Will Director William Fisher’s US$10.8 Million Share Sale Reshape Gap's (GAP) Turnaround Narrative?

- In early December 2025, an SEC filing revealed that long-time Gap director and major shareholder William Sydney Fisher sold 400,000 shares worth US$10.8 million.

- This insider move comes as Gap is ramping up brand collaborations like its new Summer Fridays collection and investing heavily in AI-enhanced supply chain efficiency and marketing to support its turnaround efforts.

- We’ll now examine how Fisher’s sizable share sale interacts with Gap’s ongoing brand revival and efficiency push to shape its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Gap Investment Narrative Recap

To own Gap today, you have to believe its brand revival, collaborations and AI-driven efficiency gains can offset sluggish category growth and competitive pressure, while management keeps margins and cash returns intact. Fisher’s US$10.8 million insider sale might unsettle sentiment in the short term, but it does not clearly alter the main near term catalyst of execution on the turnaround or the key risk around softer demand and underperforming banners like Athleta.

The Gap × Summer Fridays collection is the clearest link between this insider move and the story Gap is telling investors right now, because it sits at the intersection of brand relevance, pricing power and traffic. As Gap leans into beauty-adjacent collaborations and viral campaigns, the success or failure of these launches will be an important proof point for whether marketing buzz can actually translate into sustained sales and support the broader efficiency and margin thesis.

Yet investors should also be aware that tariff exposure and evolving trade policy could still...

Read the full narrative on Gap (it's free!)

Gap’s narrative projects $16.0 billion revenue and $956.2 million earnings by 2028.

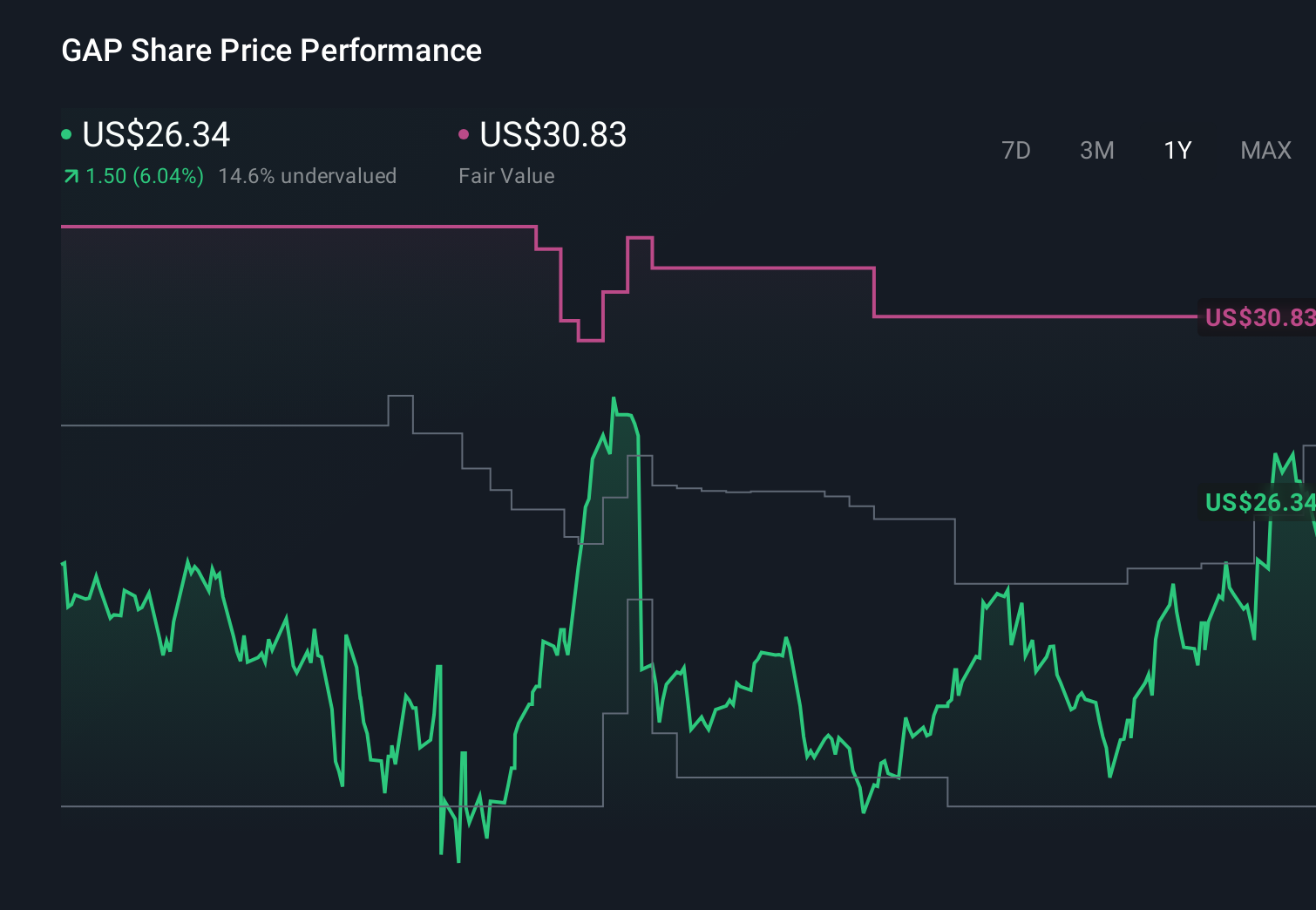

Uncover how Gap's forecasts yield a $27.71 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community value Gap between US$19.00 and US$29.12 per share, reflecting a broad spread of expectations. You can weigh those views against the company’s reliance on brand reinvigoration and AI driven efficiency to support margins and consider what that might mean for future performance.

Explore 8 other fair value estimates on Gap - why the stock might be worth 29% less than the current price!

Build Your Own Gap Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gap research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gap research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gap's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal