Astellas Pharma (TSE:4503) Valuation Check as New XOSPATA AML Data Heads to ASH Meeting

Astellas Pharma (TSE:4503) is back in the spotlight as it prepares to unveil fresh XOSPATA clinical data at the American Society of Hematology meeting, a catalyst investors watch closely for clues on future leukemia revenue.

See our latest analysis for Astellas Pharma.

That backdrop of fresh XOSPATA data lands just as momentum has been rebuilding in the stock, with a 30 day share price return of 14.41 percent helping drive a 1 year total shareholder return of 36.03 percent and signalling improving sentiment after a more modest three year total shareholder return of 7.03 percent.

If XOSPATA has you thinking more broadly about oncology opportunities, it could be worth exploring other healthcare stocks that are starting to catch the market’s attention.

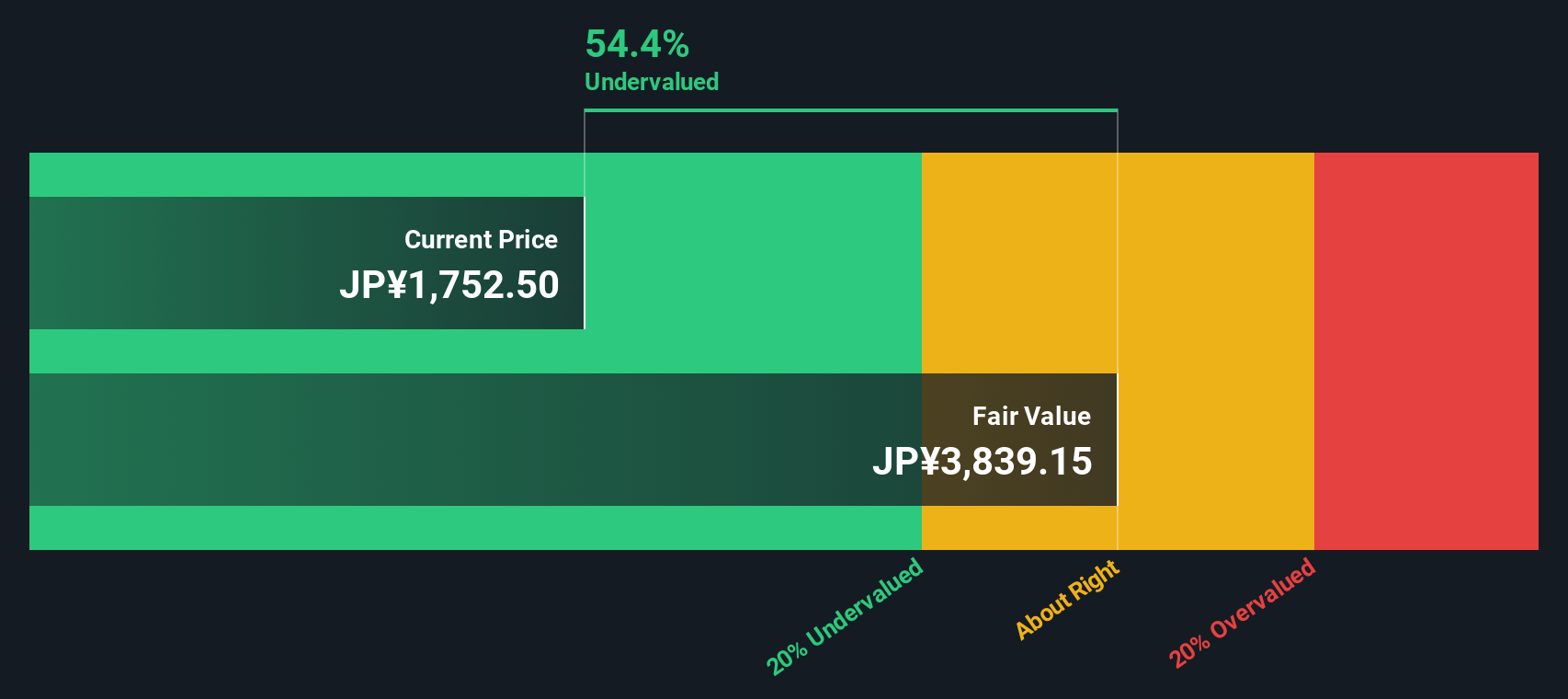

With shares already outpacing the broader market but trading at a sizeable discount to some intrinsic value estimates, investors now face a key question: is Astellas still an underappreciated oncology player, or is future growth already in the price?

Most Popular Narrative Narrative: 14.3% Overvalued

With Astellas shares closing at ¥2,048.5 against a narrative fair value of ¥1,792.14, the story leans toward optimism that the market is pricing ahead of fundamentals.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.1x on those 2028 earnings, down from 36.5x today. This future PE is greater than the current PE for the JP Pharmaceuticals industry at 16.0x.

Curious what kind of earnings ramp and margin rebuild could bridge that gap, and why it still assumes a richer multiple than peers? The full narrative unpacks the aggressive growth path and valuation stretch point by point, in numbers the market is quietly leaning on.

Result: Fair Value of ¥1,792.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pricing pressure or faster than expected erosion of XTANDI and other key brands could quickly challenge the optimistic growth assumptions that underpin this narrative.

Find out about the key risks to this Astellas Pharma narrative.

Another View: Market Ratios Tell a Different Story

While the narrative model flags Astellas as 14.3 percent overvalued, the SWS DCF model paints the opposite picture, suggesting the shares are trading around 50.5 percent below its estimated fair value of ¥4,141.75. Is the market underestimating long term cash generation, or instead placing too much weight on nearer term narrative risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Astellas Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Astellas Pharma Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a fresh, personalised view in minutes: Do it your way.

A great starting point for your Astellas Pharma research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover fresh ideas that match your strategy before the market fully catches on.

- Capture future growth potential by targeting these 26 AI penny stocks that could transform entire industries with rapid adoption and scalable business models.

- Strengthen your passive income plan by focusing on these 12 dividend stocks with yields > 3% that may support recurring cash flows through changing market cycles.

- Hunt for mispriced opportunities using these 907 undervalued stocks based on cash flows that the market has not yet fully recognised in their cash flow prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal