Newron Pharmaceuticals (SWX:NWRN): Evaluating Valuation After Launching ENIGMA-TRS 2 Phase III Evenamide Trial

Newron Pharmaceuticals (SWX:NWRN) just hit a key milestone by kicking off its ENIGMA TRS 2 Phase III trial in the US to test Evenamide as an add on therapy for treatment resistant schizophrenia.

See our latest analysis for Newron Pharmaceuticals.

That backdrop helps explain why momentum in Newron’s shares has been building, with a 30 day share price return of 39.41 percent and a 1 year total shareholder return of 157.51 percent, while the 3 year total shareholder return sits above 1,300 percent. This signals that investors are increasingly pricing in Evenamide’s long term potential alongside existing Parkinson’s revenues.

If this kind of clinical milestone has you thinking about the wider sector, it could be a good moment to explore other potential opportunities across healthcare stocks for fresh ideas.

Yet with the shares now hovering just below analyst targets and a value score that still looks attractive, is Newron trading at a discount to its long term pipeline potential, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 16.9% Overvalued

With Newron’s last close near CHF19.88 versus a narrative fair value of CHF17, the valuation gap is narrow but still points to mild optimism.

• 5-Year Revenue Outlook: In a base-case scenario (5 years from now, ~2030), we project Newron’s revenue to expand dramatically compared to today. This assumes Evenamide is approved and launched by 2028, becoming a commercial product for several years by 2030. Given the sizable TRS patient pool (out of ~3.8 million schizophrenia cases in major markets), even a moderate penetration at premium pricing could yield hundreds of millions of euros in annual sales. For context, Newron’s 2024 revenue was €51.4 million, largely from one-time license fees, so a successful Evenamide launch could multiply that figure many times over. In addition, Safinamide’s royalties (currently on the order of single-digit millions) may continue, though likely flat or declining as patents expire in the late 2020s. Analysts are already forecasting robust top-line growth (on the order of approximately 35 to 40% annually) for Newron, reflecting expectations that Evenamide will drive revenues markedly higher by 2030. Under these assumptions, we anticipate Newron’s revenue in five years could reach the high tens or even low hundreds of millions (EUR), assuming successful product rollout and market uptake.

Want to see how this narrative stretches today’s modest sales into a far larger business? The real twist lies in its revenue curve, margin leap, and the earnings multiple it believes Newron can command. Curious which assumptions do the heavy lifting, and how they turn clinical hopes into that fair value tag?

Result: Fair Value of $17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, pivotal Evenamide trial setbacks or renewed financing stress could quickly unwind today’s optimism and force a sharp reset of Newron’s valuation narrative.

Find out about the key risks to this Newron Pharmaceuticals narrative.

Another View on Valuation

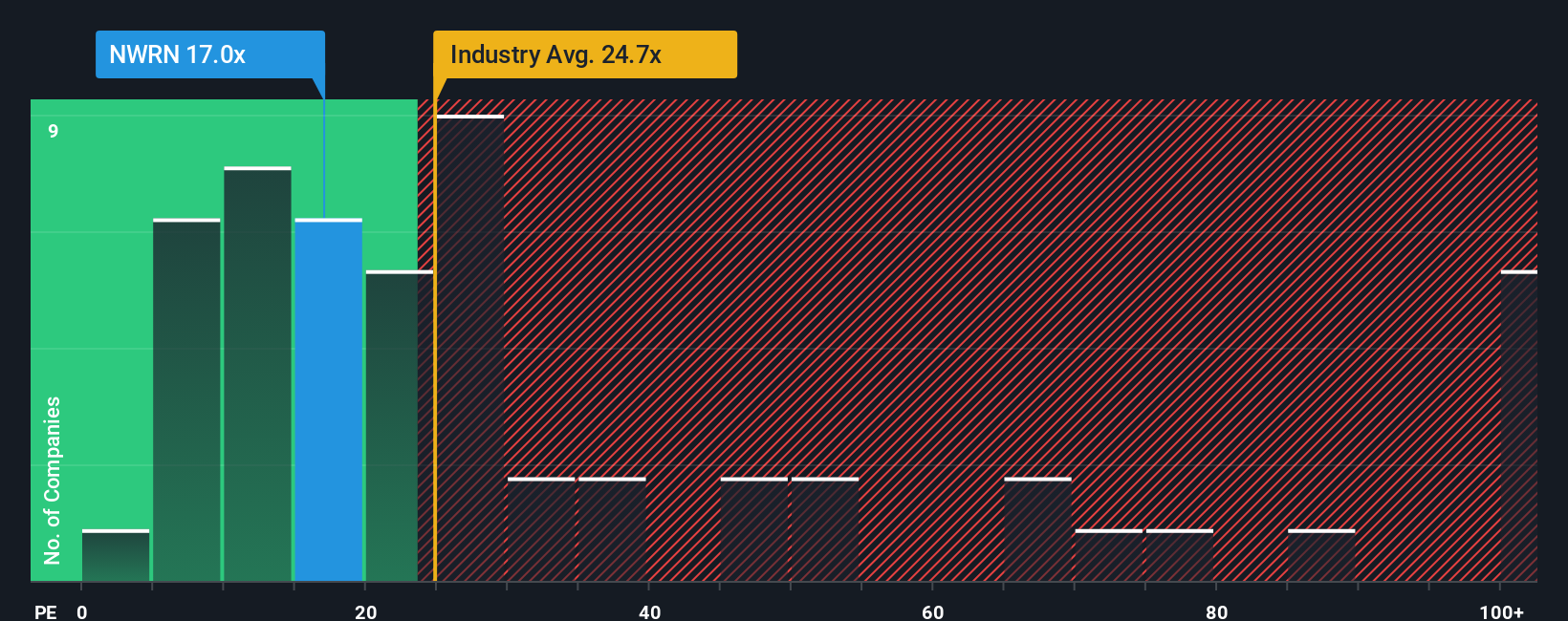

On earnings based multiples, Newron looks far cheaper than it first appears. It trades on about 16.8 times earnings, compared with roughly 24.7 times for the wider European pharma sector and 52.3 times for close peers, while our fair ratio sits higher at 25.6 times.

That gap suggests the market is still heavily discounting execution and balance sheet risk despite rapid forecast growth and newly positive profits. Investors must decide whether this represents a margin of safety or a warning sign if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Newron Pharmaceuticals Narrative

If your view differs or you would rather rely on your own analysis, you can quickly build a personalised forecast and story in under three minutes: Do it your way.

A great starting point for your Newron Pharmaceuticals research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at one opportunity. Unlock a broader watchlist by using the Simply Wall St Screener to uncover fresh ideas before the crowd notices them.

- Capture early-stage momentum by scanning these 3602 penny stocks with strong financials that pair smaller market caps with robust financial underpinnings.

- Position yourself at the forefront of automation by reviewing these 26 AI penny stocks shaping everything from data analytics to intelligent software platforms.

- Assess income-focused opportunities by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal