What Delta Air Lines (DAL)'s Renewed Wall Street Optimism Means For Shareholders

- In recent weeks, Delta Air Lines has drawn renewed attention from Wall Street as BMO Capital and other firms initiated or reiterated positive coverage, citing improving airline fundamentals, resilient travel demand, and Delta’s strong operational performance despite earlier disruptions from a federal government shutdown and FAA-mandated capacity cuts.

- Analysts now highlight Delta’s mix of premium services, loyalty economics, and diversified revenue streams as a key differentiator within U.S. airlines, pointing to its strong partnership with American Express and expanding cargo and international networks as material supports for its long-term positioning.

- Against this backdrop of upbeat analyst coverage and strengthening demand indicators, we’ll examine how this supports Delta’s investment narrative around margin resilience and premium growth.

Find companies with promising cash flow potential yet trading below their fair value.

Delta Air Lines Investment Narrative Recap

To own Delta today, you need to believe that its premium, loyalty and international strengths can offset cyclical hits to main cabin and corporate travel. The latest wave of positive analyst coverage, including BMO’s new “Outperform” rating, reinforces confidence in margin resilience, but does not materially change the near term tug of war between healthy travel demand and sector pressures from fuel, labor and regulatory driven capacity cuts.

Among recent developments, Delta’s consistent earnings beats and improved profitability, capped by Q3 2025 results where revenue and EPS came in ahead of expectations, stand out as most relevant. That track record underpins current analyst optimism and ties directly into the key catalyst of protecting margins and free cash flow through disciplined capacity, premium mix and loyalty economics, even as external shocks like the government shutdown temporarily weigh on operations.

But while the story around premium demand looks appealing, investors should also be aware of the growing risk that weaker domestic and main cabin trends could...

Read the full narrative on Delta Air Lines (it's free!)

Delta Air Lines' narrative projects $68.4 billion revenue and $4.6 billion earnings by 2028. This requires 3.4% yearly revenue growth and a modest $0.1 billion earnings increase from $4.5 billion today.

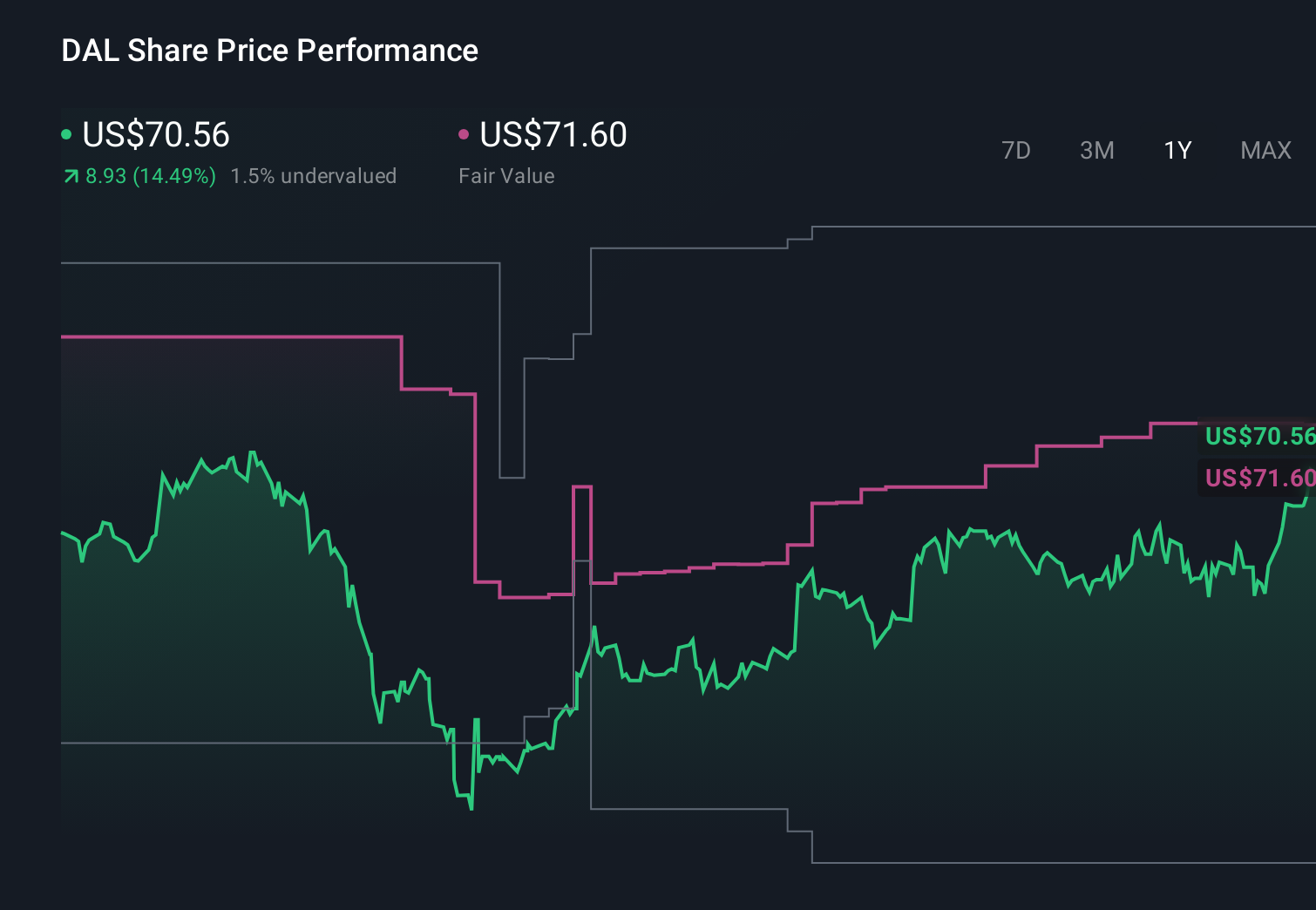

Uncover how Delta Air Lines' forecasts yield a $71.60 fair value, in line with its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$40.57 to US$140.23, showing how far apart individual views of Delta’s worth can be. When you set those against the current focus on protecting margins and free cash flow through tight capacity and premium growth, it underlines why many readers choose to compare several independent viewpoints before forming an opinion on Delta’s longer term performance.

Explore 9 other fair value estimates on Delta Air Lines - why the stock might be worth over 2x more than the current price!

Build Your Own Delta Air Lines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delta Air Lines research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Delta Air Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delta Air Lines' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal