Is It Too Late To Consider OUTFRONT Media After Its 32% Year To Date Rally?

- If you are wondering whether OUTFRONT Media is still a bargain after its run up, or if you have missed the bus, this breakdown will help you assess whether the current price really makes sense.

- The stock has quietly delivered a 1.6% gain over the last week and 12.9% over the last month. It is now up 31.8% year to date, with a 31.2% gain over the past year hinting that investors are warming up to its story.

- Investor interest has been driven by a mix of strategic moves in its transit and digital billboard footprint, as well as a broader rotation back into income generating real estate names, as yields have looked more compelling for income focused investors. At the same time, renewed attention on outdoor advertising as a complement to digital campaigns has put the sector back on the radar for growth oriented investors.

- Even after this rebound, OUTFRONT Media only scores a 3 out of 6 on our valuation checks. This suggests parts of the market may still be under pricing its cash flows. The key question is which valuation lens tells the most accurate story, and we will finish by looking at a more powerful way to connect those numbers to the long term narrative.

Approach 1: OUTFRONT Media Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes OUTFRONT Media's adjusted funds from operations, projects them into the future, and then discounts those cash flows back to today's dollars to estimate what the business is worth now.

OUTFRONT Media is currently generating about $307.5 million in free cash flow. Analysts expect this to rise to roughly $361.8 million by 2026 and $384.4 million by 2027, with Simply Wall St extrapolating this trend further to around $541.9 million by 2035, as growth gradually tapers over time. All of these figures are in $ and stay comfortably below the billion mark, but the steady climb highlights a solid free cash flow profile.

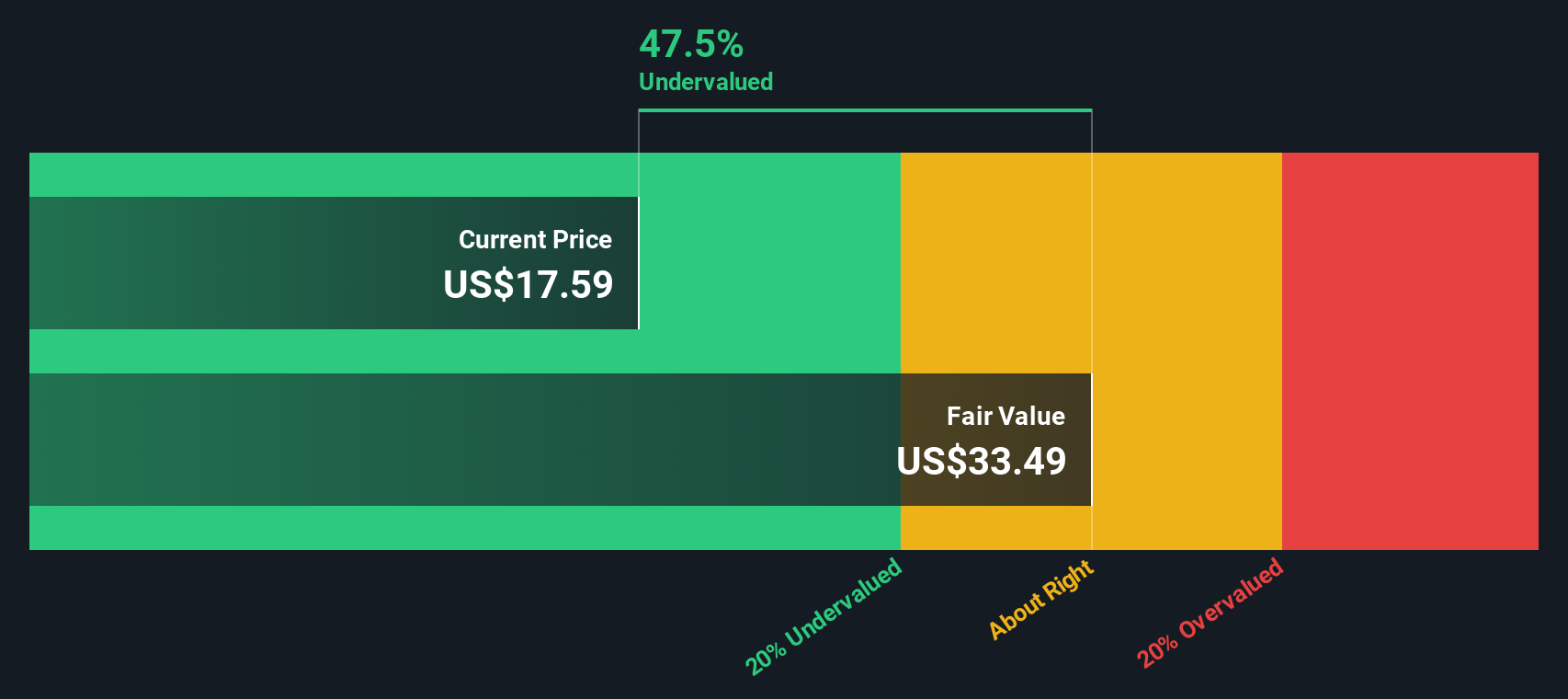

When all projected cash flows over the next decade are discounted back using this 2 stage Free Cash Flow to Equity model, the estimated intrinsic value comes out at about $40.66 per share. Compared with the current share price, this implies the stock is trading at an attractive 41.8% discount, suggesting investors are not fully pricing in the future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests OUTFRONT Media is undervalued by 41.8%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: OUTFRONT Media Price vs Earnings

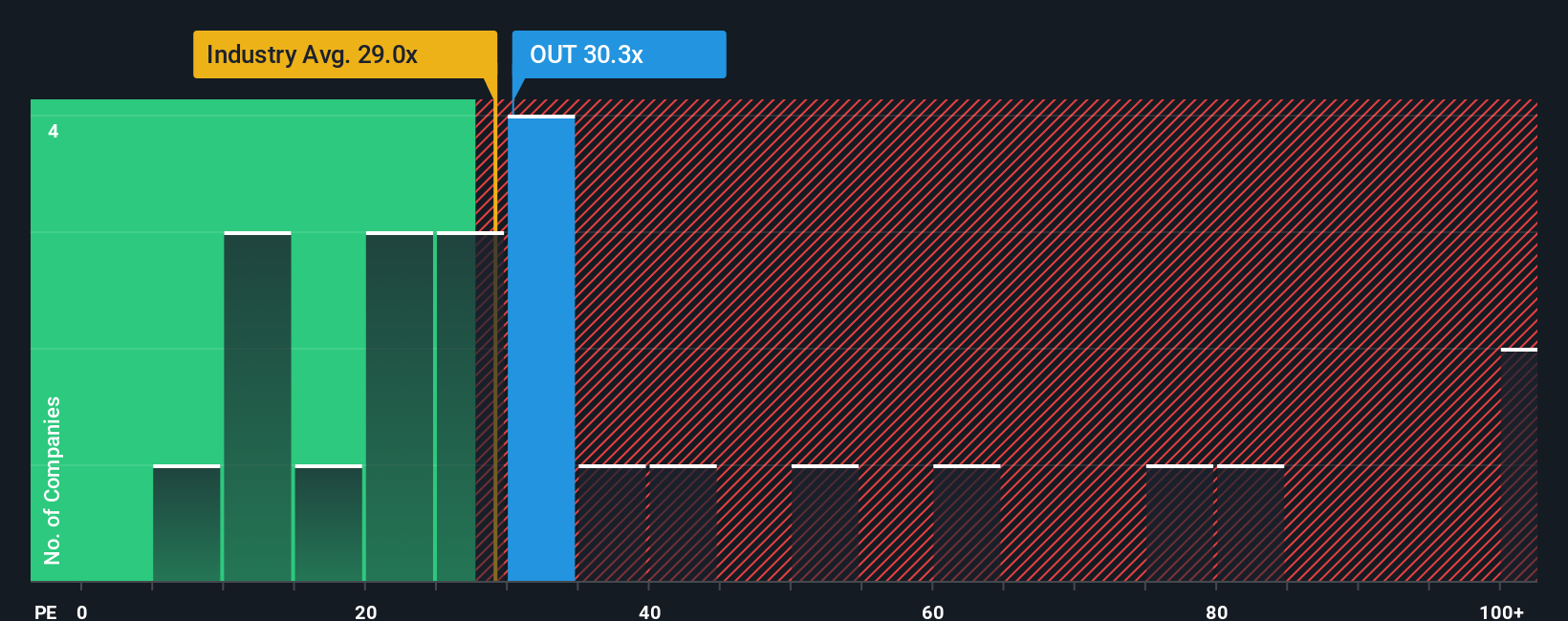

For profitable companies like OUTFRONT Media, the price to earnings, PE, ratio is a useful way to gauge how much investors are paying today for each dollar of current earnings. In general, faster growth and lower risk justify a higher PE, while slower growth or higher uncertainty usually call for a lower, more conservative multiple.

OUTFRONT Media currently trades on a PE of about 34.3x. That is meaningfully richer than both the Specialized REITs industry average of roughly 16.5x and the broader peer group, which sits closer to 22.5x. At first glance, that kind of premium might suggest the market is already baking in a lot of optimism about future earnings growth.

Simply Wall St tackles this by estimating a Fair Ratio, its proprietary view of what a stock’s PE should be once you factor in earnings growth, profit margins, risk profile, industry dynamics and market cap. For OUTFRONT Media, that Fair Ratio comes out around 37.9x, which is higher than where the stock currently trades. On this basis, the premium to peers looks justified, and the share price still appears to leave some upside on the table.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your OUTFRONT Media Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your own story about OUTFRONT Media to the numbers by linking your view of its future revenue, earnings and margins to a financial forecast and, ultimately, a fair value that sits right alongside the current share price on Simply Wall St’s Community page, where millions of investors compare and refine their ideas.

Instead of only relying on static multiples like PE, a Narrative lets you say what you think is really happening with OUTFRONT Media’s digital conversion, transit footprint and competitive pressures. You can turn that into explicit assumptions, and then see a dynamic fair value that updates when new information such as earnings reports or news about AI enabled ad buying comes in. This makes it easier to see whether your fair value is still above or below today’s price and decide if you want to buy, hold or sell.

For example, one investor’s optimistic Narrative might assume faster revenue growth, stronger margins and a higher future PE, leading to a fair value well above the current price. A more cautious Narrative might factor in slower growth, margin pressure and a lower multiple, producing a fair value closer to about $19.50 and suggesting the stock is only slightly undervalued today.

Do you think there's more to the story for OUTFRONT Media? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal