Can Freshpet’s 55% Slide and Growth Plans Justify Today’s Price in 2025?

- If you are wondering whether Freshpet is finally a bargain after its big slide, or if it is a value trap in disguise, this breakdown will help you assess whether the current share price makes sense.

- The stock has moved around lately, up about 2.7% over the last week and 15.3% over the past month, but it is still down roughly 55.8% year to date and 56.4% over the last year. This naturally raises questions about whether sentiment has swung too far.

- Recent headlines have focused on Freshpet's ongoing investments in production capacity and marketing to capture more of the refrigerated pet food market, along with management's continued push to scale operations in major retail channels. At the same time, analysts and commentators have been debating whether these growth initiatives can translate into sustained profitability quickly enough to justify the current valuation.

- Right now Freshpet scores just 0/6 on our valuation checks. This means none of our standard metrics flag it as obviously undervalued. Below, we walk through what different valuation models say about the stock and then finish with a more holistic way to judge its true worth beyond the numbers alone.

Freshpet scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Freshpet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. For Freshpet, the model used is a 2 Stage Free Cash Flow to Equity approach that starts with the company’s latest twelve month free cash flow of roughly $75.5 Million in the red, then assumes improving cash generation as the business scales.

Analysts provide explicit forecasts out to 2027, where free cash flow is expected to reach about $75 Million. Beyond that, Simply Wall St extrapolates a gradual growth path, with projected free cash flow rising to around $94.6 Million by 2035, all in $. These future cash flows are then discounted back using an appropriate required return to arrive at an estimate of what the equity is worth per share today.

On this basis, the DCF model produces an intrinsic value of about $39.42 per share, implying the stock is roughly 61.9% overvalued relative to the current market price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Freshpet may be overvalued by 61.9%. Discover 907 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Freshpet Price vs Earnings

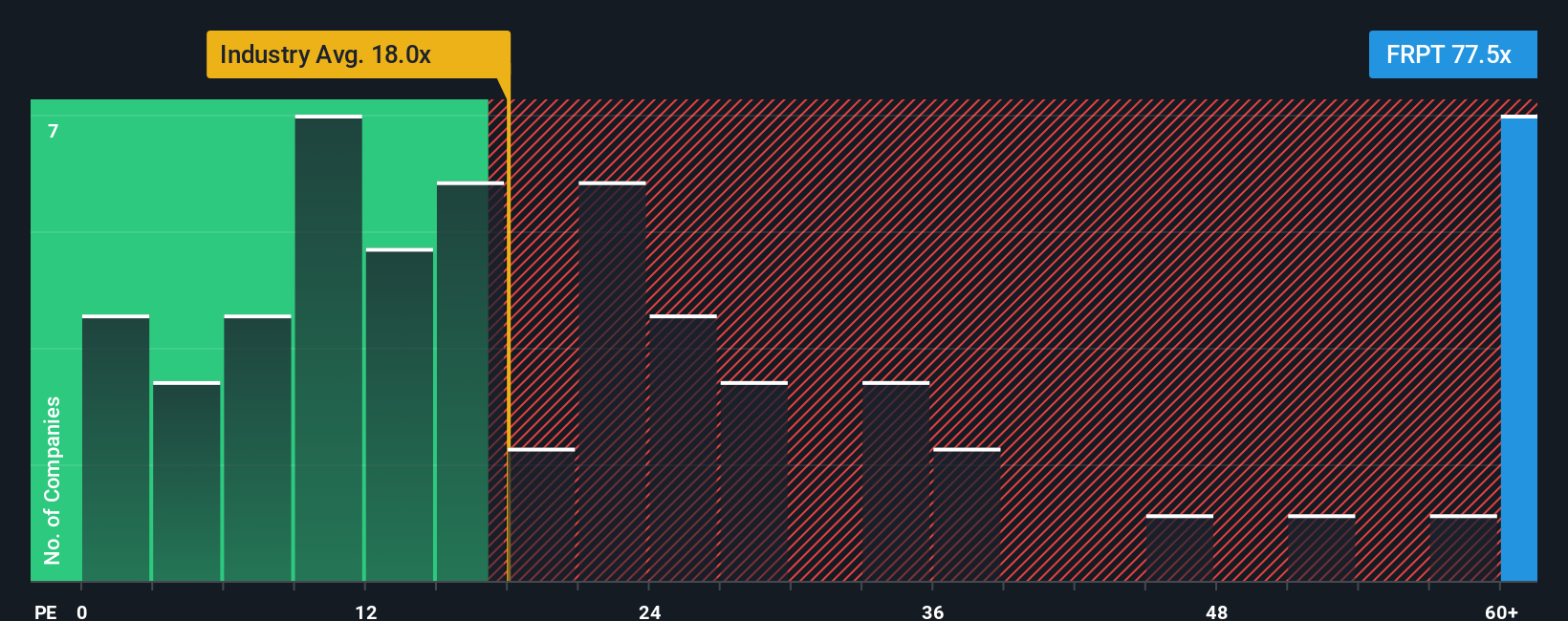

For companies that are generating profits, the price to earnings, or PE, ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. It naturally links a company’s valuation to the profits it is already producing, which makes it a practical reality check alongside more theoretical models like a DCF.

What counts as a normal or fair PE depends heavily on growth prospects and risk. Faster growing, more resilient businesses can usually justify a higher PE, while slower growing or riskier names typically deserve a discount. Freshpet currently trades on a PE of about 25.2x, which is above both the Food industry average of roughly 21.3x and the peer average of around 17.4x. This implies investors are already paying a premium multiple for its earnings.

Simply Wall St’s Fair Ratio framework refines this comparison by estimating the PE you might reasonably expect for Freshpet given its specific earnings growth outlook, industry, profit margins, size and risk profile. This produces a Fair Ratio of about 15.4x, which is well below the current 25.2x. On this basis, even after accounting for its growth and characteristics, the stock still looks meaningfully expensive.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

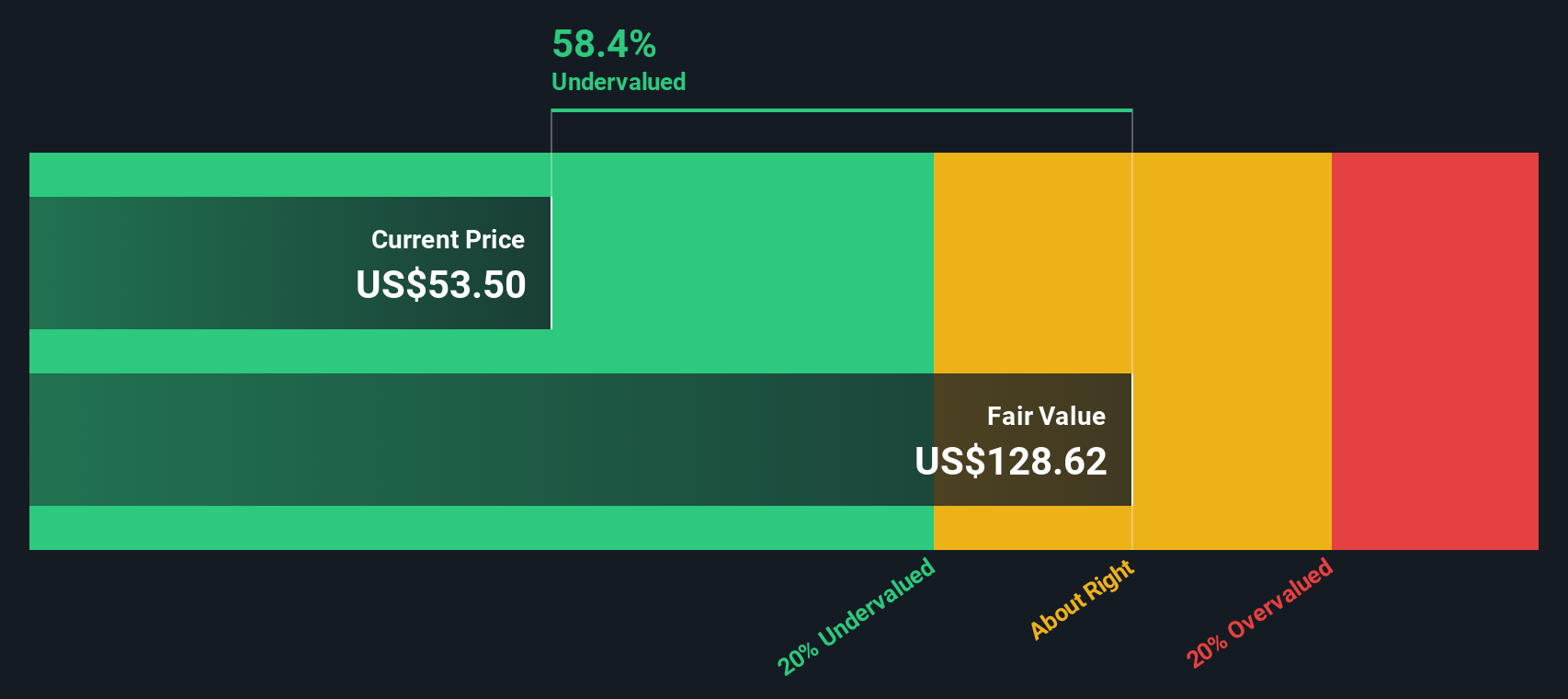

Upgrade Your Decision Making: Choose your Freshpet Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to attach your own story about Freshpet to the numbers by linking what you believe about its future revenue, earnings and margins to a financial forecast and then to a fair value estimate. All of this is available within an easy tool on Simply Wall St’s Community page that millions of investors already use to compare Fair Value against the current share price, see that Narratives automatically update as new news or earnings arrive, and explore how a bullish investor who thinks Freshpet will grow faster and prefers something closer to the top analyst target of about $116 per share will naturally build a very different Narrative from a more cautious investor who leans toward the lower end near $48 per share, even though both are using the same framework to decide whether to buy, hold or sell based on how their Fair Value compares to today’s market price.

Do you think there's more to the story for Freshpet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal