Hims & Hers Health (HIMS): Reassessing Valuation After Recent Share Price Pullback

Hims & Hers Health (HIMS) has been on a bumpy ride lately, sliding about 8% over the past month and roughly 27% in the past 3 months, even as its longer term performance stays solid.

See our latest analysis for Hims & Hers Health.

Even after that pullback, the share price is still up strongly on a year to date basis. The multi year total shareholder return points to investors steadily pricing in Hims & Hers Health’s growth runway.

If Hims & Hers Health has you thinking about where healthcare demand is heading next, it is worth exploring other potential beneficiaries across healthcare stocks to spot your next idea.

Yet with shares still up strongly this year and trading below analyst targets and some intrinsic value estimates, investors face a key question: Is Hims & Hers Health undervalued today, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 56% Undervalued

Compared to the last close at $37.88, the narrative from BlackGoat points to a far higher long term value, implying substantial upside if its projections play out.

Using a DCF model:

• Revenue CAGR: ~29% through 2030

• Net profit margins: Expanding toward 15%

• WACC: 8%, Terminal growth: 3%

We estimate a fair value of $114/share.

Curious how a fast scaling telehealth platform, rising profitability, and an aggressive future earnings multiple combine to justify that price tag? The narrative breaks down the growth runway, margin expansion, and long term cash flow assumptions underpinning this target. However, the real pivot point is how long those high growth dynamics can last before maturity kicks in.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory scrutiny around GLP 1 prescribing and any renewed fallout with major pharma partners could quickly undermine today’s optimistic valuation assumptions.

Find out about the key risks to this Hims & Hers Health narrative.

Another Lens on Value: Earnings Multiple Risk

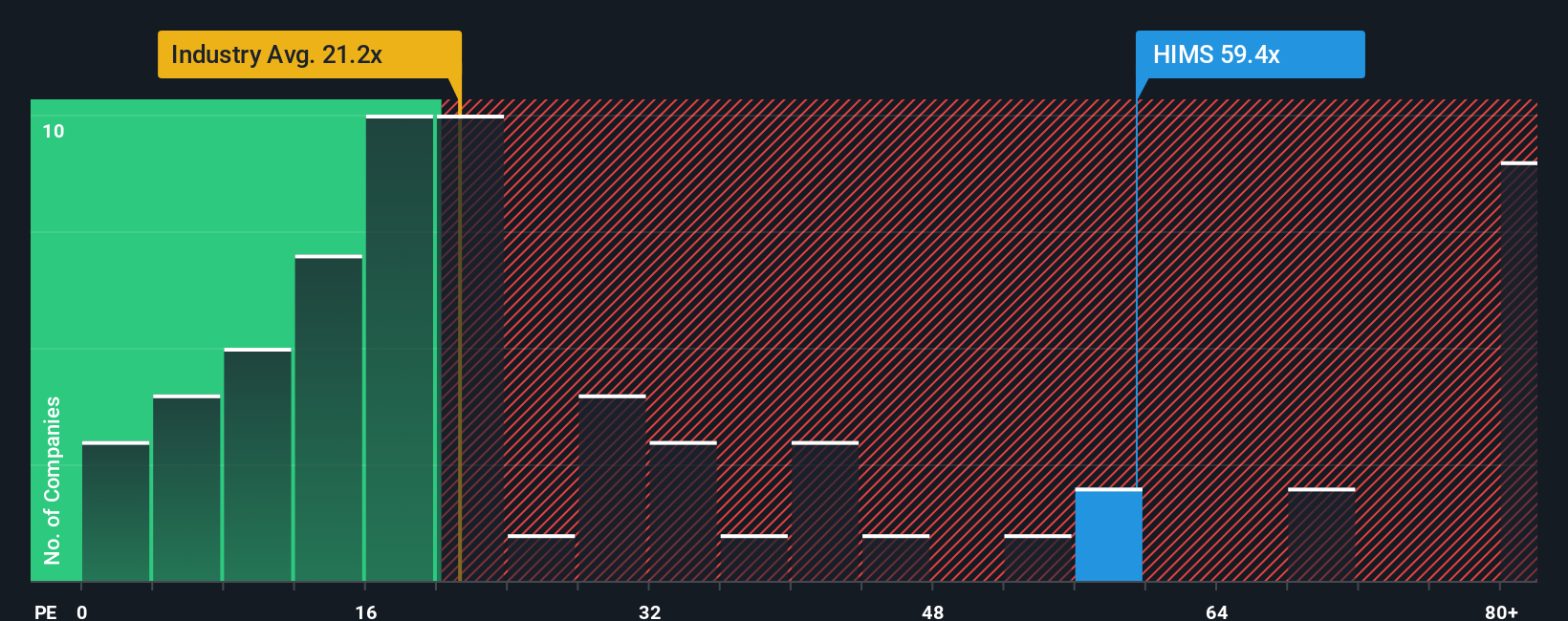

Looking beyond the DCF brings a more complex picture into focus. At about 64.5 times earnings, Hims & Hers Health trades at nearly triple the US healthcare industry average of 23.3 times and well above the 42.3 times fair ratio our models suggest. This gap highlights meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hims & Hers Health Narrative

If you see the numbers differently or want to test your own assumptions, you can build a personalized Hims & Hers Health thesis in minutes, Do it your way.

A great starting point for your Hims & Hers Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put your research momentum to work by scanning fresh opportunities that match your style instead of settling for the obvious names.

- Capture potential bargains early by reviewing these 907 undervalued stocks based on cash flows that our models flag as mispriced relative to their cash flow strength.

- Ride powerful tech tailwinds by targeting these 26 AI penny stocks positioned at the forefront of real world artificial intelligence adoption.

- Boost your income strategy by focusing on these 12 dividend stocks with yields > 3% that can strengthen total returns with meaningful cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal