Assessing Amcor (NYSE:AMCR)’s Valuation After Its Recent Share Price Decline

Amcor (AMCR) has quietly slipped about 3% over the past week and remains down roughly 12% this year, even as revenue and net income continue to grow. This sets up an interesting value debate.

See our latest analysis for Amcor.

At around $8.20, Amcor’s 1 year to date share price return of negative 12.3% and 1 year total shareholder return of negative 13.4% signal fading momentum, even as earnings growth nudges sentiment rather than transforms it.

If you like the steady cash generation story but want more market excitement, this could be a good time to explore fast growing stocks with high insider ownership.

With earnings still climbing, a solid dividend, and the shares trading at a sizeable discount to analyst targets, is Amcor now a quietly mispriced cash machine, or is the market already discounting its future growth?

Most Popular Narrative Narrative: 21.2% Undervalued

With Amcor last closing at $8.20 and the most followed narrative pointing to fair value around $10.41, the gap rests on ambitious execution.

The integration of Berry Global with Amcor is expected to yield $650 million in synergies by fiscal 2028 (with $260 million in fiscal 2026), primarily through cost reduction, procurement optimization, and operational efficiencies, which should support sustained EPS and margin expansion.

Curious how cost savings, rising margins and faster profit growth translate into that higher value range? The narrative leans on bold, compounding upgrades to revenue, earnings and profitability. Want to see exactly how those moving parts stack up, year by year, to support a richer future valuation multiple and a meaningfully higher fair value?

Result: Fair Value of $10.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubborn volume weakness and elevated leverage could easily derail the synergy story, forcing harsher portfolio actions and delaying any valuation re-rating.

Find out about the key risks to this Amcor narrative.

Another Lens On Value

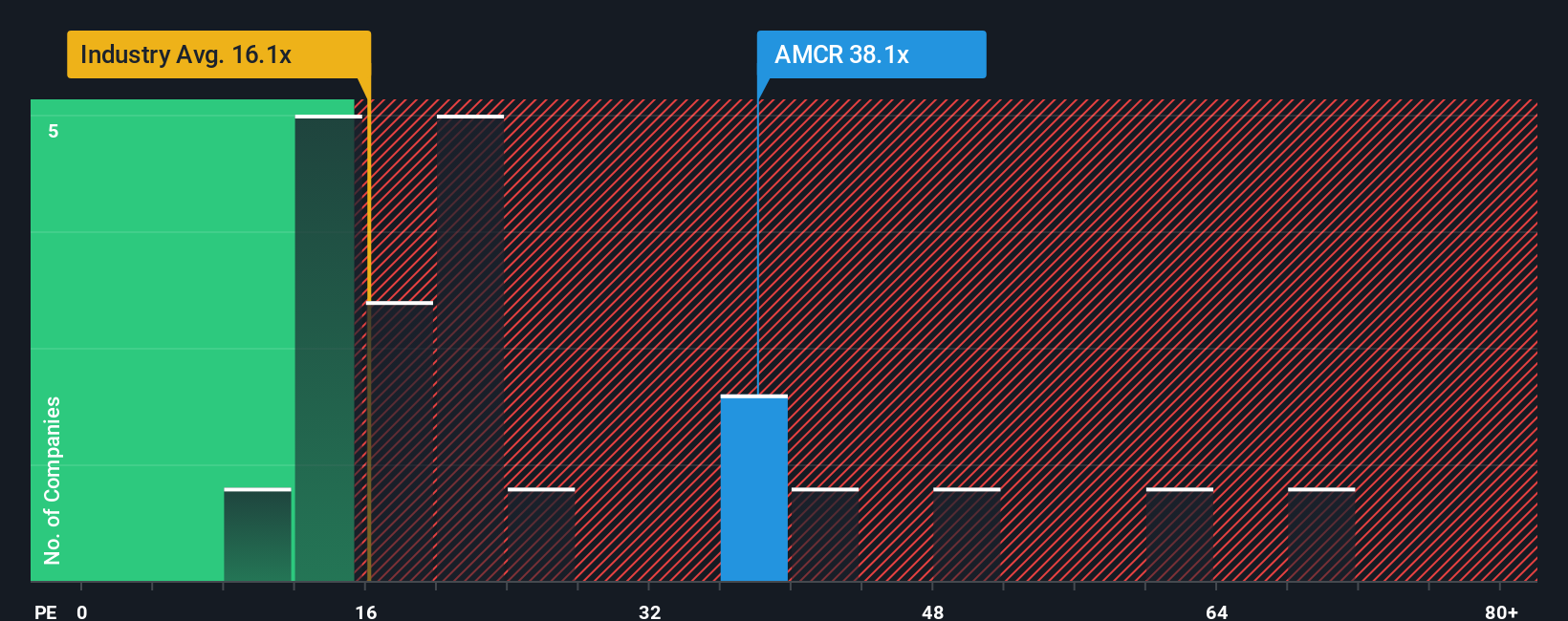

On multiples, the picture is much harsher. Amcor trades on about 32.5 times earnings, well above the North American packaging average of 19 times and our fair ratio of 24.7 times, which suggests the shares could actually be priced for disappointment if growth underwhelms.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amcor Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, make sure you are not leaving potential returns on the table by ignoring other opportunities that match your strategy on Simply Wall St.

- Capture potential mispricings by targeting companies trading below their intrinsic value with these 907 undervalued stocks based on cash flows that may be poised for a rerating.

- Position yourself for the next wave of innovation by focusing on future-facing businesses shaping tomorrow through these 26 AI penny stocks.

- Strengthen your income stream by uncovering reliable payers through these 12 dividend stocks with yields > 3% that offer attractive yields and consistent distributions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal