Assessing Las Vegas Sands' Valuation After Strong Q3 2025 Earnings Beat and Sector Outperformance

Las Vegas Sands (LVS) just topped expectations in its third quarter, with revenue up about 24% year over year and adjusted EPS jumping more than 75%, helped by standout strength at Marina Bay Sands.

See our latest analysis for Las Vegas Sands.

Even after that earnings beat, Las Vegas Sands shares trade around $66.47, with a roughly 21.5% 90 day share price return and a 24.7% one year total shareholder return. This suggests positive momentum as investors reassess growth in Asia focused resorts despite rising short interest and recent insider selling.

If this kind of rebound story has your attention, it is a good time to see what else is setting up for growth and discover fast growing stocks with high insider ownership

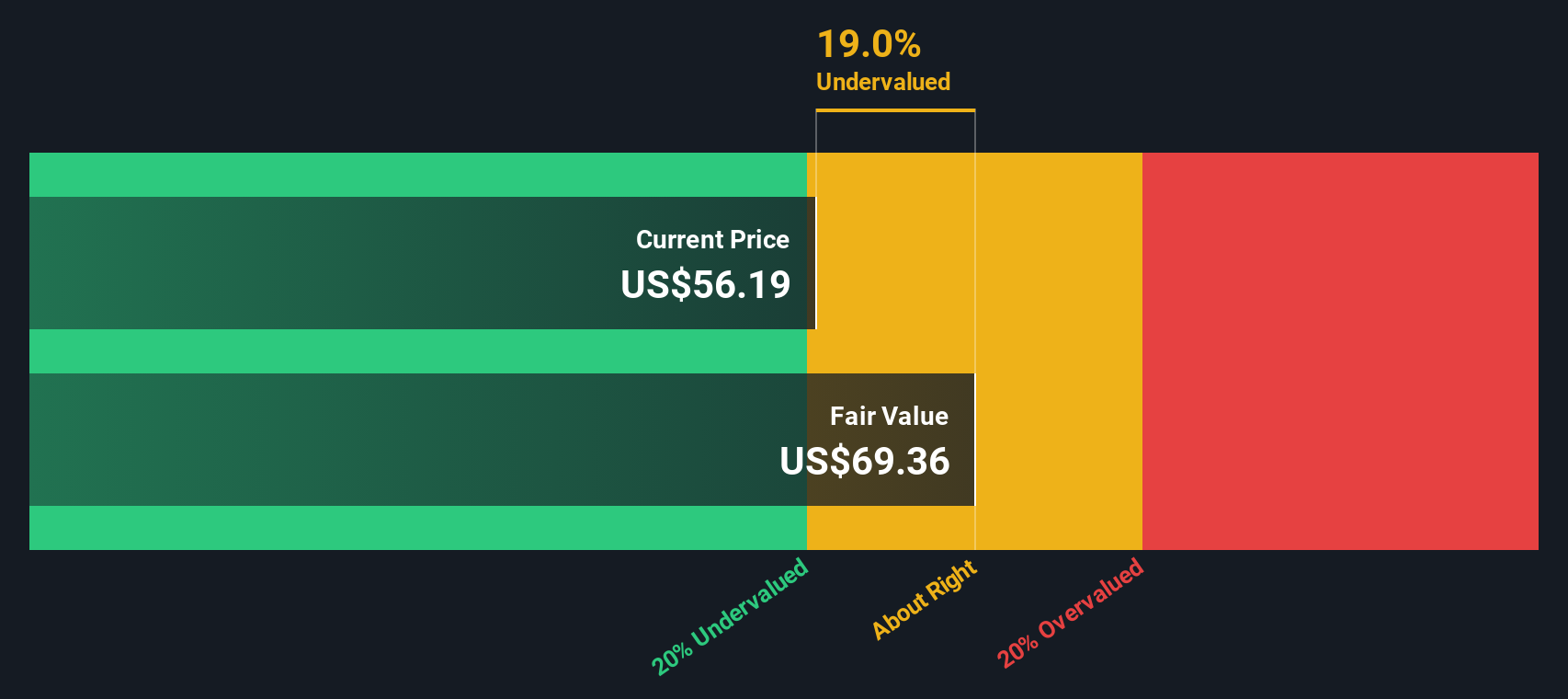

Yet despite those gains, shares still trade at a steep discount to some fair value estimates. This raises a key question: Is Las Vegas Sands quietly undervalued, or are markets already pricing in every leg of its Asia centric growth?

Most Popular Narrative Narrative: 1% Overvalued

Compared with the latest close at $66.47, the most followed narrative sees fair value at about $65.85, implying only a modest valuation gap.

The analysts have a consensus price target of $59.9 for Las Vegas Sands based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $73.5, and the most bearish reporting a price target of just $50.0.

Want to see how steady mid single digit growth, rising margins and a slimmer share count can support today’s price, even with a lower future multiple? Click through.

Result: Fair Value of $65.85 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer Macau visitation and rising competition in premium mass could still undermine recovery assumptions and challenge the earnings power behind this narrative.

Find out about the key risks to this Las Vegas Sands narrative.

Another Lens on Value

While the consensus narrative has Las Vegas Sands just 1% over fair value, our DCF model presents a different view, indicating the shares may be almost 50% undervalued. If future cash flows are even close to those assumptions, is the current price a ceiling, or simply a checkpoint?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Las Vegas Sands for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Las Vegas Sands Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way

A great starting point for your Las Vegas Sands research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by scanning focused stock lists built from real fundamentals and trends, not hype or headline noise.

- Capture potential multi baggers early by targeting overlooked businesses with strong balance sheets using these 3602 penny stocks with strong financials.

- Capitalize on the AI revolution as it reshapes industries by zeroing in on these 26 AI penny stocks.

- Strengthen your portfolio’s backbone with reliable cash generators uncovered through these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal