Has Citizens Financial Group’s 34% 2025 Rally Outrun Its Fundamentals?

- If you have been wondering whether Citizens Financial Group is still a bargain after its latest run up, you are not alone. This article is going to unpack exactly what you might be paying for at today’s price.

- The stock has climbed 5.0% over the last week, 11.7% over the past month, and is now up 34.1% year to date, building on a 31.3% 1 year gain and more than doubling investors’ money over 5 years with a 104.4% total return.

- Recent moves have been driven by a mix of improving sentiment toward regional banks and ongoing balance sheet repositioning, as investors look for banks that can handle a higher for longer rate backdrop. At the same time, regulatory headlines around capital requirements and credit quality have kept risk perception front and center, making CFG’s rebound particularly interesting.

- On our framework, Citizens Financial Group currently scores a 3/6 valuation check score, suggesting some areas of undervaluation but not a slam dunk. Next, we will break down what different valuation approaches say about that number, before finishing with a more intuitive way to think about what CFG is really worth.

Approach 1: Citizens Financial Group Excess Returns Analysis

The Excess Returns model looks at how efficiently Citizens Financial Group turns shareholder capital into profits, then values the stock based on the returns it can generate above its cost of equity. Instead of focusing on near term earnings swings, it asks whether the bank can consistently earn more on its equity than investors require as compensation for risk.

For Citizens, the model uses a Book Value of $54.97 per share and a Stable EPS of $4.98 per share, based on weighted future return on equity estimates from 14 analysts. The Average Return on Equity is 8.38%, while the Cost of Equity is $4.18 per share, leaving an Excess Return of $0.81 per share. Analysts also expect Stable Book Value to rise to $59.47 per share, informed by forecasts from 9 analysts.

Combining these inputs, the Excess Returns model estimates an intrinsic value of about $80.96 per share, implying the stock is roughly 27.8% undervalued relative to its current price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Citizens Financial Group is undervalued by 27.8%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Citizens Financial Group Price vs Earnings

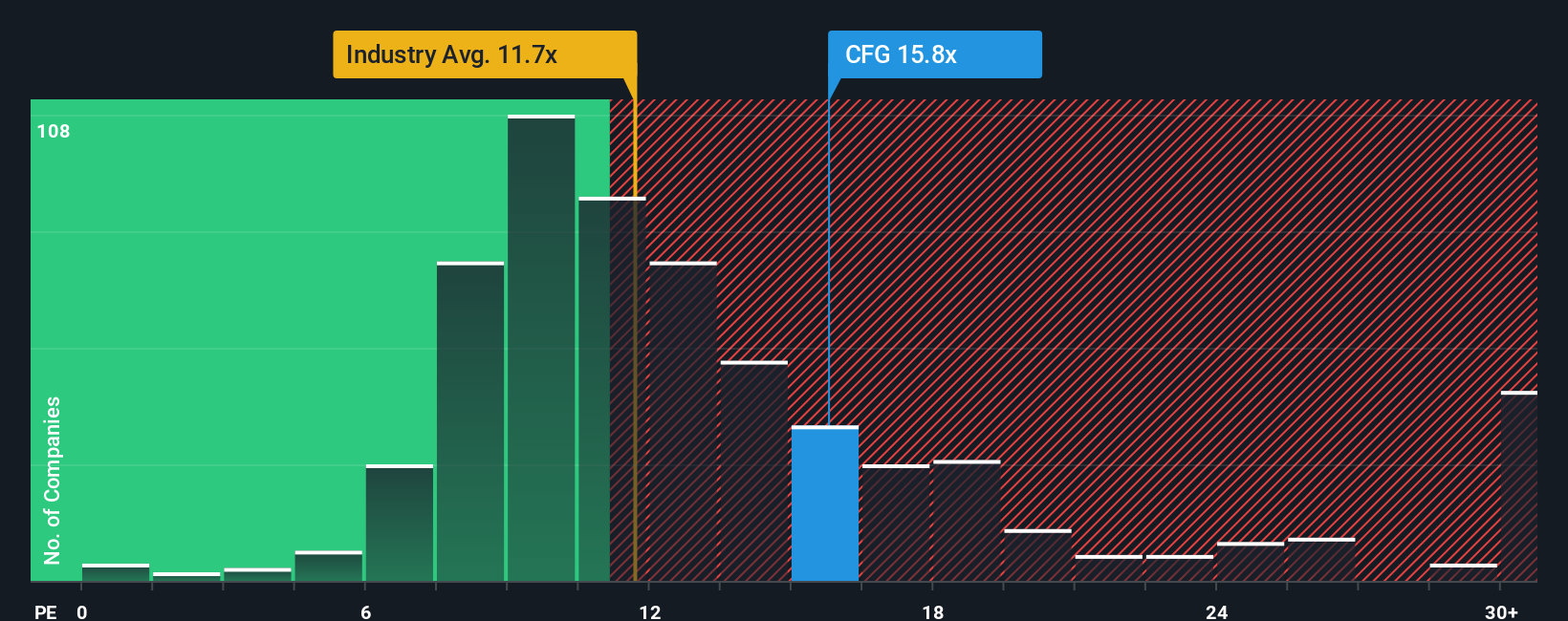

For profitable companies like Citizens Financial Group, the price to earnings (PE) ratio is a practical way to gauge whether the market price makes sense relative to the earnings the business is generating. Investors generally accept that faster growth and lower risk justify a higher normal PE, while slower growth, more cyclical earnings, or elevated risk usually call for a lower multiple.

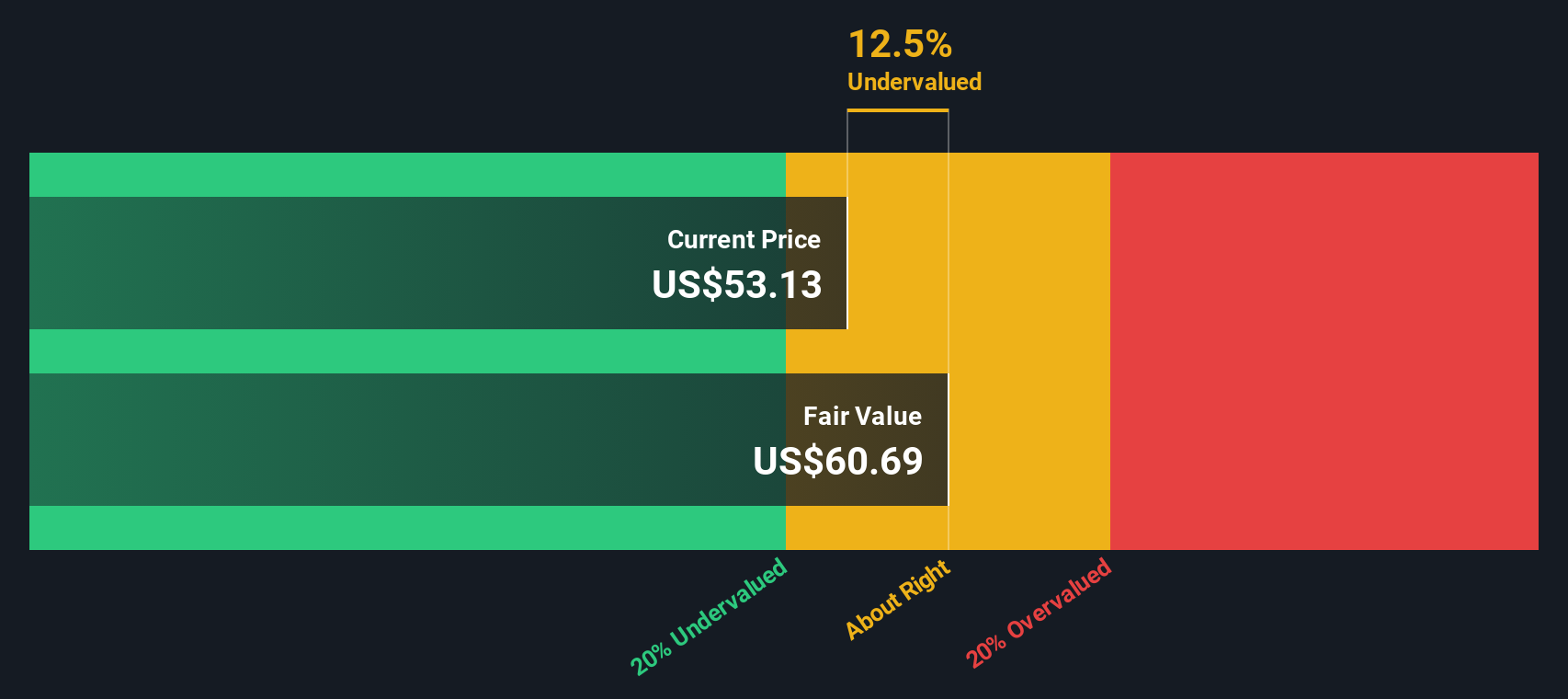

Citizens currently trades on a PE of 16.03x. That is above the broader Banks industry average of 11.90x and also higher than the 12.31x average for its peer group, suggesting the market is already ascribing a premium to its earnings. However, Simply Wall St’s Fair Ratio model, which estimates what PE Citizens should trade on given its growth outlook, profitability, size, industry, and specific risk profile, points to a fair PE of 17.24x.

This Fair Ratio approach is more tailored than a simple peer or industry comparison because it adjusts for Citizens’ unique fundamentals rather than assuming all banks deserve the same multiple. With the current 16.03x PE sitting below the 17.24x Fair Ratio, the stock screens as modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Citizens Financial Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Citizens Financial Group’s story to a set of numbers like future revenue, earnings, margins, and a fair value estimate. A Narrative on Simply Wall St’s Community page lets you spell out why you think Citizens will, for example, benefit from digital investments, deposit mix improvements, and regional expansion, then translates that story into a financial forecast and a fair value that you can compare directly with today’s share price so you can better understand the investment case. Narratives are dynamic, automatically updating as new earnings, dividend changes, lending rate moves, or news arrive, so your fair value view stays in sync with reality instead of going stale. For instance, a bullish Citizens Narrative might assume higher revenue growth, expanding margins, and a fair value closer to the top end of recent targets around $71 per share, while a more cautious Narrative could focus on commercial real estate risk and tighter margins, landing nearer the low end around $51. The platform then helps you see exactly how those different stories drive different valuations.

Do you think there's more to the story for Citizens Financial Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal