a mispriced value story or is the market correctly bracing for weaker margins and slower growth?

Most Popular Narrative: 14.2% Undervalued

Compared with the last close at $99.68, the most followed narrative sees J. M. Smucker’s fair value materially higher, hinging on improving profitability and stable growth.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.2x on those 2028 earnings, up from -8.1x today. This future PE is lower than the current PE for the US Food industry at 19.5x.

Curious how a modest revenue trajectory, rising margins, and a re rated earnings multiple can still point to upside here? The full narrative spells out the math, step by step, using a precise discount rate and detailed profit forecasts. Want to see exactly how those moving parts combine into that higher fair value target?

Result: Fair Value of $116.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent coffee commodity volatility and slower organic sales growth could squeeze margins and derail the earnings recovery that is reflected in that upside case.

Find out about the key risks to this J. M. Smucker narrative.

Another Take On Value

While the narrative sees J. M. Smucker as 14 percent undervalued versus analyst targets, our SWS DCF model is far more optimistic. It suggests the shares trade about 54 percent below a fair value of roughly $215.75. Is the market mispricing long term cash flows, or rightly discounting execution risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own J. M. Smucker Narrative

If you want to stress test these assumptions yourself and dig into the numbers directly, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your J. M. Smucker research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, take a moment to scan the market for fresh opportunities using powerful screeners on Simply Wall St that many investors overlook.

- Capture potential multibaggers early by reviewing these 3607 penny stocks with strong financials that match strong balance sheets and improving fundamentals.

- Ride structural growth trends by focusing on these 30 healthcare AI stocks transforming patient outcomes and hospital efficiency with scalable technology.

- Strengthen your income strategy by targeting these 12 dividend stocks with yields > 3% that combine solid yields with sustainable payout profiles and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal